Region:Europe

Author(s):Rebecca

Product Code:KRAB0194

Pages:87

Published On:August 2025

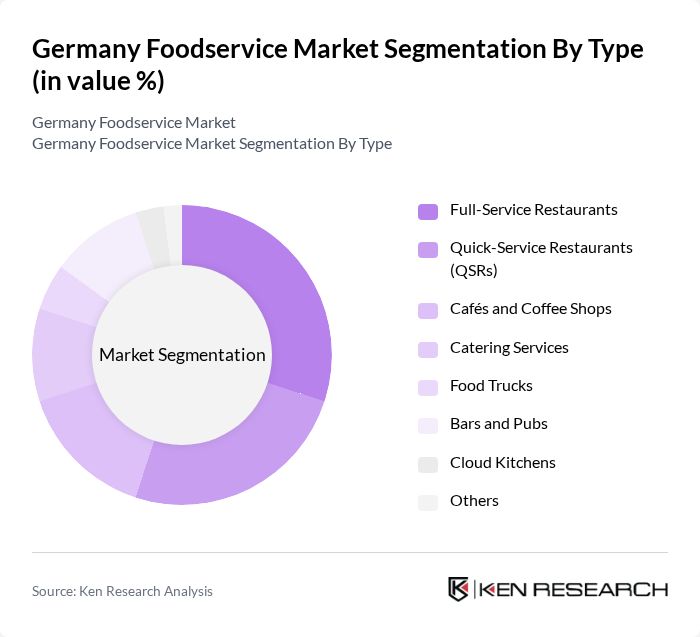

By Type:The foodservice market can be segmented into various types, including Full-Service Restaurants, Quick-Service Restaurants (QSRs), Cafés and Coffee Shops, Catering Services, Food Trucks, Bars and Pubs, Cloud Kitchens, and Others. Each of these segments caters to different consumer preferences and dining occasions, reflecting the diverse culinary landscape of Germany. Full-Service Restaurants and QSRs are the largest segments, with QSRs benefitting from the increasing demand for convenience and digital ordering, while Full-Service Restaurants remain popular for experiential dining. Cloud Kitchens are the fastest-growing segment, driven by the surge in online food delivery and changing consumer habits .

The Full-Service Restaurants segment is currently dominating the market, driven by consumer preferences for dining experiences that offer a combination of quality food and ambiance. This segment appeals to a wide demographic, including families, business professionals, and tourists, who seek a more leisurely dining experience. Quick-Service Restaurants (QSRs) also play a significant role, catering to the growing demand for convenience and fast meals, particularly among younger consumers and busy professionals. Cloud Kitchens are experiencing rapid growth, fueled by the increasing adoption of online food delivery platforms and changing consumer lifestyles .

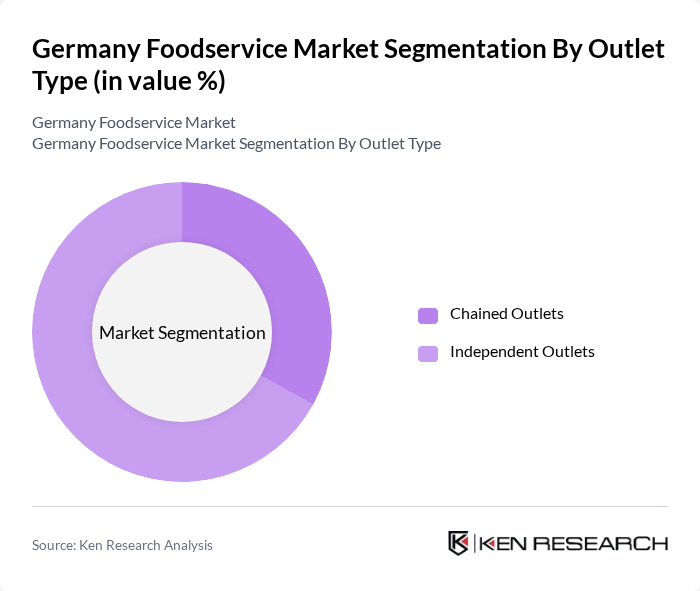

By Outlet Type:The market can also be segmented by outlet type, which includes Chained Outlets and Independent Outlets. Each type has its unique characteristics and appeals to different consumer segments, influencing their market presence and growth potential. In Germany, independent outlets constitute the majority of foodservice providers, reflecting the market's fragmented nature and consumer preference for local and unique dining experiences. Chained outlets, however, have shown greater resilience and stability, especially during periods of market disruption .

Independent Outlets dominate the market due to their sheer number and strong local presence, catering to niche markets and often focusing on unique culinary offerings that attract consumers looking for personalized dining experiences. Chained Outlets, while smaller in market share, benefit from established brand recognition, standardized service quality, and extensive marketing resources, allowing them to offer competitive pricing and consistent customer experiences .

The Germany Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Compass Group PLC, Aramark Holding Deutschland GmbH, Sodexo S.A., Elior Group S.A., Dussmann Group, LSG Sky Chefs GmbH, Autogrill Deutschland GmbH, Kofler & Kompanie GmbH, Gategroup Holding AG, Vapiano SE, Metro AG, REWE Group, EDEKA Zentrale Stiftung & Co. KG, Burger King Deutschland GmbH, McDonald's Deutschland LLC, Domino's Pizza Deutschland GmbH, Nordsee GmbH, AmRest Holdings SE (Starbucks, KFC, Pizza Hut Germany) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German foodservice market appears promising, with a strong emphasis on technology integration and sustainability. As consumer preferences evolve, operators are likely to invest in digital solutions to enhance customer experiences, such as mobile ordering and contactless payments. Additionally, the trend towards sustainable practices will drive innovation in menu offerings and operational efficiencies, positioning the market for growth amidst ongoing challenges in competition and supply chain management.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants Quick-Service Restaurants (QSRs) Cafés and Coffee Shops Catering Services Food Trucks Bars and Pubs Cloud Kitchens Others |

| By Outlet Type | Chained Outlets Independent Outlets |

| By Location | Leisure Venues Lodging (Hotels, Hostels) Retail Locations Standalone Outlets Travel (Airports, Train Stations, Highways) Tourist Locations Urban Areas Suburban Areas Rural Areas Others |

| By Service Model | Dine-In Takeaway Delivery Drive-Thru Self-Service/Automated Others |

| By Cuisine Type | Traditional German Italian Asian Middle Eastern Fast Food Plant-Based/Vegetarian Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Distribution Channel | Online Ordering Platforms Offline Sales Third-Party Delivery Services Direct Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 60 | Restaurant Owners, Managers, Head Chefs |

| Fast Food Chains | 50 | Franchise Owners, Operations Managers |

| Catering Services | 40 | Catering Managers, Event Planners |

| Food Delivery Services | 45 | Delivery Managers, Marketing Directors |

| Consumer Dining Preferences | 100 | General Consumers, Food Enthusiasts |

The Germany Foodservice Market is valued at approximately USD 138 billion, reflecting a significant growth driven by consumer demand for diverse dining options, food delivery services, and health-conscious eating trends.