Region:Global

Author(s):Rebecca

Product Code:KRAC4005

Pages:86

Published On:October 2025

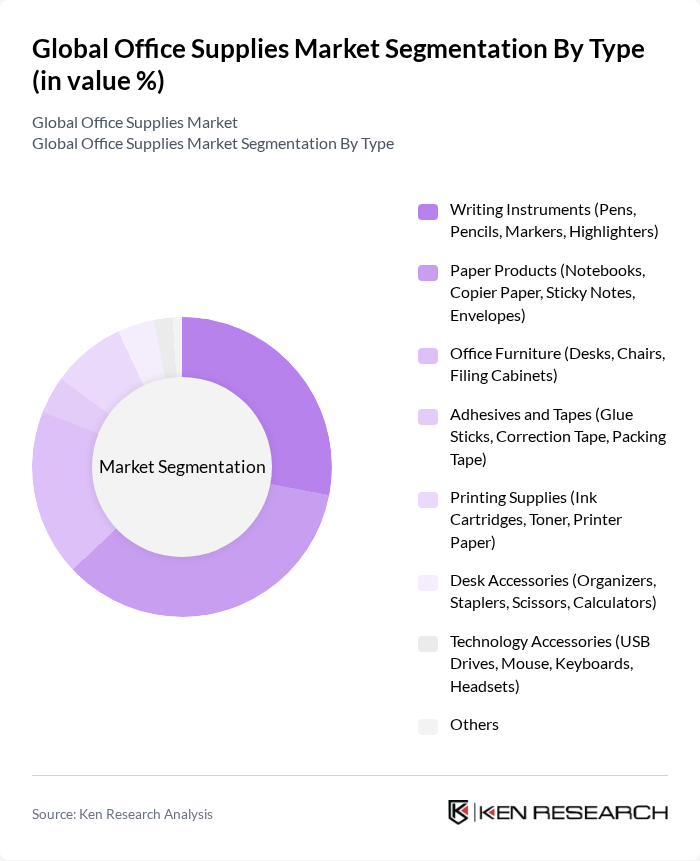

By Type:The market is segmented into various types of office supplies, including writing instruments, paper products, office furniture, adhesives and tapes, desk accessories, printing supplies, and others. Among these, writing instruments and paper products are the most dominant segments due to their essential role in daily office operations and educational settings. The demand for innovative and ergonomic designs in writing instruments has also contributed to their popularity, making them a staple in both corporate and educational environments. Sustainability trends have led to increased demand for recycled paper and eco-friendly writing tools, while digitalization is influencing the demand for tech-integrated desk accessories and printing supplies .

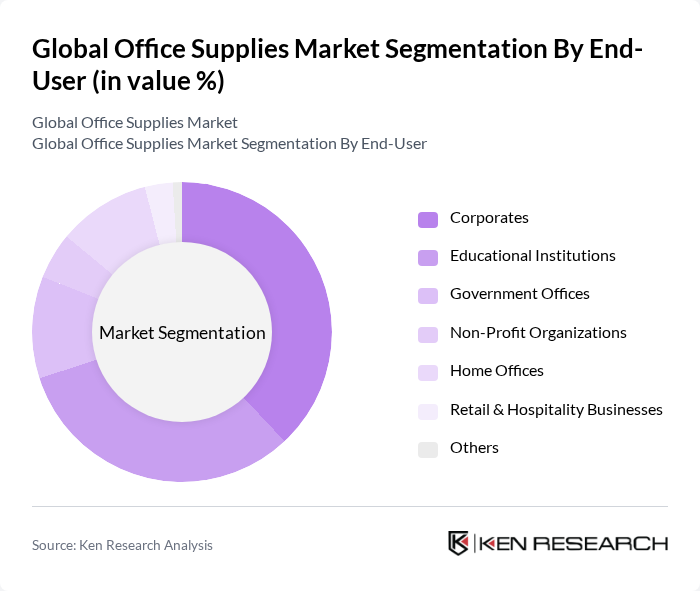

By End-User:The office supplies market is segmented by end-users, including corporates, educational institutions, government agencies, non-profit organizations, and home offices. Corporates and educational institutions are the leading segments, driven by the continuous need for supplies in professional and academic settings. The shift towards remote work and online learning has also increased the demand for home office supplies, making it a growing segment in the market. The adoption of hybrid work models and the expansion of small and medium enterprises further support demand across all end-user categories .

The Global Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Staples, Inc., Office Depot, Inc., Viking Direct, 3M Company, ACCO Brands Corporation, BIC Group, Fellowes Brands, Smead Manufacturing Company, Avery Products Corporation, Esselte Corporation, Canon Inc., HP Inc., Zebra Technologies Corporation, Sharp Corporation, Pelikan Group contribute to innovation, geographic expansion, and service delivery in this space. These companies are increasingly focusing on product innovation, sustainability initiatives, and digital transformation to strengthen their market positions .

The future of the office supplies market is poised for transformation, driven by technological advancements and evolving consumer preferences. As businesses increasingly prioritize sustainability, the demand for eco-friendly products will continue to rise. Additionally, the integration of smart technology into office supplies will enhance functionality and user experience. Companies that adapt to these trends and invest in innovative solutions will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Writing Instruments (e.g., pens, pencils) Paper Products (e.g., notebooks, printing paper) Office Furniture Adhesives and Tapes Desk Accessories (e.g., organizers, staplers) Printing Supplies (e.g., ink cartridges, toners) Others (e.g., health and safety supplies) |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Home Offices |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Direct Sales Wholesale Distributors |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Product Lifecycle Stage | Introduction Growth Maturity |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 100 | Procurement Managers, Office Administrators |

| Educational Institutions Supply Needs | 60 | Facility Managers, Purchasing Officers |

| Retail Office Supply Trends | 50 | Store Managers, Category Buyers |

| Small Business Office Supply Usage | 40 | Business Owners, Office Managers |

| Online Office Supply Purchasing Behavior | 45 | E-commerce Managers, Digital Marketing Specialists |

The Global Office Supplies Market is valued at approximately USD 267 billion, reflecting significant growth driven by increasing demand across various sectors, including education, corporate, and government, as well as the rise in remote working and online education.