Region:Africa

Author(s):Geetanshi

Product Code:KRAA3294

Pages:94

Published On:September 2025

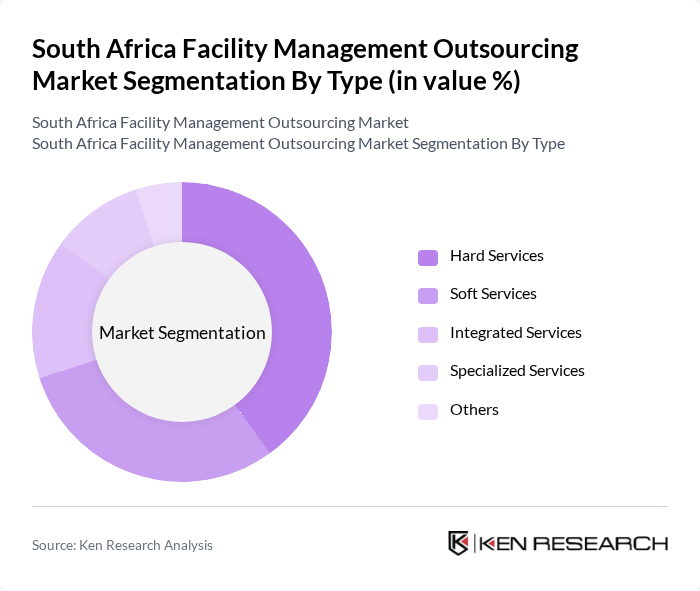

By Type:The market is segmented into various types of services, including hard services, soft services, integrated services, specialized services, and others. Hard services encompass essential maintenance tasks, while soft services focus on support functions. Integrated services combine both hard and soft services, providing a comprehensive solution. Specialized services cater to niche requirements, and other services include pest control and document management. The growing complexity of buildings and the adoption of smart technologies are increasing demand for integrated and specialized FM services, while sustainability and health & safety requirements are boosting the uptake of soft services .

The hard services segment is currently dominating the market due to the essential nature of building maintenance, HVAC, electrical, and plumbing services. As businesses prioritize the upkeep of their facilities to ensure safety and compliance, the demand for these services has increased significantly. Additionally, the growing trend of outsourcing these functions allows companies to focus on their core operations while ensuring that their facilities are well-maintained. This trend is further supported by advancements in technology that enhance service delivery and operational efficiency, such as IoT-enabled predictive maintenance and energy management systems .

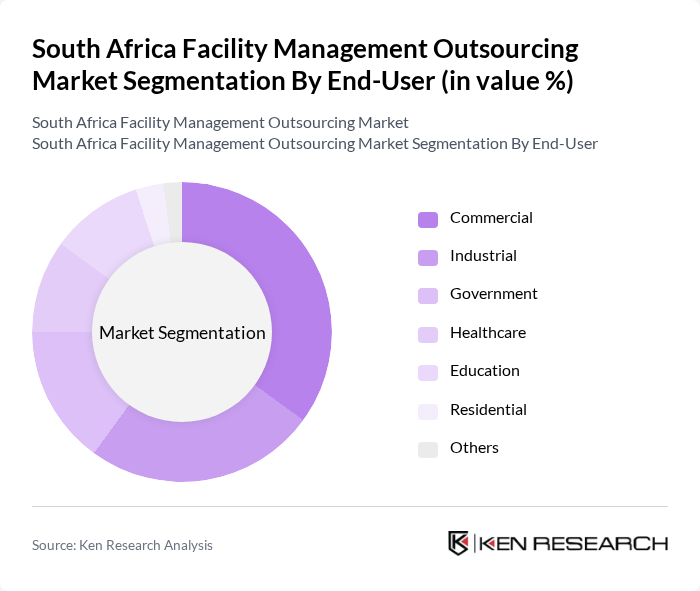

By End-User:The market is segmented by end-user categories, including commercial, industrial, government, healthcare, education, residential, and others. Each segment has unique requirements and demands tailored facility management solutions to enhance operational efficiency and service quality. The commercial and industrial sectors are the largest consumers, driven by the need for efficient space management, compliance, and sustainability initiatives .

The commercial segment leads the market, driven by the increasing number of office spaces, retail outlets, and shopping malls. As businesses strive to create conducive working environments and enhance customer experiences, the demand for facility management services in this sector has surged. Additionally, the focus on cost reduction and operational efficiency has prompted many commercial entities to outsource their facility management needs, further solidifying this segment's dominance. The rise of flexible and hybrid workspaces is also influencing FM strategies in the commercial sector .

The South Africa Facility Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Facilities Management, Servest Group, Tsebo Solutions Group, G4S Facilities Management, CSG Holdings, Envirosafe Solutions, Rentokil Initial, JHI Properties, Motseng Investment Holdings, Facilities Management Solutions (Pty) Ltd, AFS Group, AECOM, ISS Facility Services, SSG Holdings, Broll Property Group, Matrix Consulting Services, SGS South Africa, TROX South Africa, Chiefton Facilities Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African facility management outsourcing market appears promising, driven by technological innovations and a growing emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for remote monitoring and management services is expected to rise. Additionally, the focus on health and safety standards will likely lead to enhanced service offerings, positioning the market for significant growth. Companies that adapt to these trends will be better equipped to meet evolving client needs and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., building maintenance, HVAC, electrical, plumbing) Soft Services (e.g., cleaning, security, landscaping, catering) Integrated Services (bundled hard and soft services under one contract) Specialized Services (energy management, workspace optimization, waste management) Others (e.g., pest control, document management) |

| By End-User | Commercial (offices, retail, shopping malls) Industrial (manufacturing plants, warehouses) Government (public infrastructure, municipal buildings) Healthcare (hospitals, clinics, medical facilities) Education (schools, universities, colleges) Residential (apartment complexes, gated communities) Others (hospitality, sports facilities) |

| By Service Model | Outsourced Services (third-party FM providers) In-House Services (self-managed FM) Hybrid Model (combination of outsourced and in-house) |

| By Sector | Corporate Offices Retail Spaces Manufacturing Facilities Hospitality (hotels, resorts) Others (transport hubs, entertainment venues) |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Contract Duration | Short-term Contracts (less than 1 year) Long-term Contracts (1 year and above) |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-based Pricing Others (e.g., cost-plus, subscription) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Corporate Real Estate Executives |

| Healthcare Facility Outsourcing | 60 | Healthcare Administrators, Operations Managers |

| Educational Institution Services | 50 | Campus Facility Directors, Procurement Officers |

| Retail and Commercial Space Management | 40 | Store Managers, Property Management Executives |

| Government Facility Services | 40 | Public Sector Facility Managers, Compliance Officers |

The South Africa Facility Management Outsourcing Market is valued at approximately USD 4 billion, driven by urbanization, cost-effective management solutions, and a focus on operational efficiency among businesses.