Region:Middle East

Author(s):Rebecca

Product Code:KRAC9688

Pages:88

Published On:November 2025

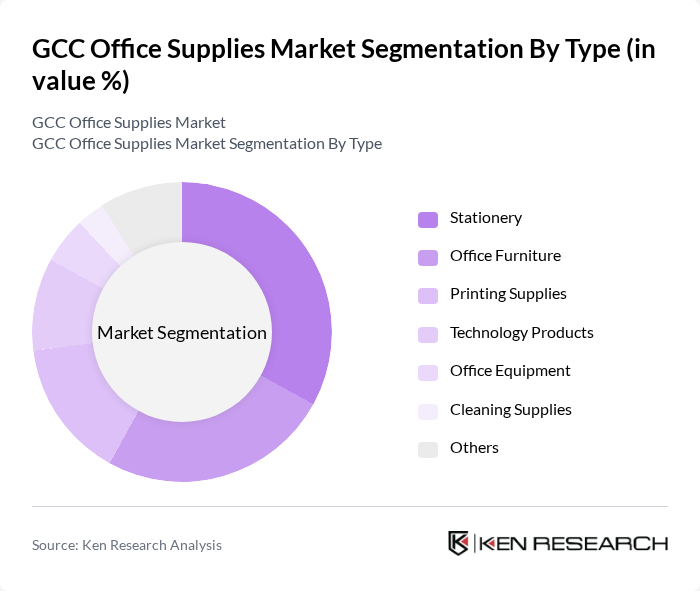

By Type:The market is segmented into stationery, office furniture, printing supplies, technology products, office equipment, cleaning supplies, and others. Stationery products remain the largest segment, supported by their essential role in daily office and educational operations, and a growing trend for personalized and branded items. Office furniture follows, driven by remote work setups and demand for ergonomic solutions. The market is also seeing increased adoption of eco-friendly stationery and technology-integrated office supplies .

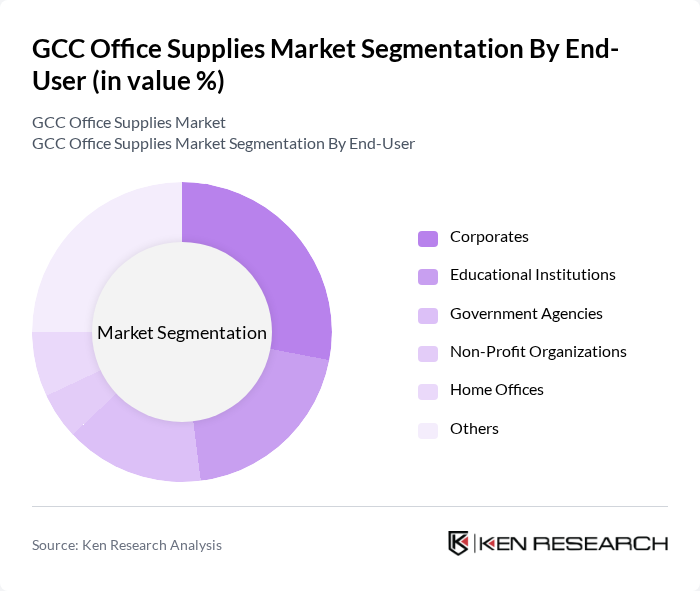

By End-User:The end-user segmentation includes corporates, educational institutions, government agencies, non-profit organizations, home offices, and others. Corporates are the leading end-users, reflecting demand for a broad range of supplies to support operations, especially as new offices and startups proliferate. Educational institutions are significant consumers, particularly for stationery and technology products, as they modernize teaching methods. The rise of remote and hybrid work models has also expanded the home office segment .

The GCC Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Office Supplies Middle East, Al Mufeed Trading, Al Ghandi Office Supplies, Al Maktab Al Mahi, Jumbo Electronics, Union Stationery, Almoe Group, Office One LLC, Amazon.ae, Noon.com, Al Reyami Office Furnishings, Farook International Stationery, Al Suwaidi Paper Factory LLC, National Stationery LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC office supplies market is poised for transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt digital procurement solutions, the demand for innovative office supplies will rise. Additionally, the focus on sustainability will shape product offerings, with eco-friendly supplies gaining traction. Companies that adapt to these trends and invest in smart office solutions will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Stationery Office Furniture Printing Supplies Technology Products Office Equipment Cleaning Supplies Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Home Offices Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Direct Sales Wholesale Distributors B2B Marketplaces Others |

| By Product Category | Writing Instruments Paper Products Office Machines Organizational Supplies Desk Accessories Others |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands Others |

| By Customer Type | Individual Consumers Small Businesses Large Enterprises Government Procurement Others |

| By Sustainability Focus | Eco-Friendly Products Recycled Materials Biodegradable Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 120 | Procurement Managers, Office Administrators |

| Small Business Office Supply Needs | 85 | Small Business Owners, Office Managers |

| Educational Institutions Supply Requirements | 65 | School Administrators, Procurement Officers |

| Government Sector Office Supplies | 55 | Government Procurement Officers, Facility Managers |

| Retail Office Supply Trends | 75 | Retail Managers, Category Buyers |

The GCC Office Supplies Market is valued at approximately USD 1 billion, driven by factors such as the expansion of educational institutions, corporate diversification, and increased government investments in infrastructure.