Region:Europe

Author(s):Dev

Product Code:KRAB3090

Pages:99

Published On:October 2025

By Type:

The Germany Facility Management Outsourcing Market is significantly influenced by the Hard Services segment, which includes maintenance, cleaning, and security services. This dominance is attributed to the essential nature of these services in ensuring operational efficiency and safety in various facilities. As businesses increasingly prioritize cost-effectiveness and reliability, the demand for hard services continues to grow, making it a critical component of the overall market.

By End-User:

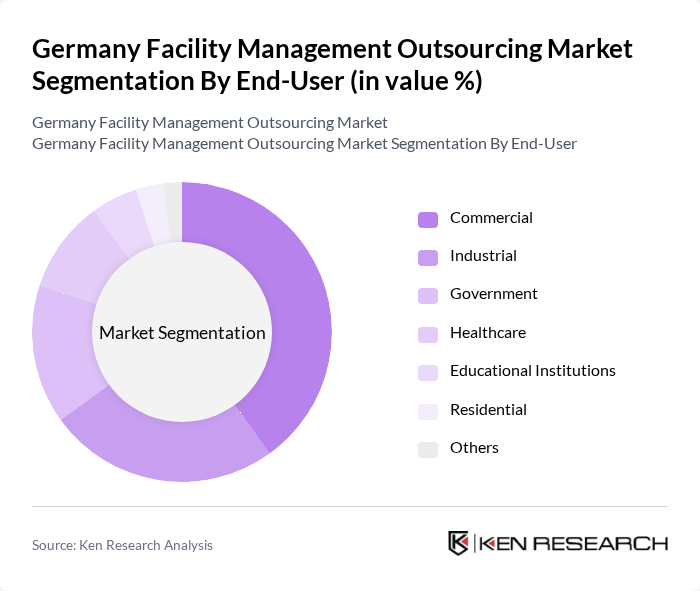

In the Germany Facility Management Outsourcing Market, the Commercial segment leads due to the high demand for facility management services in office buildings, retail spaces, and corporate environments. The growth of the commercial sector, driven by urbanization and economic expansion, has resulted in increased outsourcing of facility management functions. This trend is further supported by businesses seeking to enhance operational efficiency and focus on their core activities.

The Germany Facility Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services GmbH, Sodexo Deutschland GmbH, CBRE Group, Inc., JLL (Jones Lang LaSalle), Dussmann Group, Bilfinger SE, GDI Gesellschaft für Dienstleistung und Integration mbH, Strabag SE, Apleona GmbH, KÖTTER Services, WISAG Facility Service Holding GmbH, SODEXO Group, ENGIE Deutschland GmbH, Vebego AG, Dussmann Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management outsourcing market in Germany appears promising, driven by the increasing integration of technology and sustainability practices. As businesses continue to prioritize operational efficiency and employee well-being, the demand for innovative solutions will rise. By future, the market is expected to witness a shift towards more integrated service offerings, enhancing collaboration between service providers and clients. This evolution will likely foster a more resilient and adaptive market landscape, positioning Germany as a leader in facility management outsourcing.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Industrial Government Healthcare Educational Institutions Residential Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Region | North Germany South Germany East Germany West Germany |

| By Contract Type | Fixed-Term Contracts Open-Ended Contracts Project-Based Contracts |

| By Technology Adoption | Traditional Methods Digital Solutions Smart Technologies |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 100 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 80 | Campus Facility Managers, Procurement Officers |

| Retail Facility Management | 70 | Store Managers, Regional Facility Directors |

| Industrial Facility Services | 90 | Plant Managers, Maintenance Supervisors |

The Germany Facility Management Outsourcing Market is valued at approximately USD 45 billion, reflecting a significant growth trend driven by the demand for operational efficiency, cost reduction, and specialized services across various sectors.