Region:Europe

Author(s):Rebecca

Product Code:KRAB2986

Pages:94

Published On:October 2025

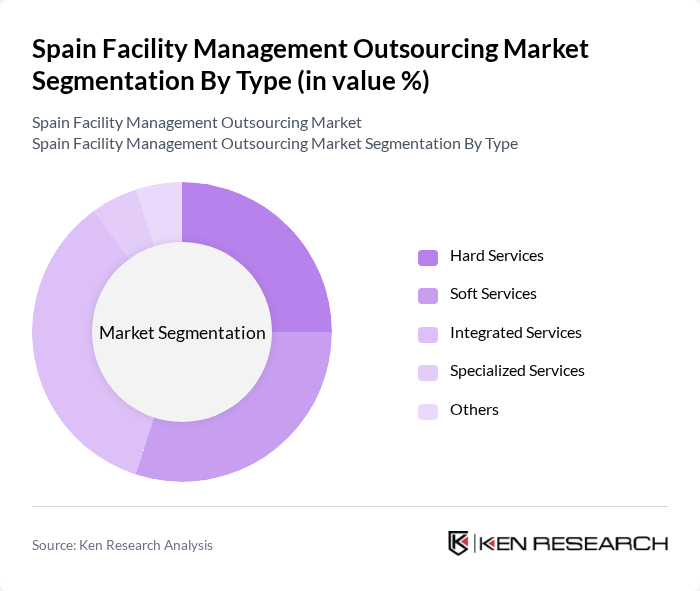

By Type:The market is segmented into various types of services, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services include cleaning and security. Integrated Services combine both hard and soft services for a comprehensive approach. Specialized Services cater to niche requirements, and Others cover any additional services not classified elsewhere. The demand for Integrated Services is particularly strong as organizations seek streamlined operations.

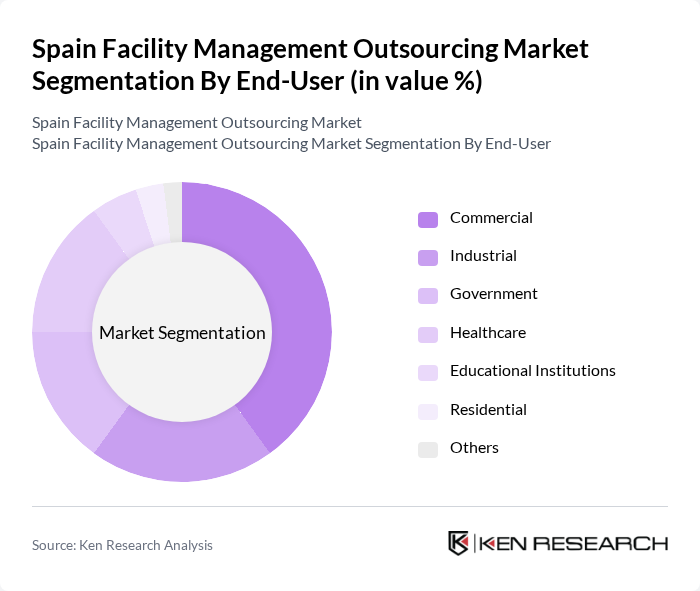

By End-User:The end-user segmentation includes Commercial, Industrial, Government, Healthcare, Educational Institutions, Residential, and Others. The Commercial sector is the largest consumer of facility management services, driven by the need for efficient operations in office spaces. The Healthcare sector also shows significant demand due to stringent regulatory requirements and the need for specialized services. Educational Institutions are increasingly outsourcing to focus on core educational activities.

The Spain Facility Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo S.A., CBRE Group, Inc., JLL (Jones Lang LaSalle), G4S plc, Aramark Corporation, Compass Group PLC, Mitie Group PLC, Serco Group PLC, C&W Services, Apleona GmbH, Bilfinger SE, OCS Group Limited, SODEXO, Dussmann Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management outsourcing market in Spain appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly adopt integrated facility management solutions, the demand for specialized service providers is expected to rise. Additionally, the focus on employee well-being and workplace experience will shape service offerings, leading to innovative solutions that enhance operational efficiency. The market is poised for growth as companies seek to leverage these trends to improve their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Industrial Government Healthcare Educational Institutions Residential Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| By Contract Type | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| By Policy Support | Subsidies Tax Incentives Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 100 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 80 | Campus Facility Managers, Procurement Officers |

| Retail Space Management | 70 | Store Managers, Regional Operations Heads |

| Industrial Facility Services | 90 | Plant Managers, Safety Officers |

The Spain Facility Management Outsourcing Market is valued at approximately USD 12 billion, reflecting a significant growth trend driven by the demand for operational efficiency, cost reduction, and specialized services across various sectors.