GCC PVC Additives Market Overview

- The GCC PVC Additives Market is valued at approximately USD 1.1 billion, based on a five-year analysis. This growth is primarily driven by the increasing demand for PVC in construction, automotive, and packaging applications. The region’s rapid urbanization, infrastructure development, and expansion of the hospitality sector have significantly contributed to market expansion, as PVC additives enhance the performance and durability of PVC products. Additionally, the surge in demand for pipes, fittings, wire cables, and profiles across the GCC further supports market growth .

- Key players in this market include Saudi Arabia, the United Arab Emirates, and Qatar. These countries dominate the market due to their robust industrial base, significant investments in construction and infrastructure projects, and a growing manufacturing sector. The presence of major chemical companies and favorable government policies further bolster their market position .

- In 2023, the GCC Standardization Organization (GSO) issued the “GSO 1068/2023: Requirements for Additives Used in Polyvinyl Chloride (PVC) Products,” establishing binding guidelines on the permissible use of additives in PVC manufacturing. The regulation mandates limits on hazardous substances, encourages the adoption of eco-friendly alternatives, and requires manufacturers to comply with documentation and labeling standards. This initiative is part of a broader regional strategy to enhance sustainability in the chemical industry and align with global environmental standards .

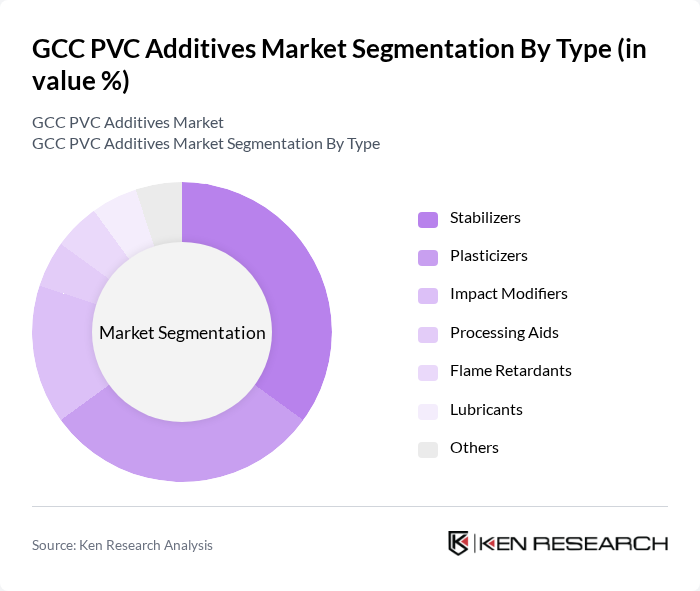

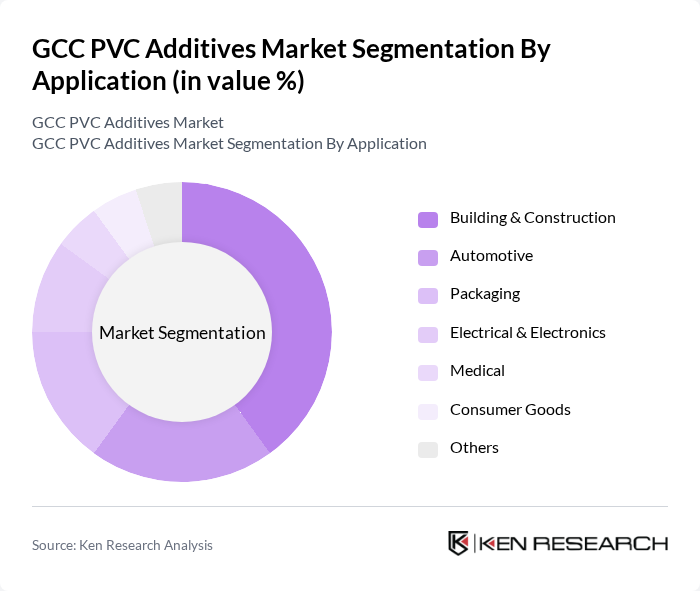

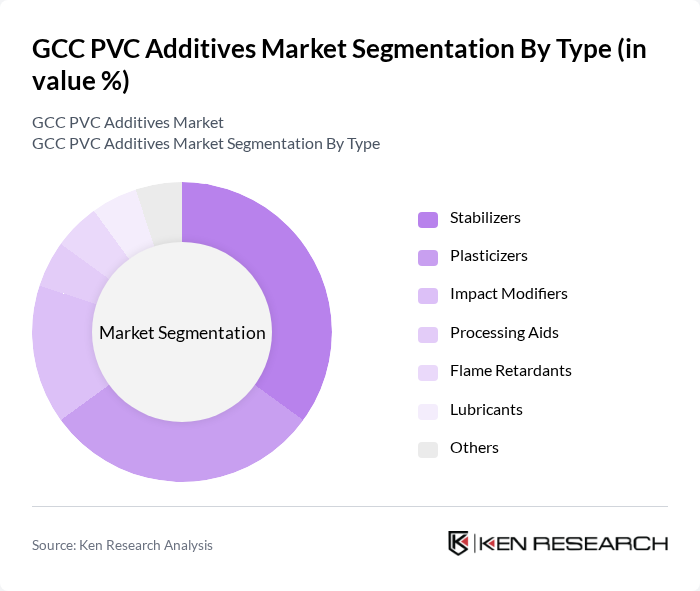

GCC PVC Additives Market Segmentation

By Type:The market is segmented into various types of additives that enhance the properties of PVC. The key subsegments include Stabilizers, Plasticizers, Impact Modifiers, Processing Aids, Flame Retardants, Lubricants, and Others. Among these, Stabilizers are crucial for maintaining the thermal stability of PVC, while Plasticizers improve flexibility and workability. The demand for these additives is driven by their essential roles in applications such as pipes, profiles, cables, and packaging, with a growing trend toward the use of non-phthalate and eco-friendly additives in response to regulatory and sustainability requirements .

By Application:The applications of PVC additives span across several industries, including Building & Construction, Automotive, Packaging, Electrical & Electronics, Medical, Consumer Goods, and Others. The Building & Construction sector is the largest consumer of PVC additives, driven by ongoing infrastructure projects, urban housing demand, and the need for durable and flexible materials in construction. The automotive sector is experiencing increased uptake due to the expansion of local vehicle manufacturing and the use of PVC in interior and exterior components. Packaging applications are also growing, supported by demand for advanced and sustainable packaging solutions .

GCC PVC Additives Market Competitive Landscape

The GCC PVC Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Clariant AG, Arkema S.A., Solvay S.A., Lanxess AG, Akzo Nobel N.V., Adeka Corporation, Dow Chemical Company, Mitsubishi Chemical Corporation, Kraton Corporation, PolyOne Corporation (now Avient Corporation), INEOS Group, HEXPOL AB, Tosoh Corporation, SABIC, Astra Polymers, Interplast Co. Ltd., Al Watania Plastics contribute to innovation, geographic expansion, and service delivery in this space.

GCC PVC Additives Market Industry Analysis

Growth Drivers

- Increasing Demand for PVC in Construction:The construction sector in the GCC region is projected to reach a value of $1.5 trillion in future, driving the demand for PVC additives. With over 65% of PVC consumption attributed to construction applications, the need for durable and versatile materials is paramount. The ongoing infrastructure projects, including the Saudi Vision 2030 initiative, further bolster this demand, as they emphasize sustainable building practices and innovative materials, enhancing the market for PVC additives significantly.

