Region:Middle East

Author(s):Dev

Product Code:KRAC2646

Pages:86

Published On:October 2025

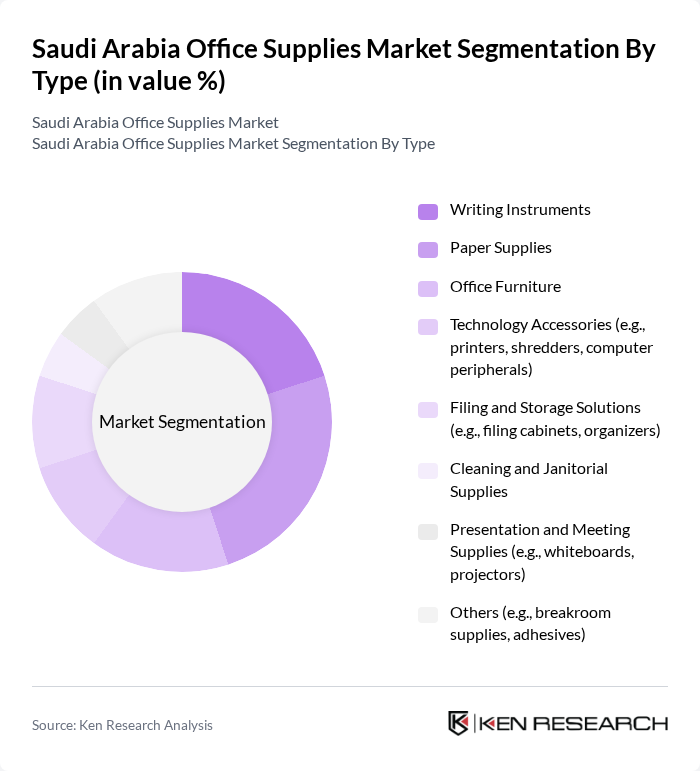

By Type:The market can be segmented into various types of office supplies, including writing instruments, paper supplies, office furniture, technology accessories, filing and storage solutions, cleaning and janitorial supplies, presentation and meeting supplies, and others. Each of these subsegments plays a crucial role in fulfilling the diverse needs of consumers and businesses. Paper supplies hold the largest share, driven by extensive use in offices and educational institutions, while writing instruments are increasingly shaped by trends in eco-friendly and sustainable materials. Office furniture demand is rising due to ergonomic and smart furniture innovations, and technology accessories remain essential for digital transformation.

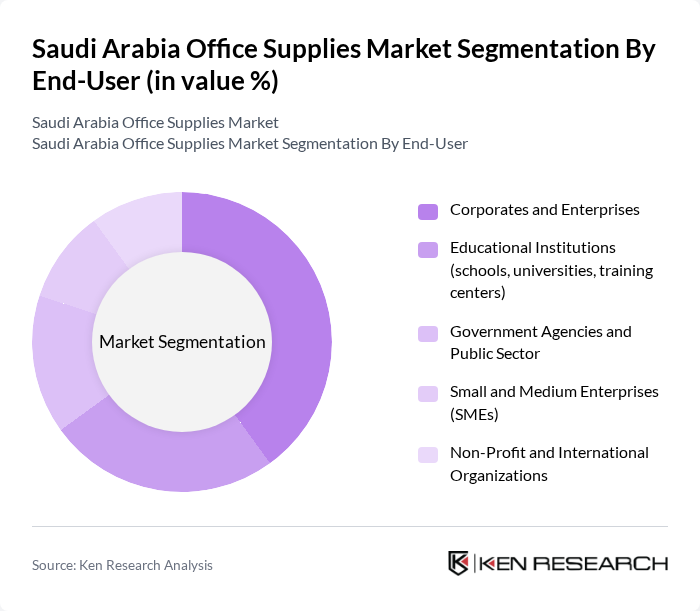

By End-User:The office supplies market is segmented by end-user categories, including corporates and enterprises, educational institutions, government agencies, small and medium enterprises (SMEs), and non-profit organizations. Each segment has unique requirements and purchasing behaviors that influence the overall market dynamics. Corporates and enterprises represent the largest segment, driven by the increasing entry of foreign companies and the establishment of regional headquarters. Educational institutions are a fast-growing segment, supported by government investments in education infrastructure and rising international student enrollment. Government agencies and SMEs also contribute significantly, with non-profit organizations representing a stable share of demand.

The Saudi Arabia Office Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jarir Marketing Company (Jarir Bookstore), Al-Amoudi Office Supplies, Al-Khodariyah Office Supplies, Al-Muhaidib Group, Bawan Company, 3M Saudi Arabia, TOTAL NET KSA, KOKUYO Co., Ltd., Staples Saudi Arabia, Office Supplies Co. (OSC), Al-Falak Electronic Equipment & Supplies Co., Al-Sheraa Office Supplies, Al-Jomaih Group, Al-Faisaliah Group, Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian office supplies market appears promising, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt digital solutions, the demand for innovative office supplies will rise. Additionally, the trend towards remote working is expected to create new opportunities for suppliers to offer tailored products. With a focus on sustainability, companies are likely to invest in eco-friendly office supplies, aligning with global environmental goals and enhancing market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Writing Instruments Paper Supplies Office Furniture Technology Accessories (e.g., printers, shredders, computer peripherals) Filing and Storage Solutions (e.g., filing cabinets, organizers) Cleaning and Janitorial Supplies Presentation and Meeting Supplies (e.g., whiteboards, projectors) Others (e.g., breakroom supplies, adhesives) |

| By End-User | Corporates and Enterprises Educational Institutions (schools, universities, training centers) Government Agencies and Public Sector Small and Medium Enterprises (SMEs) Non-Profit and International Organizations |

| By Sales Channel | Online Retail/E-commerce Brick-and-Mortar Stores (specialty and general retailers) Wholesale Distributors Direct Sales (B2B contracts) |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Supplies Procurement | 100 | Procurement Managers, Office Administrators |

| Retail Office Supplies Sales | 60 | Store Managers, Sales Representatives |

| Educational Institutions Supply Needs | 50 | Administrative Heads, Facility Managers |

| Government Office Supplies Procurement | 40 | Government Procurement Officers, Administrative Staff |

| Small Business Office Supplies Usage | 50 | Small Business Owners, Office Managers |

The Saudi Arabia Office Supplies Market is valued at approximately USD 220 million, reflecting growth driven by increasing demand from sectors such as education, corporate, and government, alongside trends like remote work and digitalization.