Region:Middle East

Author(s):Shubham

Product Code:KRAC3688

Pages:96

Published On:January 2026

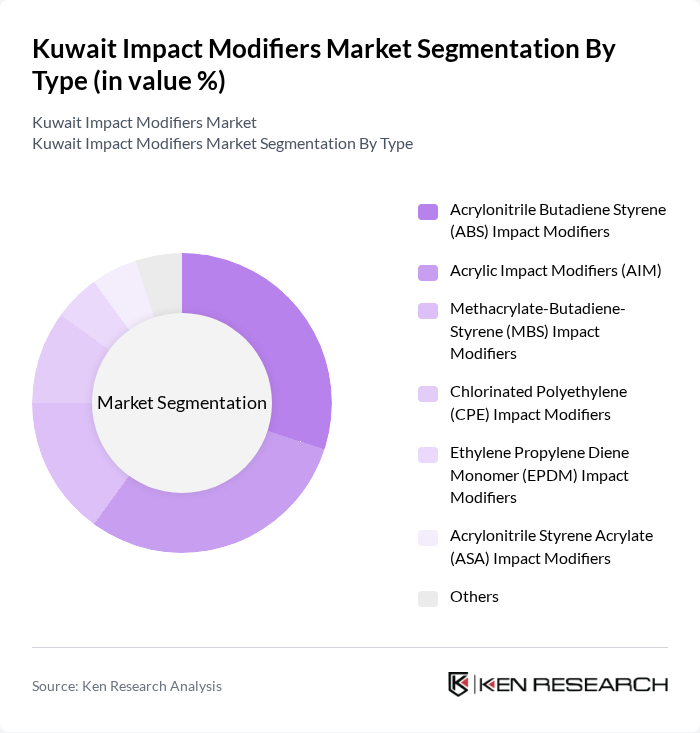

By Type:The impact modifiers market can be segmented into various types, including Acrylonitrile Butadiene Styrene (ABS) Impact Modifiers, Acrylic Impact Modifiers (AIM), Methacrylate-Butadiene-Styrene (MBS) Impact Modifiers, Chlorinated Polyethylene (CPE) Impact Modifiers, Ethylene Propylene Diene Monomer (EPDM) Impact Modifiers, Acrylonitrile Styrene Acrylate (ASA) Impact Modifiers, and Others. At a global and regional level, acrylic impact modifiers account for a major share of demand due to their widespread use in PVC window profiles, pipes, fittings, and rigid packaging, while ABS and MBS impact modifiers are also important in engineering plastics and transparent PVC applications. In Kuwait, demand closely mirrors these global patterns, with acrylic and MBS systems gaining traction in construction and packaging uses alongside ABS- and EPDM?based modifiers used in automotive and technical parts.

