Region:Asia

Author(s):Geetanshi

Product Code:KRAB2714

Pages:94

Published On:October 2025

By Type:

The market is segmented into In-house Facility Management, Outsourced Facility Management, Single FM, Bundled FM, and Integrated FM. Among these,Outsourced Facility Managementis the leading sub-segment, driven by businesses seeking to focus on core activities while leveraging specialized service providers for facility management. This trend is particularly prevalent in urban areas where operational efficiency, technology-enabled solutions, and cost-effectiveness are paramount .

By Offerings:

This segment includes Hard FM, Soft FM, Risk FM, and Administrative FM.Hard FMis currently the dominant sub-segment, as it encompasses essential services such as HVAC, electrical, plumbing, and fire safety, which are critical for maintaining operational standards in commercial and industrial facilities. The increasing focus on safety, compliance, and asset lifecycle management further propels the demand for Hard FM services .

The Indonesia Facility Management & Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Indonesia, CBRE Indonesia, JLL Indonesia, Sodexo Indonesia, Cushman & Wakefield Indonesia, Knight Frank Indonesia, PT SGS Indonesia, G4S Indonesia, Dussmann Group Indonesia, OCS Group Indonesia, Apleona Indonesia, Serco Group Indonesia, Bilfinger SE Indonesia, PT Shield-On Service Tbk, PT ISS Facility Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management and outsourcing market in Indonesia appears promising, driven by technological advancements and increasing urbanization. As businesses continue to prioritize cost efficiency and sustainability, the adoption of integrated facility management solutions is expected to rise. Additionally, the government's focus on infrastructure development will likely create new opportunities for facility management services, fostering growth and innovation in the sector while addressing the challenges posed by regulatory compliance and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | In-house Facility Management Outsourced Facility Management Single FM Bundled FM Integrated FM |

| By Offerings | Hard FM (e.g., HVAC, electrical, plumbing, fire safety) Soft FM (e.g., cleaning, security, landscaping, waste management) Risk FM Administrative FM |

| By End-User Industry | Commercial Institutional Public/Infrastructure Industrial Residential Government BFSI Healthcare Hospitality Others (Education, Retail, etc.) |

| By Service Delivery Model | Integrated Bundled Single Services |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Duration | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Outsourcing | 70 | Healthcare Administrators, Procurement Managers |

| Educational Institution Services | 60 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 50 | Store Managers, Regional Operations Managers |

| Industrial Facility Maintenance | 80 | Plant Managers, Maintenance Supervisors |

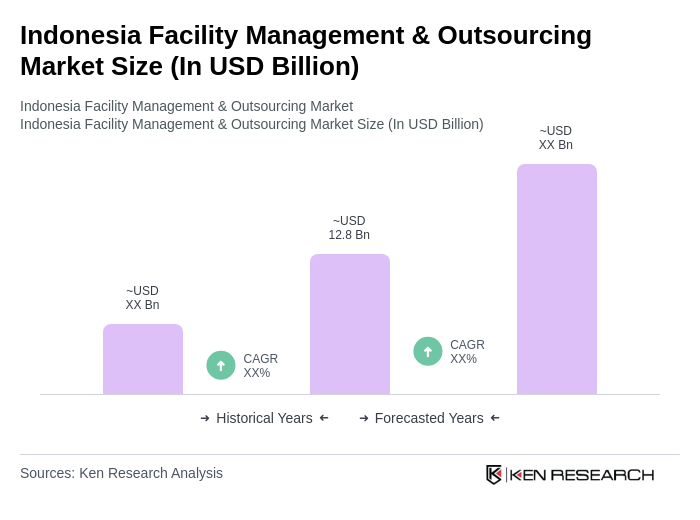

The Indonesia Facility Management & Outsourcing Market is valued at approximately USD 12.8 billion, driven by urbanization, demand for efficient building management, and the trend of outsourcing non-core functions among businesses.