Region:Middle East

Author(s):Rebecca

Product Code:KRAC9773

Pages:87

Published On:November 2025

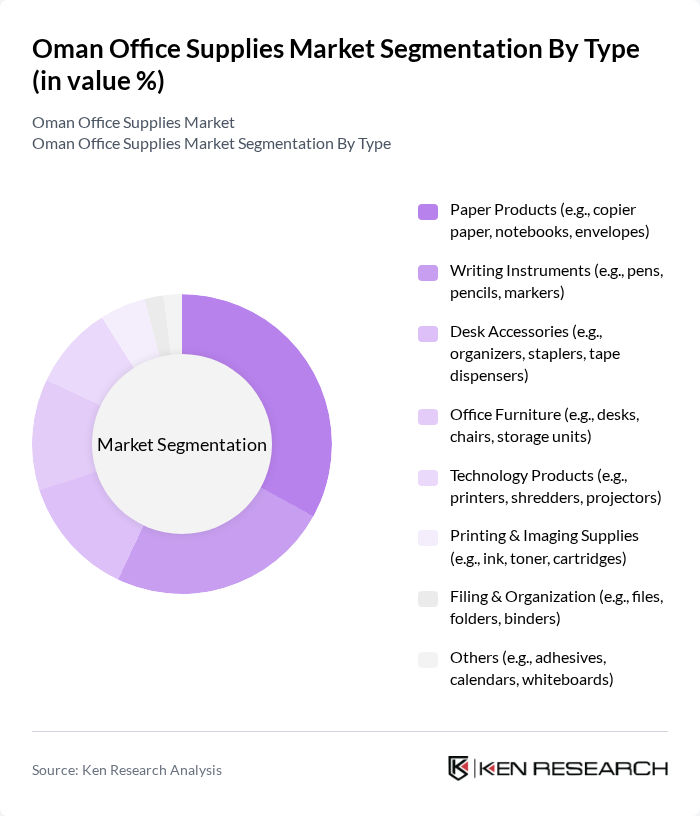

By Type:The market is segmented into various types of office supplies, including paper products, writing instruments, desk accessories, office furniture, technology products, printing and imaging supplies, filing and organization, and others. Among these, paper products and writing instruments remain the most significant segments, reflecting their essential role in daily office operations and educational settings. The demand for eco-friendly paper products and sustainable alternatives is increasing, as organizations and consumers shift toward environmentally responsible purchasing .

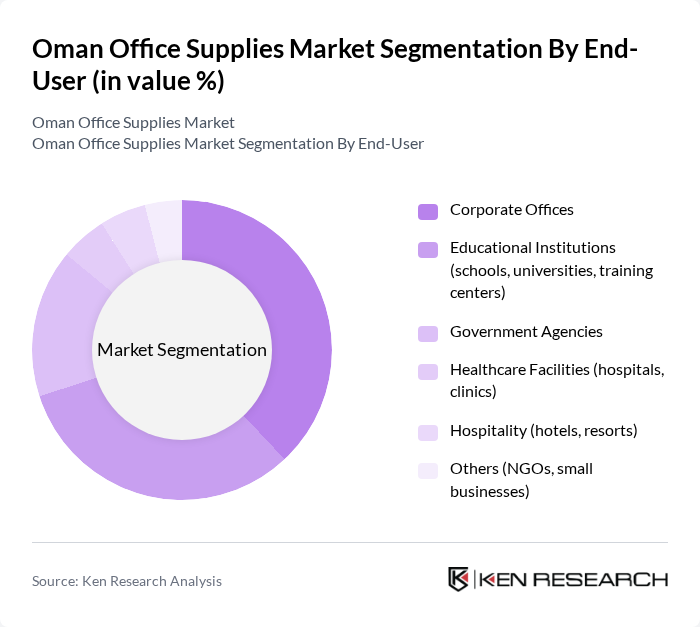

By End-User:The office supplies market is segmented by end-users, including corporate offices, educational institutions, government agencies, healthcare facilities, hospitality, and others. Corporate offices and educational institutions are the leading segments, driven by their continuous need for various office supplies to support daily operations and learning environments. The increasing number of startups, educational institutions, and government-led digitalization initiatives in Oman further fuels demand in these segments .

The Oman Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Office Supplies & Stationery Co. LLC (Muscat), Al Ahlia Office Supplies LLC, Muscat Stationery LLC, Al Mufeed Office Supplies LLC, Oman Office Equipment Co. LLC, Al Fajr Office Supplies LLC, Al Jazeera Office Supplies LLC, Al Muna Office Supplies LLC, Al Noor Office Supplies LLC, Al Shams Office Supplies LLC, Al Waha Office Supplies LLC, Al Zawya Office Supplies LLC, Al Yaqeen Office Supplies LLC, Al Huda Office Supplies LLC, and Al Maktabah Stationery LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman office supplies market is poised for transformative growth, driven by technological advancements and changing workplace dynamics. As businesses increasingly adopt digital solutions, the demand for innovative office supplies will rise. Additionally, the trend towards sustainability will encourage manufacturers to develop eco-friendly products. With government support for local manufacturing and infrastructure development, the market is expected to evolve, presenting new opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Paper Products (e.g., copier paper, notebooks, envelopes) Writing Instruments (e.g., pens, pencils, markers) Desk Accessories (e.g., organizers, staplers, tape dispensers) Office Furniture (e.g., desks, chairs, storage units) Technology Products (e.g., printers, shredders, projectors) Printing & Imaging Supplies (e.g., ink, toner, cartridges) Filing & Organization (e.g., files, folders, binders) Others (e.g., adhesives, calendars, whiteboards) |

| By End-User | Corporate Offices Educational Institutions (schools, universities, training centers) Government Agencies Healthcare Facilities (hospitals, clinics) Hospitality (hotels, resorts) Others (NGOs, small businesses) |

| By Distribution Channel | Online Retail (e-commerce platforms, B2B portals) Stationery Stores Supermarkets/Hypermarkets Direct Sales (corporate contracts) Wholesale Distributors Others |

| By Product Category | Paper Supplies Writing Supplies Desk & Drawer Organizers Binding & Presentation Supplies Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers Others |

| By Sustainability Preference | Eco-Friendly Products Recyclable Products Biodegradable Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 100 | Procurement Managers, Office Administrators |

| Educational Institutions Supply Needs | 60 | Facility Managers, Administrative Staff |

| Retail Office Supplies Sales | 50 | Store Managers, Sales Representatives |

| Government Office Supplies Procurement | 40 | Government Procurement Officers, Administrative Heads |

| Small Business Office Supplies Usage | 70 | Small Business Owners, Office Managers |

The Oman Office Supplies Market is valued at approximately USD 90 million, reflecting growth driven by the expansion of corporate offices, educational institutions, and government agencies, alongside increasing demand for technology products and eco-friendly supplies.