Region:Middle East

Author(s):Dev

Product Code:KRAA8228

Pages:100

Published On:November 2025

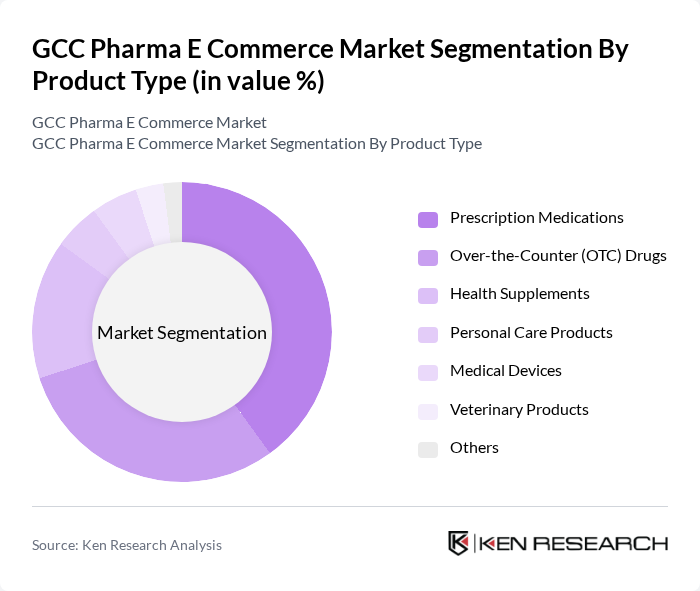

By Product Type:The product type segmentation includes various categories such as Prescription Medications, Over-the-Counter (OTC) Drugs, Health Supplements, Personal Care Products, Medical Devices, Veterinary Products, and Others. Among these, Prescription Medications and OTC Drugs are the most significant segments, driven by the increasing prevalence of chronic diseases and the growing trend of self-medication. The demand for Health Supplements and Personal Care Products is also rising as consumers become more health-conscious and seek preventive healthcare solutions.

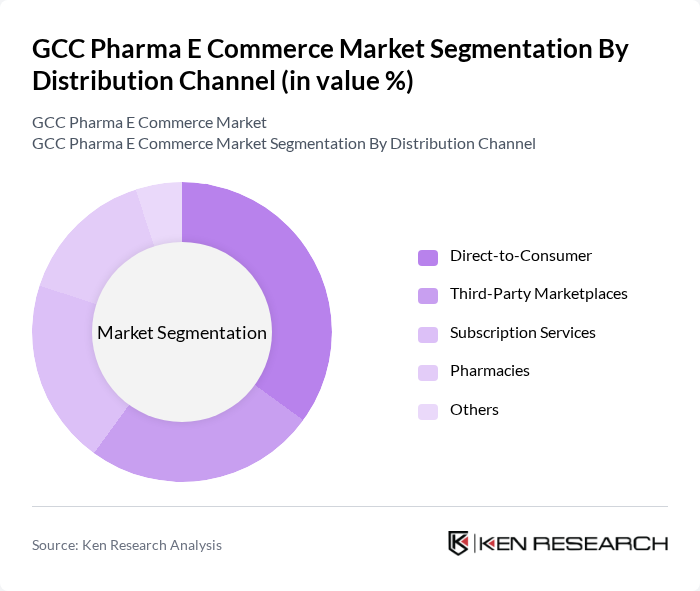

By Distribution Channel:The distribution channel segmentation includes Direct-to-Consumer, Third-Party Marketplaces, Subscription Services, Pharmacies, and Others. The Direct-to-Consumer channel is gaining traction as consumers prefer the convenience of purchasing medications directly from online platforms. Third-Party Marketplaces also play a crucial role in expanding the reach of pharmaceutical products, while Subscription Services are becoming popular for regular medication refills and health products.

The GCC Pharma E Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nahdi Medical Company, Aster Pharmacy (Aster DM Healthcare), United Pharmacies, Life Pharmacy, HealthPlus Pharmacy, Abu Dhabi Pharmacy, Al-Dawaa Pharmacies, Boots Pharmacy, Medcare Pharmacy, Kulud Pharmacy, BinSina Pharmacy, Medicina Pharmacy, Al-Jazeera Pharmaceutical Industries, Seif Pharmacy, Yodawy contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Pharma E-Commerce market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence in customer service is expected to enhance user experiences, while the growth of telemedicine services will further facilitate online pharmaceutical sales. As consumers increasingly prioritize convenience and personalized healthcare solutions, the market will likely see innovative approaches to meet these demands, fostering a more dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Medications Over-the-Counter (OTC) Drugs Health Supplements Personal Care Products Medical Devices Veterinary Products Others |

| By Distribution Channel | Direct-to-Consumer Third-Party Marketplaces Subscription Services Pharmacies Others |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Others |

| By Geographic Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Cash on Delivery Others |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Others |

| By Customer Type | Individual Consumers Healthcare Institutions Pharmacies Corporate Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Pharmacy Sales | 120 | Pharmacy Owners, E-commerce Managers |

| Consumer Purchasing Behavior | 90 | Healthcare Consumers, Online Shoppers |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Entry Strategies | 50 | Business Development Managers, Market Analysts |

| Logistics and Distribution Channels | 70 | Supply Chain Managers, Logistics Coordinators |

The GCC Pharma E Commerce Market is valued at approximately USD 3.5 billion, driven by the increasing adoption of digital health solutions and the expansion of online pharmacies, particularly accelerated by the pandemic.