Region:Middle East

Author(s):Shubham

Product Code:KRAC2831

Pages:100

Published On:October 2025

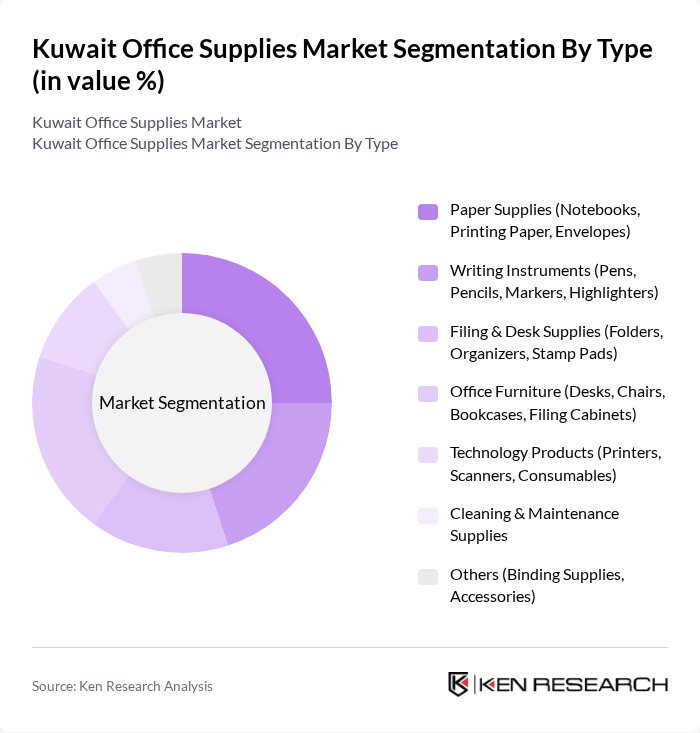

By Type:The office supplies market can be segmented into paper supplies, writing instruments, filing and desk supplies, office furniture, technology products, cleaning and maintenance supplies, and others. Each of these subsegments addresses the varied needs of businesses, educational institutions, and home offices. The segment for technology products, including printers and consumables, is experiencing notable growth due to digital transformation initiatives and increased remote working.

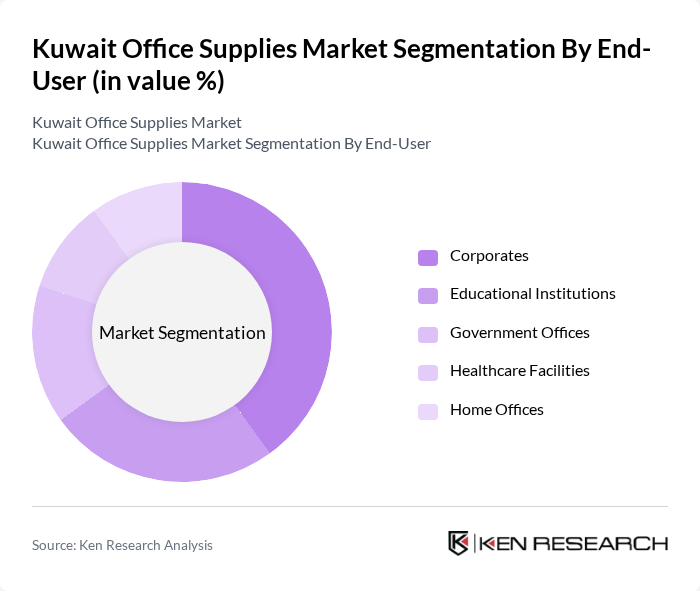

By End-User:The end-user segmentation includes corporates, educational institutions, government offices, healthcare facilities, and home offices. Each segment demonstrates distinct purchasing patterns, with corporates and educational institutions accounting for the largest shares due to sustained demand for both traditional and digital office supplies. The home office segment has grown as remote work has become more prevalent .

The Kuwait Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeed Office Supplies, Al Khorafi Group, Alghanim Industries, Office Supplies Co., Staples Kuwait, Office Depot Kuwait, Al-Dhow Stationery, Al-Mansouria Group, Al-Sayer Group, Al-Bahar Group, Al-Hamra Group, Al-Majed Group, Al-Qabas Group, Al-Salam Group, and Al-Mutawa Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait office supplies market appears promising, driven by ongoing digital transformation and a shift towards sustainable practices. As businesses increasingly adopt eco-friendly products, suppliers are likely to innovate and diversify their offerings. Additionally, the rise of remote working trends will necessitate new office supply solutions tailored for home offices. These developments indicate a dynamic market landscape, where adaptability and sustainability will be key to capturing emerging opportunities and meeting evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Paper Supplies (Notebooks, Printing Paper, Envelopes) Writing Instruments (Pens, Pencils, Markers, Highlighters) Filing & Desk Supplies (Folders, Organizers, Stamp Pads) Office Furniture (Desks, Chairs, Bookcases, Filing Cabinets) Technology Products (Printers, Scanners, Consumables) Cleaning & Maintenance Supplies Others (Binding Supplies, Accessories) |

| By End-User | Corporates Educational Institutions Government Offices Healthcare Facilities Home Offices |

| By Sales Channel | Direct Sales Online Retail/E-commerce Wholesale Distributors Retail Stores (Stationery, Supermarkets) |

| By Distribution Mode | B2B Distribution B2C Distribution E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Brand Loyalty | Brand Loyal Customers Price Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 100 | Office Managers, Procurement Specialists |

| Educational Institutions Supply Needs | 60 | School Administrators, Purchasing Officers |

| Small Business Office Supply Trends | 50 | Small Business Owners, Office Administrators |

| Government Sector Office Supplies | 40 | Government Procurement Officers, Facility Managers |

| Retail Office Supply Preferences | 45 | Retail Managers, Sales Representatives |

The Kuwait Office Supplies Market is valued at approximately USD 110 million, reflecting growth driven by the expansion of the education sector, increased government investment in educational infrastructure, and the rising adoption of e-commerce platforms for procurement.