- Rising Awareness of Environmental Regulations:The GCC countries are increasingly implementing stringent environmental regulations, with the UAE's National Climate Change Plan aiming for a 30% reduction in greenhouse gas emissions in future. This regulatory landscape is pushing manufacturers to adopt eco-friendly PVC additives, which are compliant with these regulations. As a result, the market for sustainable additives is expected to grow, with an estimated increase in demand for green products by 30% over the next five years, reflecting a significant shift in industry practices.

- Technological Advancements in Additive Manufacturing:The GCC region is witnessing rapid technological advancements in additive manufacturing, with investments exceeding $600 million in future. These innovations are enhancing the performance and functionality of PVC additives, leading to improved product quality and efficiency. The integration of smart additives, which can respond to environmental changes, is expected to revolutionize applications in construction and automotive sectors, further driving the market growth as manufacturers seek competitive advantages through technology.

Market Challenges

- Fluctuating Raw Material Prices:The GCC PVC additives market faces significant challenges due to fluctuating raw material prices, particularly for petrochemicals, which constitute over 75% of production costs. In future, the price of ethylene, a key raw material, surged by 20%, impacting profit margins for manufacturers. This volatility creates uncertainty in pricing strategies and can hinder investment in new technologies, ultimately affecting market stability and growth prospects in the region.

- Competition from Alternative Materials:The rise of alternative materials, such as bio-based plastics and composites, poses a significant challenge to the GCC PVC additives market. With the global market for bioplastics projected to reach $25 billion in future, manufacturers are increasingly pressured to innovate and reduce costs. This competition can lead to market share erosion for traditional PVC products, necessitating a strategic shift towards more sustainable and competitive offerings to retain relevance in the evolving landscape.

GCC PVC Additives Market Future Outlook

The GCC PVC additives market is poised for transformative growth, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt eco-friendly practices, the demand for bio-based and smart additives is expected to rise significantly. Additionally, the expansion of the automotive and packaging sectors will further enhance market dynamics. With ongoing investments in infrastructure and a focus on compliance with environmental regulations, the region is likely to witness a robust evolution in PVC additive applications, fostering innovation and competitiveness.

Market Opportunities

- Growth in the Packaging Industry:The GCC packaging industry is projected to reach $35 billion in future, creating substantial opportunities for PVC additives. As consumer demand for sustainable packaging solutions increases, manufacturers are likely to invest in innovative PVC formulations that meet these needs, enhancing market potential and driving growth in this segment.

- Increasing Use of PVC in Medical Applications:The medical sector in the GCC is expanding rapidly, with healthcare spending expected to exceed $120 billion in future. This growth presents opportunities for PVC additives in medical devices and packaging, as the demand for high-quality, biocompatible materials rises. Manufacturers can capitalize on this trend by developing specialized additives tailored for medical applications, thus broadening their market reach.