Region:Europe

Author(s):Rebecca

Product Code:KRAB5324

Pages:94

Published On:October 2025

By Service Type:

The service type segmentation includes various subsegments such as Transportation, Warehousing, Last-Mile Delivery Solutions, Reverse Logistics, Freight Management Solutions, Order Management Systems, Inventory Management Solutions, and Others. Among these, Transportation remains the largest revenue-generating segment, reflecting the ongoing need for efficient movement of goods across Germany’s extensive logistics network. However, Last-Mile Delivery Solutions are experiencing the fastest growth, driven by consumer demand for rapid, flexible, and reliable delivery services. Companies are investing in automation, real-time tracking, and route optimization to enhance last-mile delivery performance, making it a critical area for innovation and expansion .

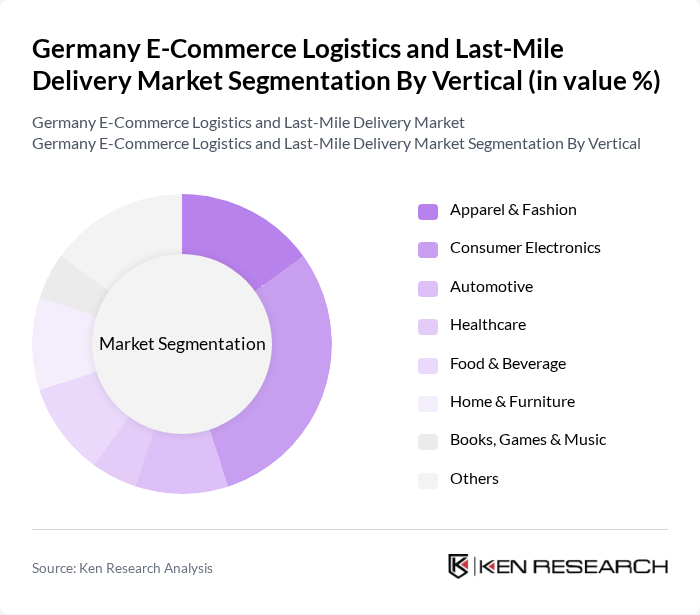

By Vertical:

The vertical segmentation encompasses various industries including Apparel & Fashion, Consumer Electronics, Automotive, Healthcare, Food & Beverage, Home & Furniture, Books, Games & Music, and Others. The Consumer Electronics sector is currently leading the market, driven by the rapid growth of online sales and the increasing demand for electronic products. This vertical benefits from the need for secure, efficient logistics solutions to handle high-value items and ensure timely deliveries, which are crucial for customer satisfaction in this competitive market. Apparel & Fashion and Food & Beverage also represent significant shares, reflecting the diversity of Germany’s e-commerce landscape .

The Germany E-Commerce Logistics and Last-Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Hermes Germany GmbH, DPD Deutschland GmbH, GLS Germany GmbH, UPS Germany, FedEx Express Germany, Amazon Logistics, DB Schenker, Kuehne + Nagel, Zalando SE, Lieferando, Rhenus Logistics, Geodis, Sendcloud, Instabox contribute to innovation, geographic expansion, and service delivery in this space .

The future of the German e-commerce logistics and last-mile delivery market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As sustainability becomes a priority, companies are likely to invest in eco-friendly delivery solutions. Furthermore, the integration of AI and automation will enhance operational efficiency, allowing logistics providers to meet the increasing demand for faster delivery services. The focus on omnichannel strategies will also reshape the logistics landscape, ensuring a seamless shopping experience for consumers.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Roadways, Railways, Airways, Waterways) Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers, Others) Last-Mile Delivery Solutions Reverse Logistics Freight Management Solutions Order Management Systems Inventory Management Solutions Others |

| By Vertical | Apparel & Fashion Consumer Electronics Automotive Healthcare Food & Beverage Home & Furniture Books, Games & Music Others |

| By Logistics Type | Forward Logistics Reverse Logistics |

| By Model | PL (Third-Party Logistics) PL (Fourth-Party Logistics) Others |

| By Operation | Domestic International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Urban Planning Experts |

| Consumer Preferences in Delivery | 80 | Online Shoppers, Customer Experience Managers |

| Impact of Sustainability on Logistics | 60 | Sustainability Managers, Corporate Social Responsibility Officers |

| Technology Adoption in Last-Mile Delivery | 50 | IT Managers, Operations Directors |

| Challenges in E-commerce Logistics | 40 | Supply Chain Analysts, Logistics Consultants |

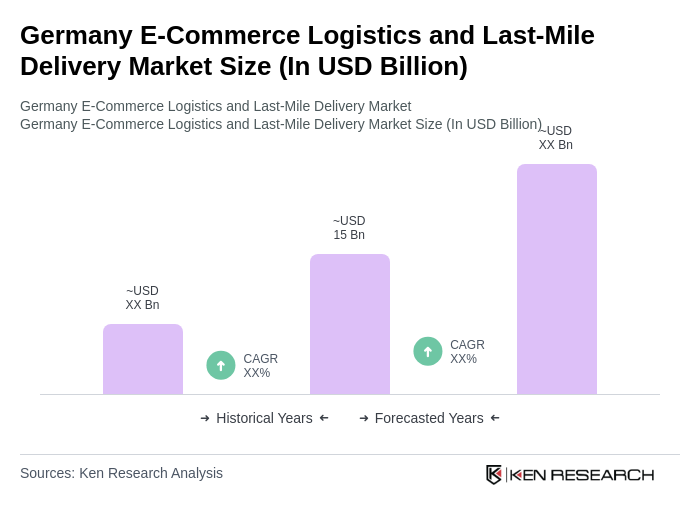

The Germany E-Commerce Logistics and Last-Mile Delivery Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing penetration of online shopping and consumer demand for faster delivery options.