GCC Polyethylene Terephthalate (PET) Market Overview

- The GCC Polyethylene Terephthalate (PET) Market is valued at approximately USD 4.2 billion, based on a five-year analysis of regional PET demand and pricing levels for polyethylene terephthalate in the Gulf Cooperation Council countries. This growth is primarily driven by the increasing demand for sustainable packaging solutions, particularly in the food and beverage sector, as well as the rising consumer preference for lightweight and recyclable materials. The market is also supported by advancements in recycling technologies and government initiatives promoting the use of recycled PET, including investment in mechanical and chemical recycling lines and bottle-to-bottle rPET projects in the region.

- Key players in this market include Saudi Arabia, the United Arab Emirates, and Qatar, with Saudi Arabia holding the largest share of GCC PET demand and supply on the back of its integrated petrochemical value chain and access to purified terephthalic acid and monoethylene glycol feedstocks. These countries dominate the market due to their robust petrochemical industries, strategic investments in PET resin and bottle-grade production facilities, and supportive policy frameworks that encourage the development of sustainable materials and recycling capacity. Additionally, the presence of major global companies and joint ventures in these regions, such as SABIC and Alpek/JBF RAK, further strengthens their market position through large-scale capacities and export-oriented operations.

- In 2023, the GCC governments implemented regulations aimed at reducing plastic waste, including mandates for increased recycling rates and the use of recycled materials in packaging. One of the key frameworks is the Gulf Cooperation Council Standardization Organization’s “GSO 1863/2021 – Packaging – Requirements for the recovery and recycling of packaging waste”, which sets technical requirements for design for recyclability, collection, and material recovery, including plastics packaging used for food and beverages. In parallel, national measures such as the Saudi “Waste Management Law 2021” issued by the Saudi Ministry of Environment, Water and Agriculture, and the United Arab Emirates “Federal Law No. 12 of 2018 on Integrated Waste Management” introduced obligations for segregation, recycling targets, and extended producer responsibility schemes that are increasingly applied to PET bottles and other plastic packaging. These regulations are designed to promote environmental sustainability and encourage manufacturers to adopt eco-friendly practices, thereby enhancing the overall growth of the PET market through higher collection rates and demand for recycled PET content.

Market.png)

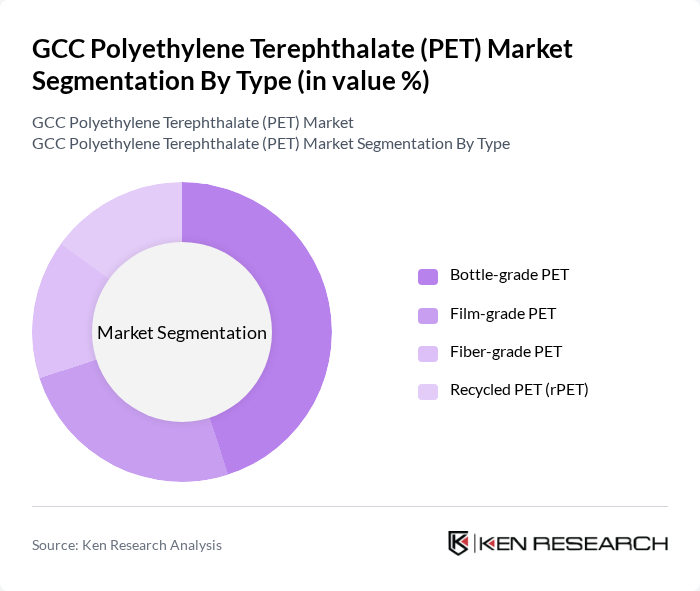

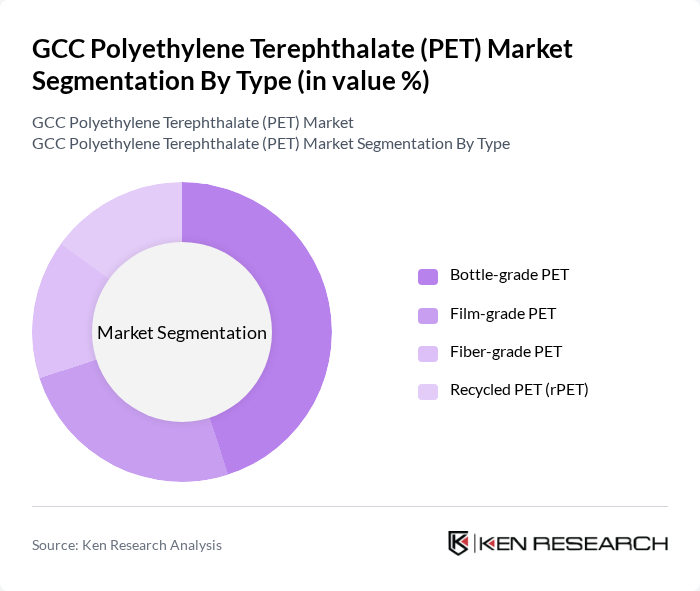

GCC Polyethylene Terephthalate (PET) Market Segmentation

By Type:The market is segmented into four main types: Bottle-grade PET, Film-grade PET, Fiber-grade PET, and Recycled PET (rPET). Among these, Bottle-grade PET is the most dominant segment due to its extensive use in beverage packaging, which is driven by consumer demand for bottled water, carbonated soft drinks, juices, and dairy-based beverages across the GCC. The increasing focus on sustainability has also led to a rise in the adoption of rPET, as manufacturers seek to meet regulatory requirements, corporate sustainability targets, and consumer preferences for eco-friendly products, including the use of high rPET content bottles and closed-loop bottle-to-bottle applications.

