Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0019

Pages:98

Published On:August 2025

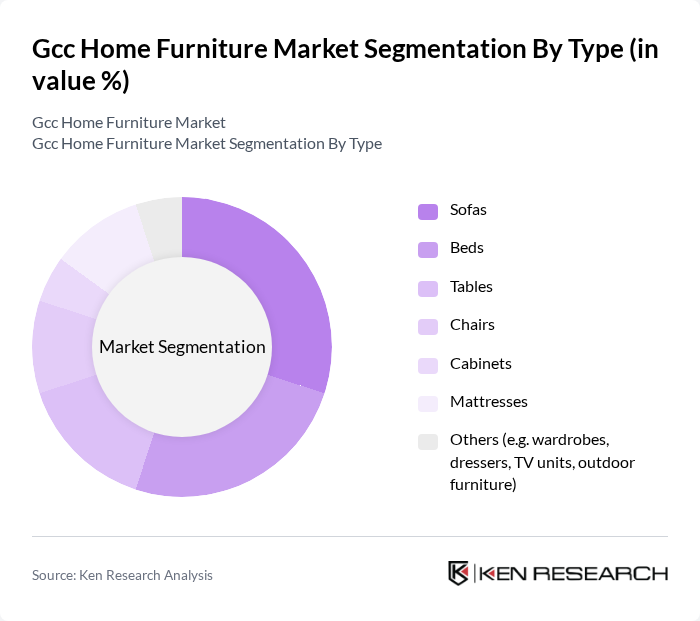

By Type:The home furniture market can be segmented into various types, including sofas, beds, tables, chairs, cabinets, mattresses, and others such as wardrobes, dressers, TV units, and outdoor furniture. Sofas and beds are the most popular categories due to their essential role in both home aesthetics and comfort. The demand for multi-functional and space-saving furniture is rising, especially in urban areas where efficient use of space is critical. Modern consumers are also seeking customizable and modular furniture solutions that blend functionality with contemporary design .

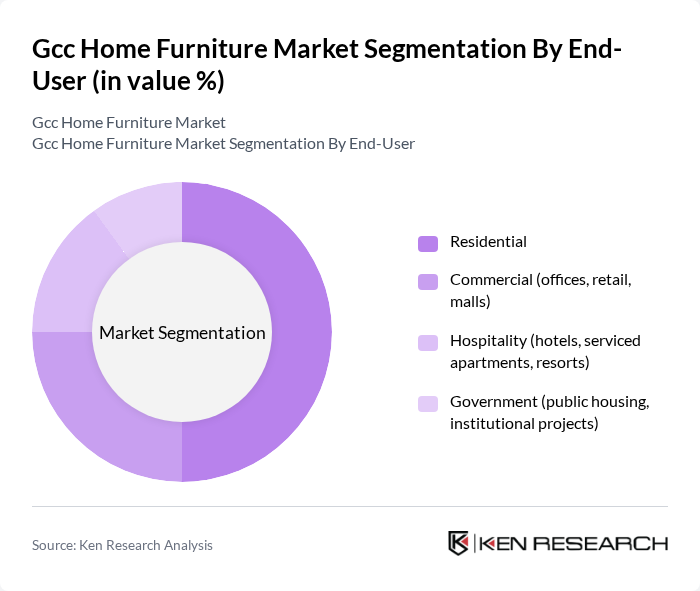

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment dominates the market, driven by increasing home ownership, renovation activities, and a focus on personalized living spaces. The commercial sector is also significant, with offices, retail spaces, and malls requiring stylish and functional furniture to enhance productivity and customer experience. The hospitality sector is expanding due to the rise in tourism and the establishment of new hotels and resorts, which demand high-quality, durable, and aesthetically pleasing furniture solutions .

The GCC home furniture market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, THE One, Danube Home, Landmark Group, Al-Futtaim Group, Royal Furniture, Muji, Habitat, Home Box, Aati Home, Al Huzaifa Furniture, Mamas & Papas, KARE Design, Bukannan Furniture, United Furniture, Marina Home Interiors, Gautier Furniture, Western Furniture LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC home furniture market is poised for significant transformation as consumer preferences evolve towards sustainability and technology integration. In future, the demand for eco-friendly materials is expected to rise, driven by increased environmental awareness among consumers. Additionally, the integration of smart technology into furniture is anticipated to enhance user experience, making homes more functional. These trends will likely shape product offerings and marketing strategies, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sofas Beds Tables Chairs Cabinets Mattresses Others (e.g. wardrobes, dressers, TV units, outdoor furniture) |

| By End-User | Residential Commercial (offices, retail, malls) Hospitality (hotels, serviced apartments, resorts) Government (public housing, institutional projects) |

| By Sales Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (showrooms, furniture stores) Direct Sales (B2B contracts, project sales) Distributors (wholesalers, regional agents) |

| By Material | Wood (solid wood, engineered wood) Metal (steel, aluminum) Plastic (polypropylene, PVC) Fabric (upholstery, leather, synthetic) |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Functionality | Multi-functional (sofa beds, storage beds, extendable tables) Standard Customizable (modular, made-to-order) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Sales | 100 | Store Managers, Sales Executives |

| Consumer Preferences in Home Furnishing | 120 | Homeowners, Renters |

| Interior Design Trends | 80 | Interior Designers, Architects |

| Online Furniture Shopping Behavior | 90 | eCommerce Managers, Digital Marketing Specialists |

| Manufacturing Insights | 60 | Production Managers, Supply Chain Analysts |

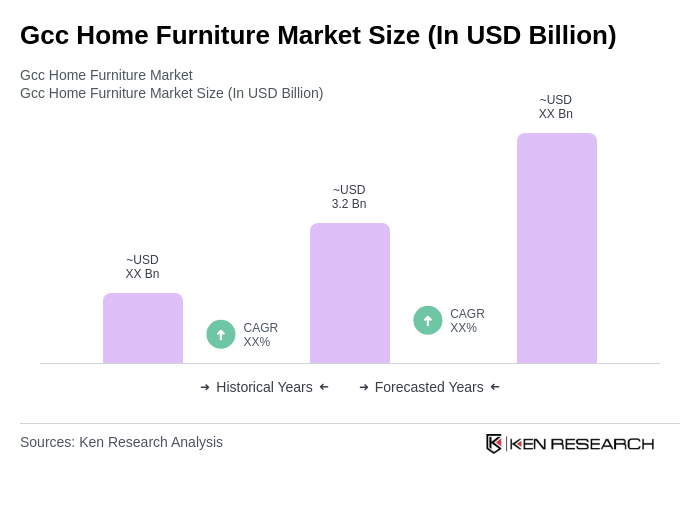

The GCC home furniture market is valued at approximately USD 3.2 billion, driven by factors such as increasing disposable incomes, rapid urbanization, and a growing trend towards home improvement and interior design.