Region:Asia

Author(s):Dev

Product Code:KRAA3557

Pages:98

Published On:September 2025

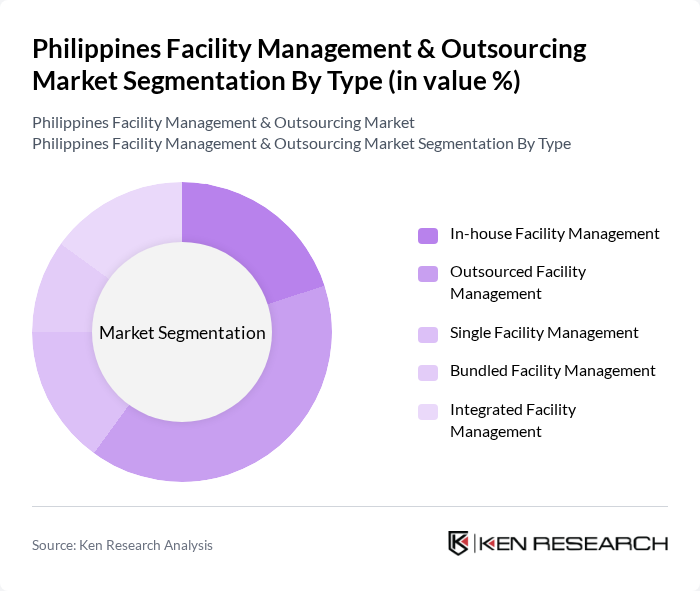

By Type:

The market is segmented into various types, including In-house Facility Management, Outsourced Facility Management, Single Facility Management, Bundled Facility Management, and Integrated Facility Management. Among these,Outsourced Facility Managementis currently the leading sub-segment, driven by the increasing trend of companies focusing on their core competencies while outsourcing non-core functions. This approach allows businesses to enhance operational efficiency, access specialized expertise, and reduce costs, making it a preferred choice for many organizations. The shift is further accelerated by skills shortages, outcome-based key-performance indicators, and the need for compliance expertise.

By Offering Type:

This market is also segmented by offering type into Hard Facility Management and Soft Facility Management.Hard Facility Management, which includes maintenance and repair services, is currently the dominant segment, accounting for approximately 64% of the market. This is due to the essential nature of these services in ensuring operational efficiency and safety of facilities, particularly in commercial and industrial sectors. The segment is further supported by the upkeep needs of ageing infrastructure and the adoption of smart building systems for predictive maintenance.

The Philippines Facility Management & Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle IP, Inc.), ISS Facility Services, Inc., Sodexo Group, G4S Facilities Management Philippines, Inc., Cushman & Wakefield LLC, Santos Knight Frank, Inc., Colliers International Philippines, Inc., SGS Philippines, Inc., Century Properties Management, Inc., WeCare Facility Management Services Inc., OCS Group Holdings Ltd., Community Property Managers Group, Inc., and Kontrac Facilities Management Services LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines facility management and outsourcing market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As smart building technologies gain traction, companies will increasingly adopt IoT solutions to enhance operational efficiency. Additionally, the rising focus on health and safety standards, particularly post-pandemic, will shape service offerings. The integration of facility management services is expected to streamline operations, providing a competitive edge to firms that adapt to these emerging trends effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | In-house Facility Management Outsourced Facility Management Single Facility Management Bundled Facility Management Integrated Facility Management |

| By Offering Type | Hard Facility Management Soft Facility Management |

| By End-User Industry | Commercial Institutional Public/Infrastructure Industrial Other End-user Industries |

| By Geographic Coverage | Metro Manila Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 120 | Facility Managers, Operations Directors |

| Outsourcing Service Providers | 90 | Business Development Managers, Service Delivery Heads |

| Real Estate Management | 60 | Property Managers, Asset Managers |

| Cleaning and Maintenance Services | 50 | Service Supervisors, Quality Assurance Managers |

| Security Services in Facilities | 40 | Security Managers, Risk Management Officers |

The Philippines Facility Management & Outsourcing Market is valued at approximately USD 4.05 billion, reflecting significant growth driven by urbanization, commercial real estate development, and the adoption of smart building technologies.