Region:Europe

Author(s):Dev

Product Code:KRAA0421

Pages:90

Published On:August 2025

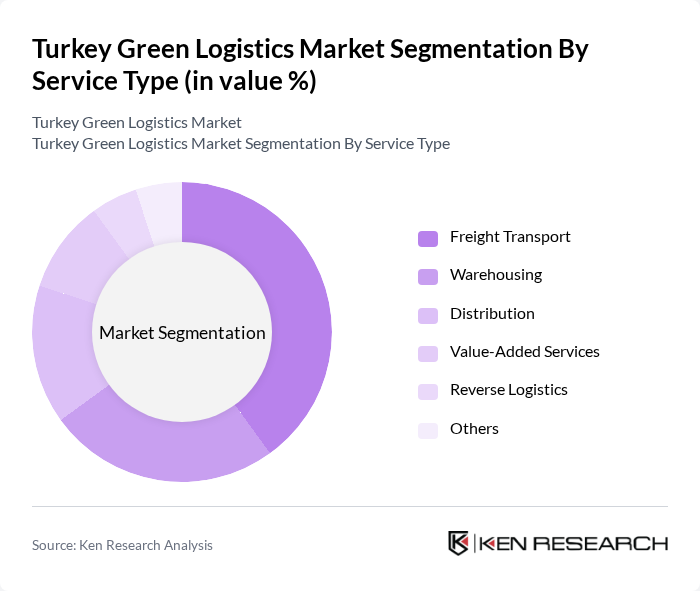

By Service Type:The service type segmentation includes various categories such as Freight Transport, Warehousing, Distribution, Value-Added Services, Reverse Logistics, and Others. Each of these segments plays a crucial role in the overall logistics framework, with specific services catering to different logistical needs. The warehousing and distribution sector is expanding due to the rise in retail and e-commerce, with a focus on last-mile delivery services and automation for efficiency .

The Freight Transport segment is the dominant player in the Turkey Green Logistics Market, accounting for a significant portion of the market share. This dominance is attributed to the increasing demand for efficient and sustainable transportation solutions, driven by the growth of e-commerce and the need for timely deliveries. Companies are increasingly adopting electric and hybrid vehicles to meet regulatory requirements and consumer expectations for greener logistics. The trend towards multimodal transport solutions, including rail, road, air, and sea, is also gaining traction, further enhancing the efficiency and sustainability of freight transport .

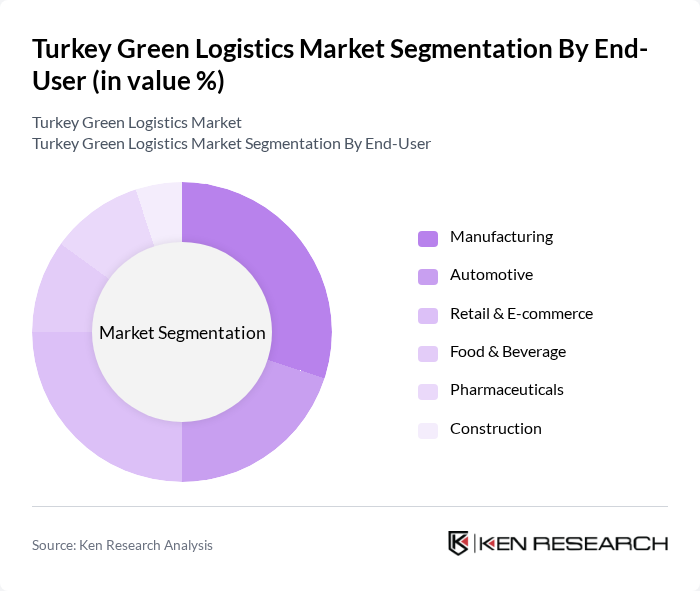

By End-User:The end-user segmentation encompasses various industries including Manufacturing, Automotive, Retail & E-commerce, Food & Beverage, Pharmaceuticals, Construction, and Others. Each sector has unique logistics requirements that influence the demand for green logistics services. The rapid expansion of e-commerce and manufacturing sectors is particularly boosting demand for sustainable logistics solutions .

