Region:Middle East

Author(s):Rebecca

Product Code:KRAD5058

Pages:89

Published On:December 2025

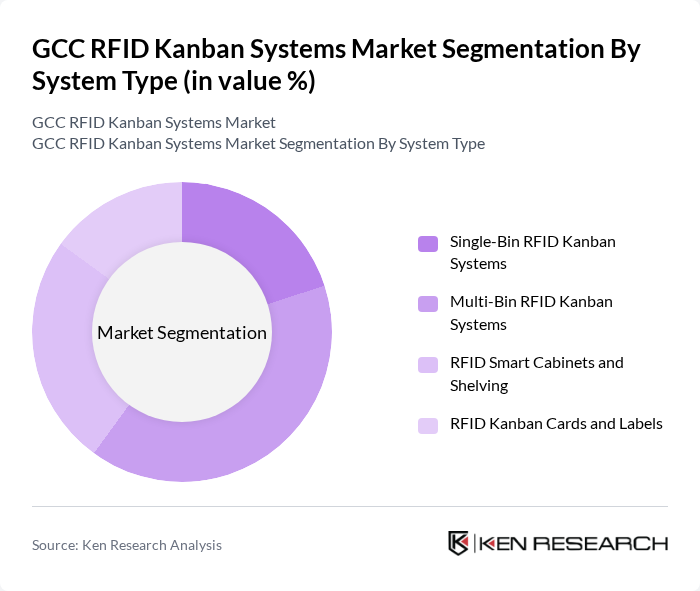

By System Type:The segmentation under System Type includes Single-Bin RFID Kanban Systems, Multi-Bin RFID Kanban Systems, RFID Smart Cabinets and Shelving, and RFID Kanban Cards and Labels. Single-bin and multi-bin RFID Kanban architectures are both widely adopted globally for inventory automation, with single-bin RFID Kanban systems currently accounting for the largest share worldwide due to their simplicity and lower implementation complexity, while multi-bin RFID Kanban systems are growing rapidly as hospitals and manufacturers seek greater redundancy and continuous replenishment capability. In the GCC, multi-bin RFID Kanban systems, RFID smart cabinets, and shelving solutions are particularly favored in healthcare and high-value manufacturing environments for improving inventory accuracy, minimizing manual counts, and reducing stockouts of critical consumables.

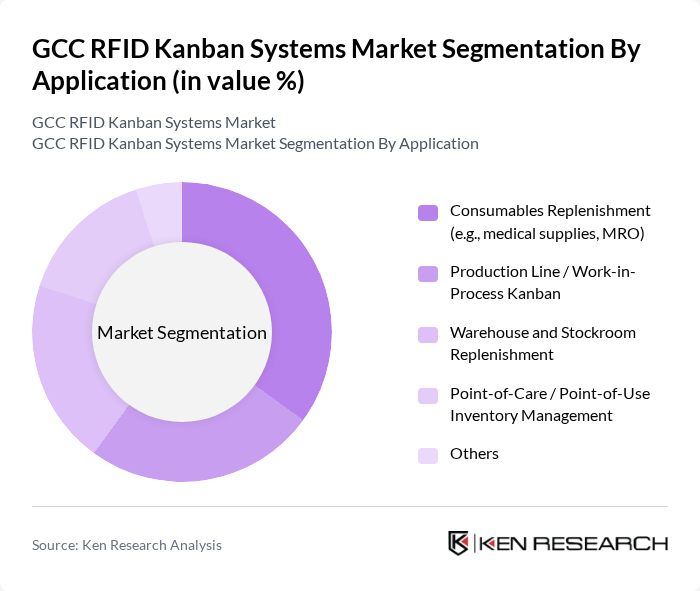

By Application:The application segmentation includes Consumables Replenishment (e.g., medical supplies, MRO), Production Line / Work-in-Process Kanban, Warehouse and Stockroom Replenishment, Point-of-Care / Point-of-Use Inventory Management, and Others. Globally, RFID Kanban systems are extensively used for real-time consumables and spare-parts replenishment in healthcare, manufacturing, and MRO environments, where they support automated reordering, reduction of manual inventory checks, and lower stockout risk. The Consumables Replenishment and Point-of-Care / Point-of-Use Inventory Management segments are particularly important in hospitals and clinics, where RFID Kanban-enabled cabinets and Kanban boxes improve visibility of medical supplies and implants, a trend further reinforced by post?pandemic emphasis on resilient healthcare supply chains.

The GCC RFID Kanban Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zebra Technologies Corporation, Impinj, Inc., Avery Dennison Corporation (including Smartrac brand), SATO Holdings Corporation, NXP Semiconductors N.V., HID Global Corporation (an ASSA ABLOY Group brand), Terso Solutions, Inc., Logistyx Technologies / Körber Supply Chain (RFID Kanban solutions), Wavemark, Inc. (Cardinal Health), Stanley Healthcare (Securitas Healthcare), Palex Medical, LogiTag Systems Ltd., Mobile Aspects, Inc., MediQR / RFID Global Solution, Inc., GCC System Integrators and Partners (e.g., Emitac Healthcare Solutions, TECHNOMED Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC RFID Kanban systems market appears promising, driven by technological advancements and increasing digitalization across industries. As businesses prioritize efficiency and transparency, the integration of IoT and AI technologies is expected to enhance the capabilities of RFID systems. Furthermore, the growing emphasis on sustainability will likely push companies to adopt eco-friendly practices, aligning with regional goals for sustainable development and operational excellence in supply chain management.

| Segment | Sub-Segments |

|---|---|

| By System Type | Single-Bin RFID Kanban Systems Multi-Bin RFID Kanban Systems RFID Smart Cabinets and Shelving RFID Kanban Cards and Labels |

| By Application | Consumables Replenishment (e.g., medical supplies, MRO) Production Line / Work-in-Process Kanban Warehouse and Stockroom Replenishment Point-of-Care / Point-of-Use Inventory Management Others |

| By End-User Industry | Healthcare Providers (Hospitals, Clinics, Pharmacies) Automotive and Discrete Manufacturing Food & Beverage and FMCG Logistics, 3PL, and Distribution Centers Retail and E-commerce Fulfilment Others |

| By Component | RFID Kanban Boxes / Bins RFID Tags and Labels RFID Readers and Gateways RFID-Enabled Cabinets / Shelves Software Platform & Integration (Middleware, Analytics, Cloud) Services (Design, Integration, Managed Services) |

| By Deployment Mode | On-Premises Cloud-Based (SaaS) Hybrid Others |

| By Geography (Within GCC) | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Healthcare Use Case (GCC Hospitals & Clinics) | Operating Room and Cath Lab Inventory Central Stores and Pharmacy Kanban Ward and Point-of-Care Supplies Implantable Devices and High-Value Assets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector RFID Implementation | 120 | Operations Managers, Supply Chain Analysts |

| Retail Inventory Management | 90 | Inventory Managers, Retail Operations Directors |

| Logistics and Distribution Centers | 80 | Logistics Coordinators, Warehouse Managers |

| Healthcare Supply Chain Solutions | 70 | Healthcare Administrators, Procurement Officers |

| Food and Beverage Industry Tracking | 60 | Quality Control Managers, Supply Chain Directors |

The GCC RFID Kanban Systems Market is valued at approximately USD 260 million, reflecting a significant growth driven by the increasing adoption of automation in supply chain management and the need for real-time tracking of goods across various sectors.