Region:Middle East

Author(s):Shubham

Product Code:KRAB8819

Pages:90

Published On:October 2025

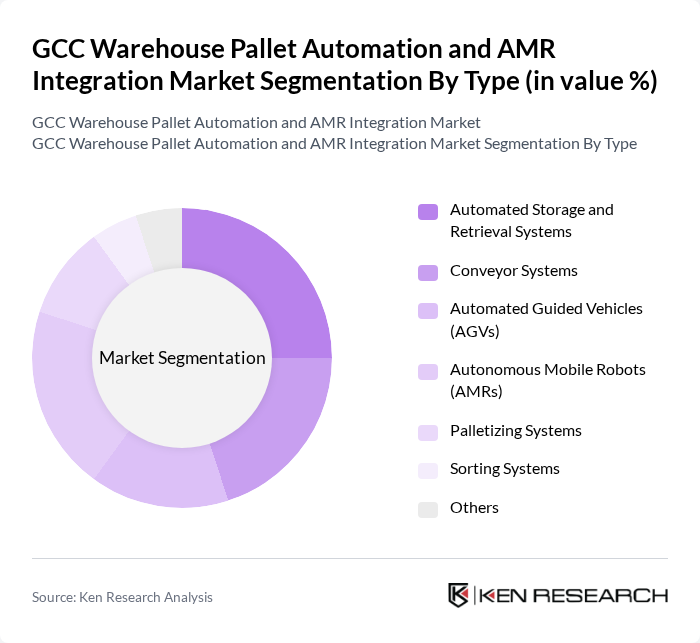

By Type:The market is segmented into various types of automation solutions, including Automated Storage and Retrieval Systems, Conveyor Systems, Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Palletizing Systems, Sorting Systems, and Others. Each of these segments plays a crucial role in enhancing warehouse efficiency and productivity.

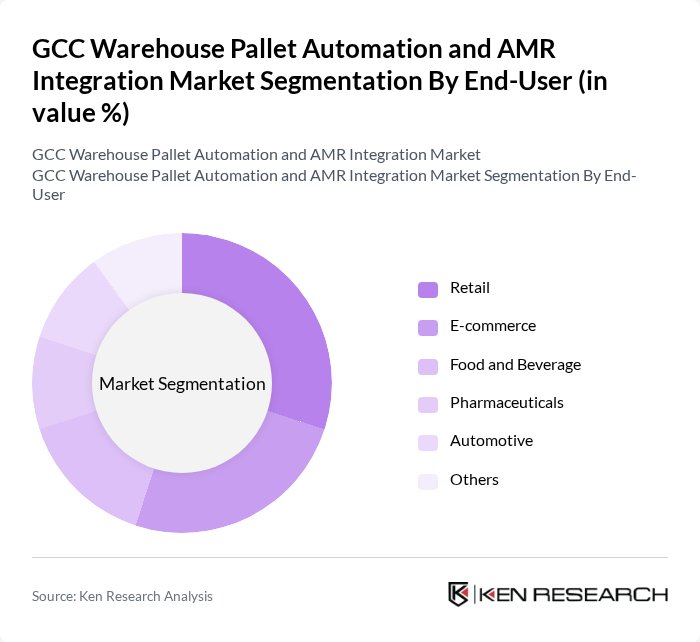

By End-User:The end-user segmentation includes Retail, E-commerce, Food and Beverage, Pharmaceuticals, Automotive, and Others. Each sector has unique requirements for automation, driving the demand for tailored solutions.

The GCC Warehouse Pallet Automation and AMR Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic, Honeywell Intelligrated, Siemens AG, KUKA AG, Swisslog Holding AG, Jungheinrich AG, Toyota Industries Corporation, Vanderlande Industries, Fetch Robotics, Seegrid Corporation, GreyOrange, Locus Robotics, AHS (Automated Handling Systems), Bastian Solutions, Cobalt Robotics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC warehouse pallet automation and AMR integration market appears promising, driven by ongoing technological advancements and increasing demand for efficient logistics solutions. As companies continue to embrace Industry 4.0 practices, the integration of AI and IoT technologies will likely enhance operational efficiencies. Furthermore, the expansion of e-commerce and retail sectors will necessitate more sophisticated warehousing solutions, positioning automation as a critical component for businesses aiming to remain competitive in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems Conveyor Systems Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Palletizing Systems Sorting Systems Others |

| By End-User | Retail E-commerce Food and Beverage Pharmaceuticals Automotive Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Returns Processing Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Industry Vertical | Manufacturing Logistics and Transportation Healthcare Electronics Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Adoption | 150 | Warehouse Managers, Automation Engineers |

| AMR Integration in Supply Chains | 100 | Logistics Directors, IT Managers |

| Impact of Automation on Operational Efficiency | 80 | Operations Managers, Process Improvement Specialists |

| Investment Trends in Warehouse Technologies | 70 | Financial Analysts, Procurement Officers |

| Future of Robotics in Logistics | 90 | Research Analysts, Industry Experts |

The GCC Warehouse Pallet Automation and AMR Integration Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions and technological advancements in automation.