Region:Europe

Author(s):Shubham

Product Code:KRAB1225

Pages:88

Published On:October 2025

By Type:The market is segmented into Home Furniture, Office Furniture, Hospitality Furniture, Healthcare Furniture, Modular Furniture (Kitchens, Wardrobes, Storage, Workstations), Outdoor Furniture, Custom/Bespoke Furniture, Luxury Furniture, and Others. Each segment addresses specific consumer needs, with home furniture dominating due to high residential demand, while modular and multifunctional solutions are increasingly favored for their adaptability and efficient use of space. Office furniture is evolving toward flexible, collaborative designs, and healthcare furniture is advancing rapidly to meet the needs of an aging population and modern medical environments .

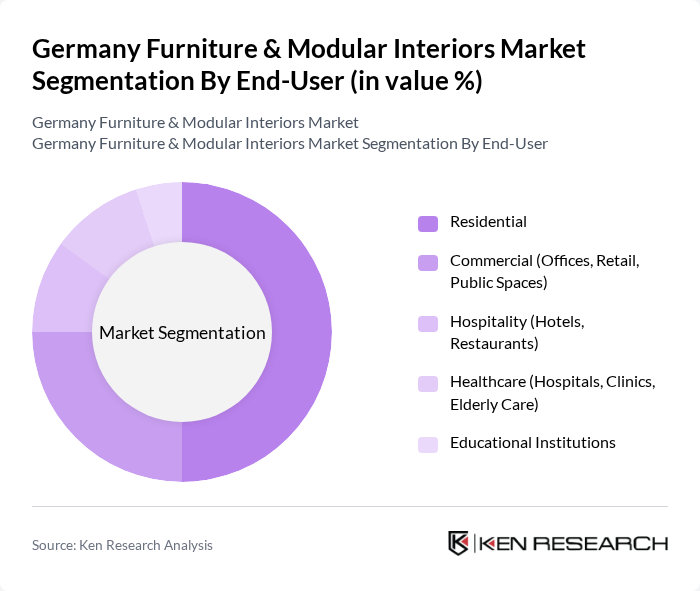

By End-User:The end-user segmentation covers Residential, Commercial (Offices, Retail, Public Spaces), Hospitality (Hotels, Restaurants), Healthcare (Hospitals, Clinics, Elderly Care), and Educational Institutions. Residential remains the largest segment, driven by ongoing home improvement and interior design trends. Commercial and hospitality sectors are increasingly adopting flexible, modular solutions to optimize space and enhance user experience. Healthcare and educational segments are advancing, with a focus on ergonomic, durable, and easy-to-maintain furniture to meet specialized requirements .

The Germany Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Deutschland GmbH & Co. KG, Möbel Höffner, XXXLutz Deutschland, Roller GmbH & Co. KG, Home24 SE, Otto Group (including OTTO, Baur, and Heine), Möbel Martin GmbH & Co. KG, Kika/Leiner Deutschland, Baur Versand (GmbH & Co KG), BoConcept Germany, Muji Germany, Westwing Group SE, Vitra GmbH, Ligne Roset Deutschland, Cassina S.p.A. (Germany), Wilkhahn Wilkening + Hahne GmbH & Co. KG, Häcker Küchen GmbH & Co. KG, Hülsta-Werke Hüls GmbH & Co. KG, Interlübke GmbH, Rolf Benz AG & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany furniture and modular interiors market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technology into furniture is expected to enhance user experience, while the focus on ergonomic designs will cater to the growing health-conscious demographic. Additionally, the shift towards online retailing will facilitate greater accessibility, allowing consumers to explore diverse options conveniently, thus reshaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Furniture Office Furniture Hospitality Furniture Healthcare Furniture Modular Furniture (Kitchens, Wardrobes, Storage, Workstations) Outdoor Furniture Custom/Bespoke Furniture Luxury Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, Public Spaces) Hospitality (Hotels, Restaurants) Healthcare (Hospitals, Clinics, Elderly Care) Educational Institutions |

| By Sales Channel | Online Retail Offline Retail (Showrooms, Specialty Stores) Direct Sales Distributors/Dealers |

| By Material | Wood & Engineered Wood Metal Plastic & Polymers Fabric & Upholstery Glass Others (Stone, Composite) |

| By Design Style | Modern Traditional Contemporary Rustic Scandinavian |

| By Price Range | Budget Mid-range Premium |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Modular Interiors | 90 | Office Managers, Facility Coordinators |

| Online Furniture Retail Trends | 60 | E-commerce Managers, Digital Marketing Specialists |

| Sustainability in Furniture Design | 50 | Product Designers, Sustainability Consultants |

| Consumer Preferences in Modular Interiors | 70 | General Consumers, Home Decor Enthusiasts |

The Germany Furniture & Modular Interiors Market is valued at approximately USD 21 billion, reflecting a robust demand for sustainable and customizable furniture solutions, driven by urbanization and home renovation activities.