The Retail & E-commerce sector is leading the end-user market, driven by the rapid growth of online shopping and the increasing consumer preference for sustainable delivery options. Companies in this sector are investing heavily in green logistics to enhance their brand image and meet the growing demand for environmentally friendly practices. The need for efficient last-mile delivery solutions is also propelling the adoption of green logistics in this segment, as businesses strive to reduce their carbon footprint while maintaining customer satisfaction .

The Turkey Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, PTT Cargo, DHL Turkey, UPS Turkey, Kuehne + Nagel Turkey, DB Schenker Turkey, CEVA Logistics Turkey, Ekol Logistics, Borusan Lojistik, Netlog Logistics, Mars Logistics, Omsan Lojistik, Horoz Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey green logistics market appears promising, driven by increasing environmental regulations and consumer demand for sustainable practices. As the government intensifies its support for green initiatives, logistics companies are likely to invest more in eco-friendly technologies. Additionally, the rise of e-commerce is expected to further propel the adoption of green logistics solutions, as businesses seek to meet consumer expectations for sustainability while optimizing their operations for efficiency and cost-effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Service Type (Freight Transport, Warehousing, Distribution, Value-Added Services, Reverse Logistics) | Freight Transport (Road, Rail, Air, Sea) Warehousing Distribution Value-Added Services (Packaging, Labeling, Kitting) Reverse Logistics Others |

| By End-User (Manufacturing, Automotive, Retail & E-commerce, Food & Beverage, Pharmaceuticals, Construction, Others) | Manufacturing Automotive Retail & E-commerce Food & Beverage Pharmaceuticals Construction Others |

| By Region (Marmara, Aegean, Mediterranean, Central Anatolia, Eastern Anatolia, Southeastern Anatolia) | Marmara Aegean Mediterranean Central Anatolia Eastern Anatolia Southeastern Anatolia |

| By Mode of Transport (Road, Rail, Air, Sea, Multimodal) | Road Rail Air Sea Multimodal Others |

| By Application (Last-Mile Delivery, Long-Haul Transport, Cold Chain Logistics, Urban Logistics, Cross-Border Logistics) | Last-Mile Delivery Long-Haul Transport Cold Chain Logistics Urban Logistics Cross-Border Logistics Others |

| By Technology Adoption (Electric Vehicles, Alternative Fuels, IoT & Telematics, Automation & Robotics, AI-driven Optimization) | Electric Vehicles Alternative Fuels (CNG, LNG, Hydrogen) IoT & Telematics Automation & Robotics AI-driven Optimization Others |

| By Ownership (Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), In-house Logistics) | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-house Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Logistics | 60 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Supply Chain Sustainability | 50 | Operations Directors, Environmental Compliance Officers |

| E-commerce Sustainable Delivery Practices | 45 | eCommerce Managers, Logistics Analysts |

| Transportation Emission Reduction Strategies | 40 | Fleet Managers, Sustainability Consultants |

| Waste Management in Logistics | 40 | Waste Management Officers, Supply Chain Managers |

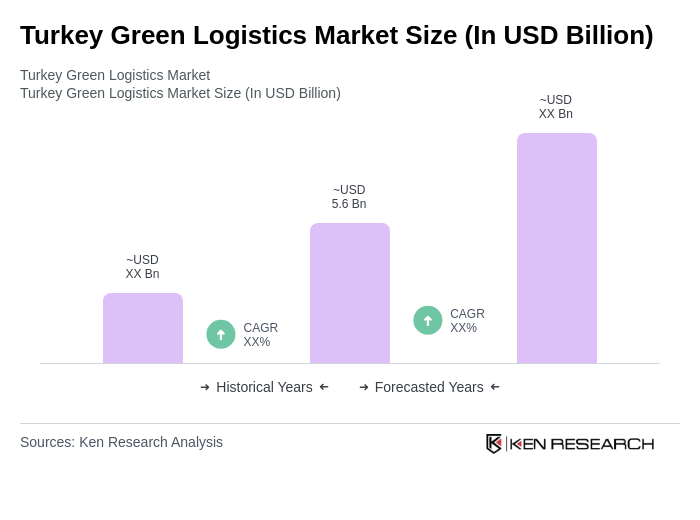

The Turkey Green Logistics Market is valued at approximately USD 5.6 billion, reflecting a significant growth trend driven by environmental regulations, consumer demand for sustainability, and technological advancements in eco-friendly logistics solutions.