Region:Asia

Author(s):Shubham

Product Code:KRAC2212

Pages:82

Published On:October 2025

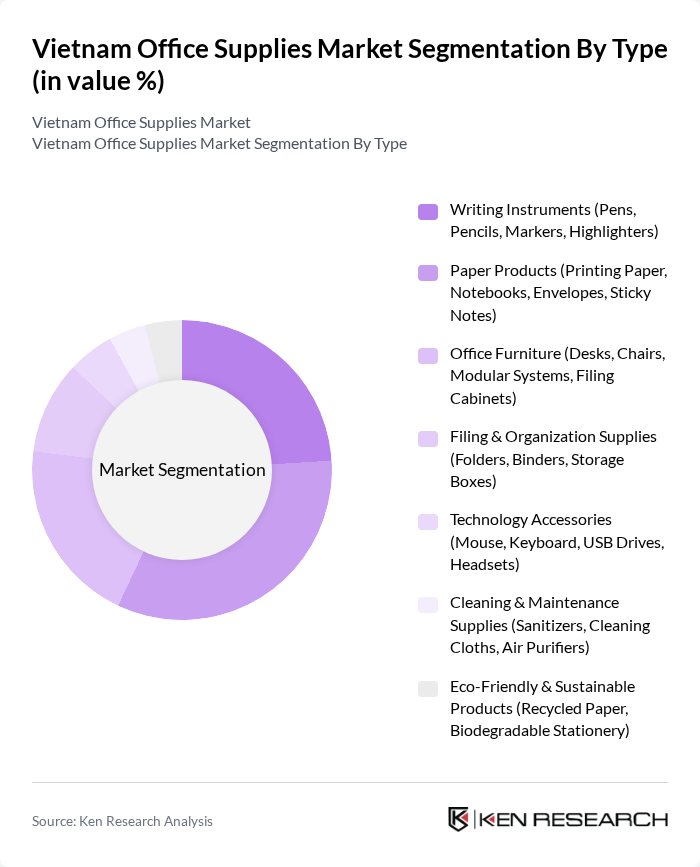

By Type:The market is segmented into various types of office supplies, including writing instruments, paper products, office furniture, filing and organization supplies, technology accessories, cleaning and maintenance supplies, and eco-friendly products. Each of these segments caters to specific consumer needs and preferences, reflecting the diverse requirements of different end-users .

The paper products segment currently leads the market, accounting for the largest share due to high demand for printing paper, notebooks, and related products in both educational and corporate settings. The expansion of the education sector and the growth of e-commerce and packaging industries have further fueled the need for paper products. Writing instruments remain a critical sub-segment, driven by ongoing demand in schools and offices .

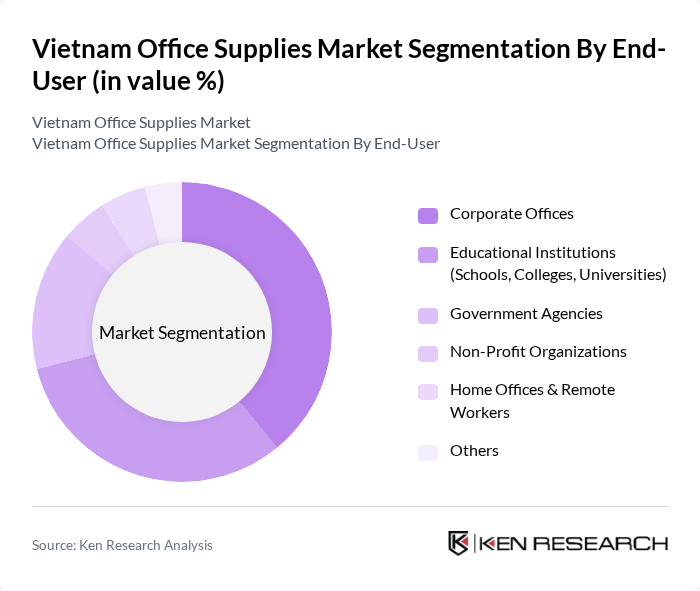

By End-User:The office supplies market is segmented by end-users, including corporate offices, educational institutions, government agencies, non-profit organizations, home offices, and remote workers. Each segment has unique requirements and purchasing behaviors, influencing the types of products that are in demand .

Corporate offices are the leading end-user segment, driven by the need for a wide range of office supplies to support daily operations. The increasing number of businesses, the trend toward flexible and hybrid workspaces, and the focus on employee productivity and comfort have resulted in significant investments in office supplies, making corporate offices a key driver of market growth .

The Vietnam Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thien Long Group, V?n phòng ph?m Phùng Nguy?n, KOKUYO Co., Ltd., Pentel, 3M Vietnam, Furaka JSC, AA Corporation, The One Furniture, Saigon Paper Corporation, Duy Tan Plastic, Binh Minh Plastic, Rong Phuong Bac Trading Co., Ltd., Xuan Hoa Company, Vixfurniture Company Co., Ltd., vpphongha.com.vn contribute to innovation, geographic expansion, and service delivery in this space .

The future outlook for the Vietnam office supplies market appears promising, driven by ongoing digital transformation and the increasing emphasis on sustainability. As businesses continue to adopt advanced technologies, the demand for innovative office supplies will likely rise. Additionally, the growing awareness of environmental issues is pushing companies to seek eco-friendly products. With the government supporting SMEs and promoting digitalization, the market is poised for significant growth, creating opportunities for suppliers to innovate and expand their offerings in response to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Writing Instruments (Pens, Pencils, Markers, Highlighters) Paper Products (Printing Paper, Notebooks, Envelopes, Sticky Notes) Office Furniture (Desks, Chairs, Modular Systems, Filing Cabinets) Filing & Organization Supplies (Folders, Binders, Storage Boxes) Technology Accessories (Mouse, Keyboard, USB Drives, Headsets) Cleaning & Maintenance Supplies (Sanitizers, Cleaning Cloths, Air Purifiers) Eco-Friendly & Sustainable Products (Recycled Paper, Biodegradable Stationery) |

| By End-User | Corporate Offices Educational Institutions (Schools, Colleges, Universities) Government Agencies Non-Profit Organizations Home Offices & Remote Workers Others |

| By Sales Channel | Online Retail (E-commerce Platforms) Brick-and-Mortar Stores (Stationery Shops, Supermarkets) Wholesale Distributors Direct Sales (Corporate Procurement) Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers Others |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products Declining Products |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 100 | Procurement Managers, Office Administrators |

| Small and Medium Enterprises (SMEs) Office Needs | 80 | Business Owners, Office Managers |

| Educational Institutions Supply Requirements | 60 | School Administrators, Purchasing Officers |

| Government Sector Office Supplies | 50 | Government Procurement Officers, Facility Managers |

| Retail Office Supply Trends | 40 | Retail Managers, Sales Directors |

The Vietnam Office Supplies Market is valued at approximately USD 843 million, reflecting significant growth driven by economic expansion, urbanization, and increased demand from sectors like education, corporate, and government.