Region:Middle East

Author(s):Shubham

Product Code:KRAB7456

Pages:93

Published On:October 2025

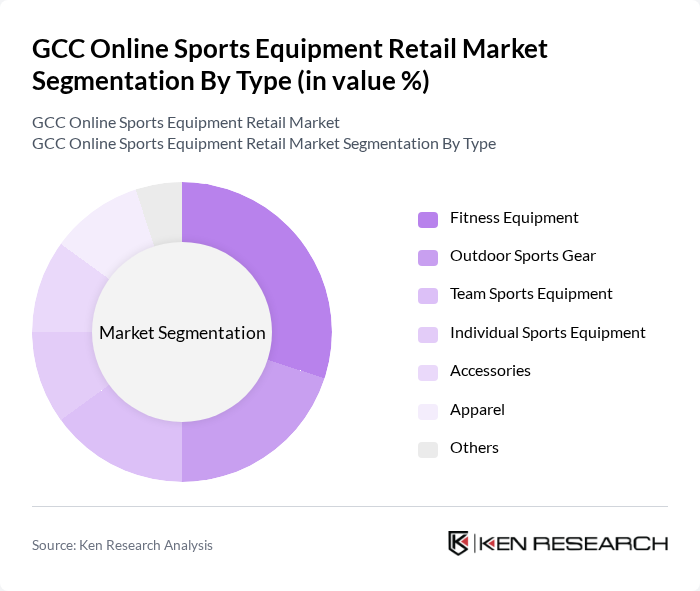

By Type:The market is segmented into various types of sports equipment, including fitness equipment, outdoor sports gear, team sports equipment, individual sports equipment, accessories, apparel, and others. Each sub-segment caters to different consumer needs and preferences, reflecting the diverse interests in sports and fitness activities across the GCC region.

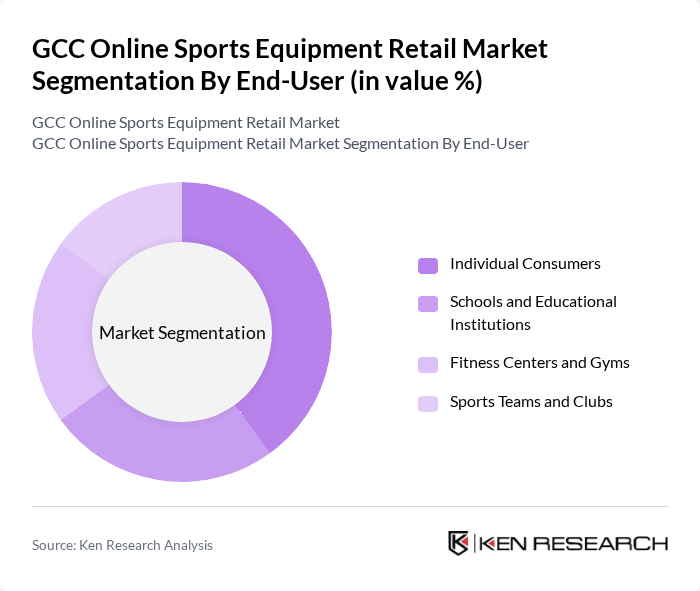

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, fitness centers and gyms, and sports teams and clubs. Each of these segments has unique requirements and purchasing behaviors, influencing the overall dynamics of the online sports equipment retail market.

The GCC Online Sports Equipment Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon, Sports Direct, Amazon, Sun & Sand Sports, Go Sport, Carrefour, Lulu Hypermarket, Intersport, Fitness First, Al-Futtaim Group, Adventure HQ, Pro Sports, The Athlete's Foot, Nike, and Adidas contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online sports equipment retail market is poised for continued growth, driven by technological advancements and changing consumer behaviors. As mobile commerce expands, with mobile transactions expected to account for 50% of e-commerce sales in the future, retailers will need to optimize their platforms for mobile users. Additionally, the integration of innovative technologies, such as augmented reality, will enhance the online shopping experience, making it more interactive and personalized, thus attracting a broader customer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Sports Gear Team Sports Equipment Individual Sports Equipment Accessories Apparel Others |

| By End-User | Individual Consumers Schools and Educational Institutions Fitness Centers and Gyms Sports Teams and Clubs |

| By Sales Channel | Direct Online Sales Third-Party Marketplaces Social Media Platforms Mobile Applications |

| By Distribution Mode | Home Delivery Click and Collect Subscription Services |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Sports Equipment Retailers | 150 | eCommerce Managers, Marketing Directors |

| Consumer Insights on Sports Equipment | 200 | Active Sports Participants, Fitness Enthusiasts |

| Distribution Channels for Sports Equipment | 100 | Supply Chain Managers, Retail Operations Heads |

| Market Trends in Fitness Equipment | 80 | Product Managers, Brand Strategists |

| Consumer Preferences in Sports Gear | 120 | General Consumers, Sports Coaches |

The GCC Online Sports Equipment Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased fitness participation and the rising trend of online shopping among consumers in the region.