Kuwait Baby Food Packaging Market Overview

- The Kuwait Baby Food Packaging Market is valued at USD 95 million, based on a five-year analysis of industry and regional reports. Growth is primarily driven by a rising birth rate, increasing consumer awareness of infant nutrition, and a marked shift toward eco-friendly and convenient packaging solutions. Parents in Kuwait are increasingly seeking packaging that ensures safety, freshness, and ease of use, with demand further supported by the adoption of innovative, sustainable materials and formats such as pouches and BPA-free plastics .

- Kuwait City remains the dominant market hub, attributed to its high population density, concentration of affluent families, and urban lifestyle. The prevalence of major retail chains and supermarkets in Kuwait City has facilitated easy access to a wide variety of packaged baby food products, reinforcing consumer preferences for convenience and quality .

- The Ministerial Decree No. 39/2019 issued by the Ministry of Health of Kuwait mandates that all baby food packaging must comply with the Gulf Technical Regulation for Food Safety Requirements in Baby Food (GSO 2371:2014). This regulation requires packaging to be free from harmful substances such as BPA, mandates accurate labeling of ingredients and nutritional content, and sets strict standards for hygiene and traceability in the production and packaging process .

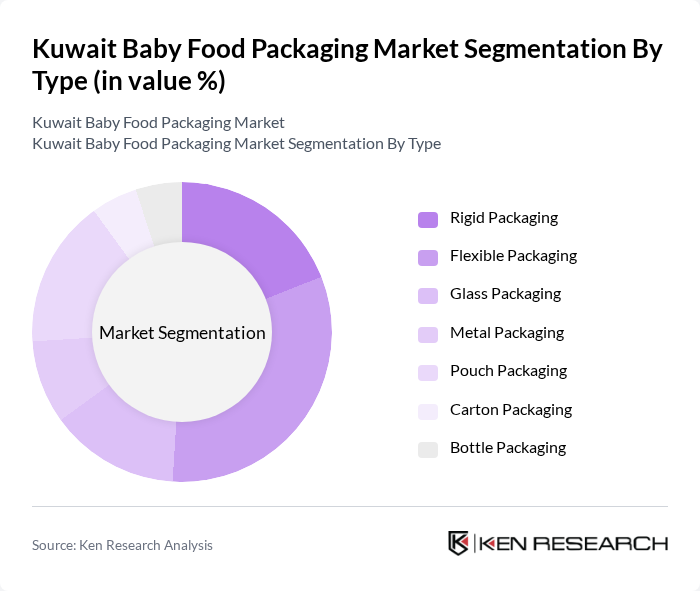

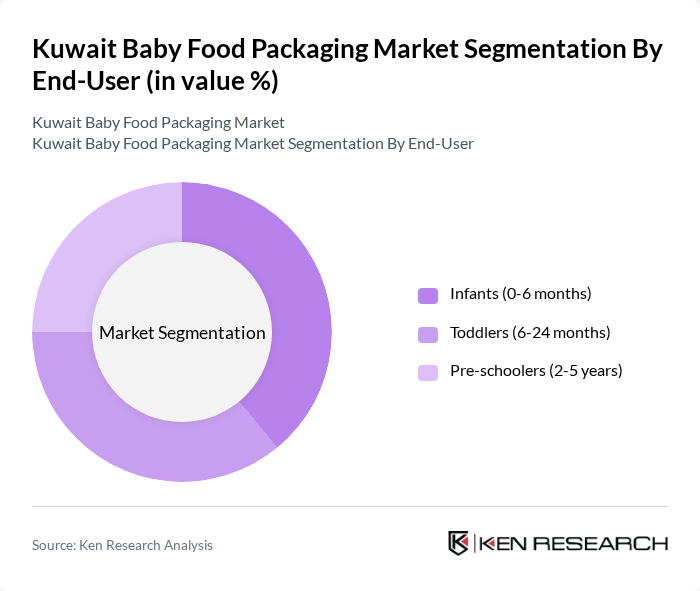

Kuwait Baby Food Packaging Market Segmentation

By Type:The market is segmented into Rigid Packaging, Flexible Packaging, Glass Packaging, Metal Packaging, Pouch Packaging, Carton Packaging, and Bottle Packaging. Flexible and pouch packaging are increasingly preferred due to their lightweight, portability, and ability to preserve freshness, while glass and metal formats remain relevant for premium and specialized products. Rigid and carton packaging continue to serve traditional and bulk-purchase segments, with innovation focused on recyclability and user-friendly designs .

