Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7289

Pages:95

Published On:December 2025

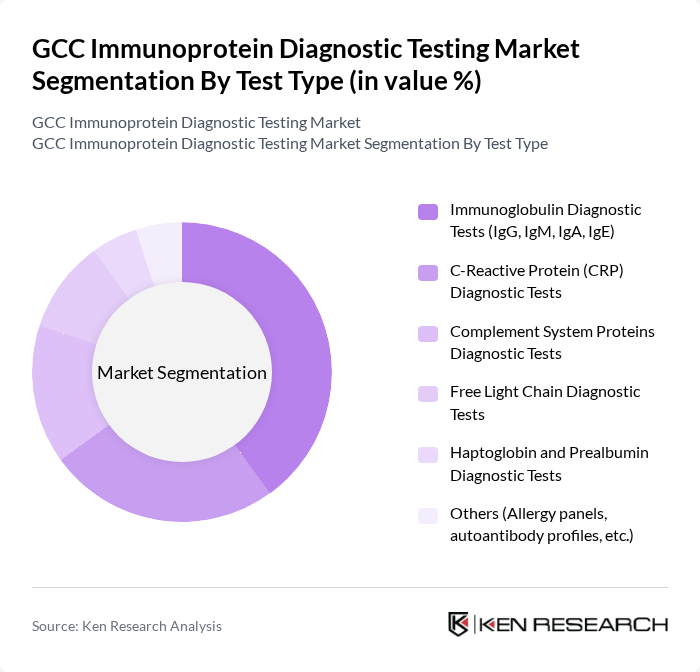

By Test Type:The market is segmented into various test types, including Immunoglobulin Diagnostic Tests (IgG, IgM, IgA, IgE), C-Reactive Protein (CRP) Diagnostic Tests, Complement System Proteins Diagnostic Tests, Free Light Chain Diagnostic Tests, Haptoglobin and Prealbumin Diagnostic Tests, and Others (Allergy panels, autoantibody profiles, etc.). Among these, Immunoglobulin Diagnostic Tests are leading due to their widespread application in diagnosing primary and secondary immunodeficiencies, autoimmune disorders, allergies, and infectious diseases and in monitoring immune responses to therapies and vaccines, which aligns with global trends where immunoglobulin tests account for the largest revenue share in immunoprotein diagnostics.

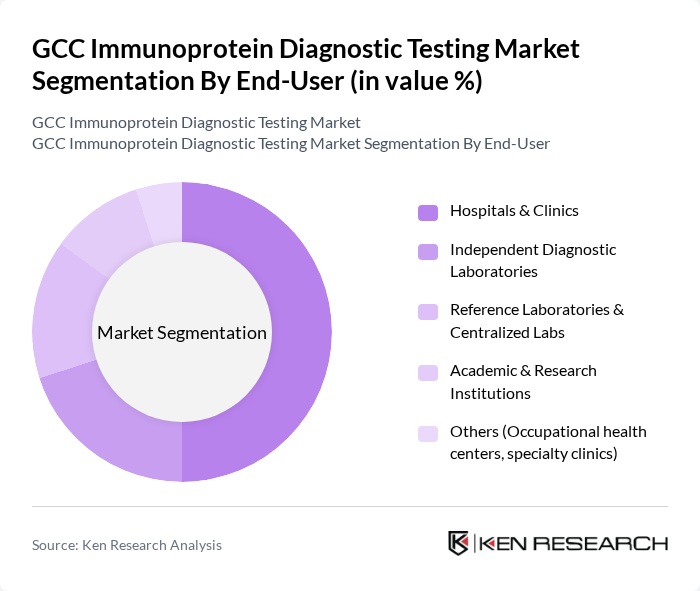

By End-User:The end-user segmentation includes Hospitals & Clinics, Independent Diagnostic Laboratories, Reference Laboratories & Centralized Labs, Academic & Research Institutions, and Others (Occupational health centers, specialty clinics). Hospitals & Clinics dominate this segment due to their high patient footfall, the integration of automated immunoassay systems into hospital laboratories, and the necessity for rapid diagnostic services in emergency, inpatient, and outpatient clinical settings, while independent and reference laboratories are gaining share as centralized hubs for high-volume immunoprotein testing.

The GCC Immunoprotein Diagnostic Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Siemens Healthineers AG, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Beckman Coulter, Inc. (A Danaher Company), DiaSorin S.p.A., bioMérieux S.A., Sysmex Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Roche Diagnostics Middle East FZCO, Abbott Laboratories S.A. (Saudi Arabia), Al Borg Diagnostics, National Reference Laboratory (NRL) – UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC immunoprotein diagnostic testing market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence in diagnostics is expected to enhance test accuracy and efficiency, while the expansion of telemedicine will facilitate remote access to testing services. As healthcare systems prioritize preventive care, the demand for immunoprotein tests will likely grow, positioning the market for sustained development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Immunoglobulin Diagnostic Tests (IgG, IgM, IgA, IgE) C-Reactive Protein (CRP) Diagnostic Tests Complement System Proteins Diagnostic Tests Free Light Chain Diagnostic Tests Haptoglobin and Prealbumin Diagnostic Tests Others (Allergy panels, autoantibody profiles, etc.) |

| By End-User | Hospitals & Clinics Independent Diagnostic Laboratories Reference Laboratories & Centralized Labs Academic & Research Institutions Others (Occupational health centers, specialty clinics) |

| By Clinical Application | Infectious Disease Testing Oncology & Tumor Marker Testing Autoimmune Disease Testing Endocrine & Metabolic Disorder Testing Allergy Testing Others (Cardiovascular, inflammatory, transplant monitoring) |

| By Assay Technology | Enzyme-Linked Immunosorbent Assay (ELISA) Chemiluminescent Immunoassay (CLIA) Radioimmunoassay (RIA) Nephelometry & Turbidimetry Rapid / Point-of-Care Immunoassays Others |

| By Sample Type | Serum / Plasma Whole Blood Urine Cerebrospinal Fluid (CSF) and Other Body Fluids Others (Saliva, dried blood spots, etc.) |

| By Distribution Channel | Direct Tenders to Hospitals & Public Institutions Distributor / Dealer Sales Direct Sales to Private Laboratories Online & E-Procurement Platforms Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Rest of GCC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 45 | Laboratory Managers, Clinical Pathologists |

| Diagnostic Centers | 35 | Operations Managers, Medical Technologists |

| Healthcare Providers | 30 | General Practitioners, Immunologists |

| Regulatory Bodies | 20 | Health Policy Analysts, Regulatory Affairs Specialists |

| Research Institutions | 25 | Research Scientists, Academic Professors |

The GCC Immunoprotein Diagnostic Testing Market is valued at approximately USD 1.1 billion, reflecting a mid-single-digit share of the global immunoprotein diagnostic testing market, which is estimated to be between USD 9 to 10 billion.