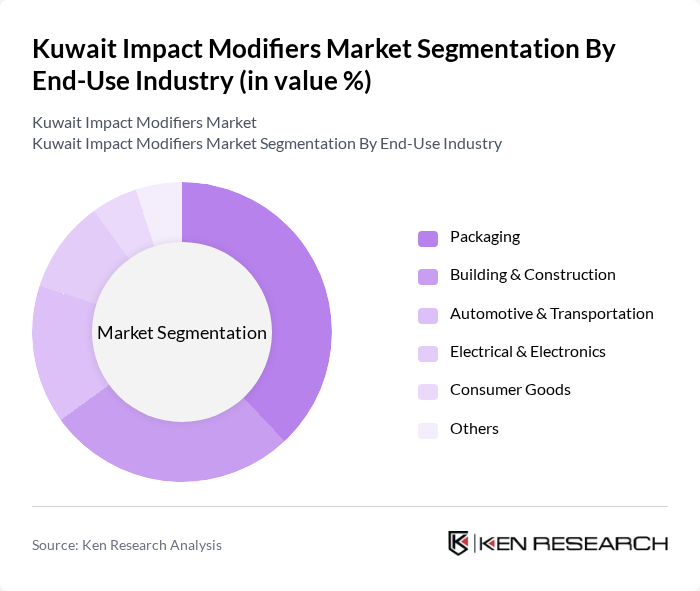

By End-Use Industry:The impact modifiers market is segmented by end-use industries, including Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Consumer Goods, and Others. Globally, the packaging segment represents the largest share of impact modifier consumption, particularly for rigid and semi?rigid packaging that requires enhanced toughness and stress?crack resistance, followed by building and construction applications in PVC profiles, pipes, and sheets. In Kuwait, this pattern is similar, with the Packaging industry acting as the largest consumer of impact modifiers, driven by the increasing demand for durable and high?performance packaging for food, beverages, and consumer products, while infrastructure and housing projects under Kuwait Vision 2035 support strong usage in Building & Construction, and the Automotive & Transportation segment contributes through under?the?hood components and exterior parts requiring improved impact resistance.

The Kuwait Impact Modifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Kuwait Petroleum Corporation (KPC), Kuwait Integrated Petroleum Industries Company (KIPIC), Petrochemical Industries Company (PIC), EQUATE Petrochemical Company, Dow Chemical (Kuwait operations/joint ventures), Arkema (Regional Middle East Operations), BASF (Regional Middle East Operations), LG Chem (Regional Middle East Operations), Mitsubishi Chemical Group (Regional Middle East Operations), Kaneka Corporation (Regional Middle East Operations), Local Plastic Compounders and Masterbatch Producers, Regional Distributors of Impact Modifiers in Kuwait, Pipe & Profile Converters Using Impact Modifiers in Kuwait, Other Relevant Chemical & Additives Suppliers Active in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait impact modifiers market appears promising, driven by increasing investments in sustainable construction and automotive sectors. As the government emphasizes eco-friendly practices, manufacturers are likely to innovate and develop bio-based impact modifiers, aligning with global sustainability trends. Additionally, the integration of smart technologies in manufacturing processes is expected to enhance efficiency and product customization, catering to specific industry needs. This evolving landscape presents significant opportunities for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylonitrile Butadiene Styrene (ABS) Impact Modifiers Acrylic Impact Modifiers (AIM) Methacrylate-Butadiene-Styrene (MBS) Impact Modifiers Chlorinated Polyethylene (CPE) Impact Modifiers Ethylene Propylene Diene Monomer (EPDM) Impact Modifiers Acrylonitrile Styrene Acrylate (ASA) Impact Modifiers Others |

| By End-Use Industry | Packaging Building & Construction Automotive & Transportation Electrical & Electronics Consumer Goods Others |

| By Application | PVC Pipes & Fittings PVC Window & Door Profiles PVC Sheets & Films Engineering Plastics Others |

| By Distribution Channel | Direct Sales to Converters/OEMs Distributors & Traders Online/Platform-Based Sales Others |

| By Region (Within Kuwait) | Al Asimah (Kuwait City) Al Ahmadi Al Farwaniyah Al Jahra Hawalli Mubarak Al-Kabeer |

| By Product Form | Granules/Pellets Powders Liquids/Dispersions Others |

| By Performance Characteristics | High Impact Resistance Low Temperature Impact Performance Weatherability and UV Resistance Chemical and Stress-Crack Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Impact Modifiers | 60 | Product Development Managers, Quality Assurance Engineers |

| Construction Material Applications | 40 | Construction Project Managers, Material Engineers |

| Consumer Goods Packaging | 45 | Brand Managers, Packaging Engineers |

| Industrial Applications | 50 | Operations Managers, Procurement Specialists |

| Research & Development Insights | 40 | R&D Directors, Polymer Scientists |

The Kuwait Impact Modifiers Market is valued at approximately USD 140 million, reflecting a five-year historical analysis and trends in global and regional markets for impact modifiers and plastic additives.