By End-User:The end-user segmentation includes Infants (0-6 months), Toddlers (6-24 months), and Pre-schoolers (2-5 years). Each group exhibits distinct consumption patterns, with infants primarily consuming formula and purees in single-serve packs, toddlers favoring snacks and ready-to-eat meals in pouches or flexible packaging, and pre-schoolers increasingly consuming a wider variety of snacks and drinks in convenient, resealable formats .

Kuwait Baby Food Packaging Market Competitive Landscape

The Kuwait Baby Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company, Hero Group, Hain Celestial Group, Inc., Plum Organics, Beech-Nut Nutrition Company, Earth's Best Organic, Happy Family Organics, Sprout Organic Foods, Little Spoon, Yumi, Once Upon a Farm, Baby Gourmet Foods, Amcor PLC, Mondi Group, Berry Global Group, Inc., Sonoco Products Company, Winpak Ltd., Ardagh Group, Ball Corporation, Cascades, Inc., Hood Packaging Corp., EPL Global (Essel Propack Limited) contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Baby Food Packaging Market Industry Analysis

Growth Drivers

- Increasing Demand for Organic Baby Food:The organic baby food segment in Kuwait is projected to reach approximately 15 million KWD in future, driven by a 20% annual increase in consumer preference for organic products. This shift is largely influenced by parents' growing awareness of health benefits associated with organic ingredients, as evidenced by a 30% rise in organic baby food sales over the past two years. The trend aligns with global movements towards healthier eating habits, further propelling market growth.

- Rising Health Consciousness Among Parents:In Kuwait, 65% of parents are increasingly prioritizing health and nutrition for their children, leading to a surge in demand for nutritious baby food options. This heightened awareness is reflected in the 10% growth of health-focused baby food brands in future. Additionally, the World Health Organization reports that 40% of parents are now actively seeking products with no artificial additives, indicating a significant shift towards healthier choices in baby food packaging.

- Expansion of Retail Channels:The retail landscape for baby food in Kuwait is evolving, with a 25% increase in the number of specialized baby product stores and online platforms. This expansion is supported by a 15% rise in e-commerce sales for baby products, as parents increasingly prefer the convenience of online shopping. The growth of retail channels enhances product accessibility, allowing brands to reach a broader audience and cater to the rising demand for diverse baby food options.

Market Challenges

- Stringent Regulatory Compliance:The baby food packaging industry in Kuwait faces significant challenges due to stringent regulatory requirements. Compliance with food safety standards, such as those set by the Kuwait Public Authority for Food and Nutrition, necessitates rigorous testing and certification processes. In future, over 50% of local manufacturers reported increased costs associated with meeting these regulations, which can hinder market entry for new players and limit innovation in packaging solutions.

- High Competition Among Brands:The competitive landscape in the Kuwait baby food packaging market is intensifying, with over 30 brands vying for market share. This saturation leads to aggressive pricing strategies, resulting in reduced profit margins for manufacturers. A recent industry report indicated that 40% of brands are struggling to differentiate their products, which can stifle innovation and limit the introduction of new packaging technologies that appeal to health-conscious consumers.

Kuwait Baby Food Packaging Market Future Outlook

The future of the Kuwait baby food packaging market appears promising, driven by increasing consumer demand for organic and health-oriented products. As parents become more health-conscious, the market is likely to see a rise in innovative packaging solutions that emphasize sustainability and convenience. Additionally, the growth of e-commerce platforms will facilitate easier access to diverse baby food options, further enhancing market dynamics. Companies that adapt to these trends will likely gain a competitive edge in this evolving landscape.

Market Opportunities

- Growth in E-commerce for Baby Products:The e-commerce sector for baby products in Kuwait is expected to grow by 30% in future, presenting significant opportunities for brands to enhance their online presence. This shift allows companies to reach tech-savvy parents who prefer shopping online, thereby increasing sales and brand visibility in a competitive market.

- Introduction of Eco-friendly Packaging Solutions:With 70% of consumers expressing a preference for eco-friendly packaging, brands that adopt sustainable materials can tap into this growing market segment. The demand for biodegradable and recyclable packaging is projected to increase, offering companies a chance to differentiate themselves while contributing to environmental sustainability.