By End-User Industry:The end-user industries for PET include Food and Beverage, Textiles and Apparel, Automotive, Electrical and Electronics, Healthcare and Pharmaceuticals, and Consumer Goods and Household. The Food and Beverage sector is the largest consumer of PET, primarily due to the high demand for bottled beverages, on-the-go consumption, and the preference for PET bottles in hot-climate markets such as Saudi Arabia and the United Arab Emirates. The growing trend towards sustainable packaging is also influencing other sectors, leading to increased adoption of PET in textiles and apparel via polyester fibers, in automotive for lightweight components, and in consumer goods and household products where durability, clarity, and recyclability are key purchasing criteria.

GCC Polyethylene Terephthalate (PET) Market Competitive Landscape

The GCC Polyethylene Terephthalate (PET) Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Indorama Ventures Public Company Limited, EQUATE Petrochemical Company, Petrochemikal Industries Company K.S.C. (PIC), Qatar Petrochemical Company (QAPCO), Bahrain National Gas Company (BANAGAS), Alpek Polyester, Reliance Industries Limited, Eastman Chemical Company, Jiangsu Sanfangxiang Group Co., Ltd., Nan Ya Plastics Corporation, Far Eastern New Century Corporation, M&G Chemicals, DAK Americas LLC, Lotte Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

GCC Polyethylene Terephthalate (PET) Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging:The GCC region is witnessing a significant shift towards sustainable packaging solutions, driven by consumer preferences and corporate responsibility. In future, the sustainable packaging market in the GCC was valued at approximately $1.3 billion, with expectations to reach $1.6 billion. This growth is fueled by a 35% increase in demand for eco-friendly materials, particularly in the food and beverage sectors, where PET is increasingly favored for its recyclability and lightweight properties.

- Growth in the Beverage Industry:The beverage industry in the GCC is projected to grow at a rate of 6% annually, reaching a market size of $22 billion. This growth is primarily driven by rising disposable incomes and changing consumer lifestyles, leading to increased consumption of bottled beverages. As a result, the demand for PET, which accounts for over 65% of beverage packaging, is expected to rise significantly, further solidifying its position in the market.

- Technological Advancements in Recycling:The GCC is investing heavily in recycling technologies, with over $600 million allocated to enhance recycling capabilities. Innovations such as advanced sorting and processing technologies are expected to increase the recycling rate of PET from 25% to 45%. This advancement not only supports sustainability goals but also reduces dependency on virgin materials, making recycled PET a more attractive option for manufacturers and consumers alike.

Market Challenges

- Fluctuating Raw Material Prices:The PET market faces significant challenges due to the volatility of raw material prices, particularly crude oil and paraxylene. In future, the price of paraxylene surged by 18%, impacting production costs for PET manufacturers. This fluctuation creates uncertainty in pricing strategies and profit margins, forcing companies to adapt quickly to maintain competitiveness in a price-sensitive market.

- Stringent Environmental Regulations:The GCC region is increasingly implementing stringent environmental regulations aimed at reducing plastic waste. In future, several countries introduced laws mandating a 30% reduction in single-use plastics. Compliance with these regulations requires significant investment in sustainable practices and technologies, posing a challenge for PET manufacturers who must balance regulatory compliance with operational costs and market demands.

GCC Polyethylene Terephthalate (PET) Market Future Outlook

The GCC PET market is poised for transformative growth, driven by a robust shift towards sustainability and innovation. As consumer awareness of environmental issues increases, companies are expected to invest in advanced recycling technologies and sustainable practices. The anticipated rise in e-commerce will further boost demand for PET packaging solutions. Additionally, the expansion into emerging markets will provide new avenues for growth, allowing manufacturers to capitalize on the increasing demand for eco-friendly products and packaging solutions.

Market Opportunities

- Growth in E-commerce Packaging:The e-commerce sector in the GCC is projected to reach $30 billion, creating substantial demand for efficient and sustainable packaging solutions. This growth presents an opportunity for PET manufacturers to develop innovative packaging that meets the needs of online retailers while adhering to sustainability standards, thereby enhancing market penetration.

- Innovations in Biodegradable PET:The development of biodegradable PET is gaining traction, with investments exceeding $250 million. This innovation aligns with global sustainability trends and offers a competitive edge in the market. As consumer preferences shift towards environmentally friendly products, biodegradable PET can capture a significant share of the packaging market, appealing to eco-conscious consumers.

Market.png)