Region:Europe

Author(s):Geetanshi

Product Code:KRAD0023

Pages:88

Published On:August 2025

By Type:The agricultural machinery market can be segmented into various types, including tractors, harvesters, planting and seeding equipment, ploughing and cultivating machinery, sprayers, irrigation systems, haying and forage machinery, livestock equipment, and others. Among these, tractors and harvesters are the most significant segments, driven by their essential roles in modern farming practices. The increasing trend towards mechanization in agriculture has led to a higher demand for these machines, as they enhance productivity and efficiency in farming operations. Precision agriculture equipment and autonomous machinery are also gaining traction, reflecting the market's focus on digital and sustainable solutions .

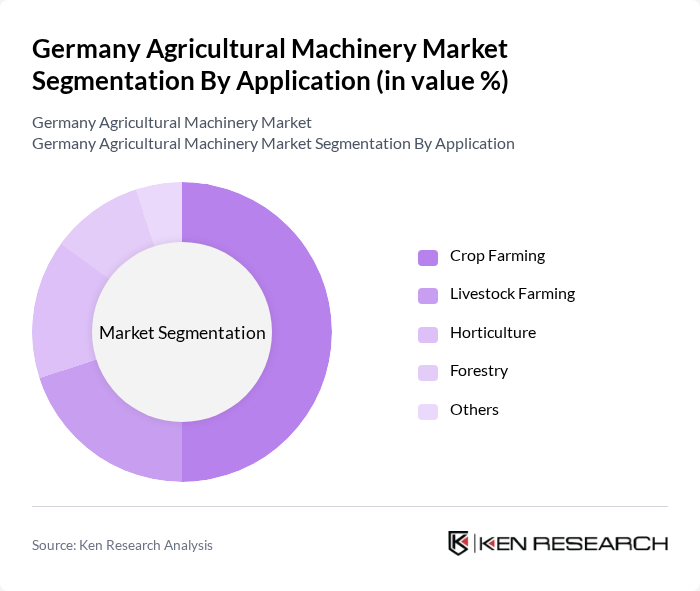

By Application:The market can also be segmented based on application, which includes crop farming, livestock farming, horticulture, forestry, and others. Crop farming is the leading application segment, driven by the increasing need for food production and the adoption of modern farming techniques. The growing population and rising food demand have led to a surge in crop farming activities, necessitating the use of advanced agricultural machinery to enhance yield and efficiency. Livestock farming and horticulture are also significant, supported by investments in animal welfare and specialty crop production .

The Germany Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere GmbH & Co. KG, AGCO GmbH (Fendt, Massey Ferguson, Valtra), CLAAS KGaA mbH, CNH Industrial N.V. (Case IH, New Holland), Kubota (Deutschland) GmbH, SDF Group (SAME DEUTZ-FAHR), HORSCH Maschinen GmbH, Lemken GmbH & Co. KG, AMAZONE-Werke H. Dreyer GmbH & Co. KG, Grimme Landmaschinenfabrik GmbH & Co. KG, Kuhn Group (Bucher Industries AG), Pöttinger Landtechnik GmbH, Kverneland Group (Kubota Holdings Europe B.V.), Väderstad AB, Strautmann & Söhne GmbH u. Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural machinery market in Germany appears promising, driven by ongoing technological innovations and a strong push towards sustainability. As farmers increasingly adopt smart farming solutions, the integration of IoT and automation will likely enhance operational efficiency. Additionally, the focus on electric and hybrid machinery is expected to grow, aligning with environmental goals. These trends indicate a transformative phase for the industry, fostering a more sustainable and productive agricultural landscape in Germany.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Planting and Seeding Equipment Ploughing and Cultivating Machinery Sprayers Irrigation Systems Haying and Forage Machinery Livestock Equipment Others |

| By Application | Crop Farming Livestock Farming Horticulture Forestry Others |

| By End-User | Large Farms Medium Farms Small Farms Agricultural Cooperatives Others |

| By Sales Channel | Direct Sales Distributors Online Retail Auctions Others |

| By Distribution Mode | Wholesale Retail Direct-to-Consumer Others |

| By Price Range | Budget Mid-Range Premium |

| By Technology | Conventional Machinery Smart Machinery Autonomous Machinery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Manufacturers | 60 | Product Managers, Sales Directors |

| Harvesting Equipment Suppliers | 50 | Operations Managers, Marketing Heads |

| Farmers and Agricultural Cooperatives | 120 | Farm Owners, Cooperative Leaders |

| Distributors and Retailers | 40 | Supply Chain Managers, Retail Operations Heads |

| Research and Development Experts | 40 | R&D Managers, Innovation Directors |

The Germany Agricultural Machinery Market is valued at approximately USD 9.6 billion, reflecting a significant growth driven by technological advancements, increased demand for efficient farming practices, and sustainable agricultural solutions.