Region:Central and South America

Author(s):Shubham

Product Code:KRAB1253

Pages:100

Published On:October 2025

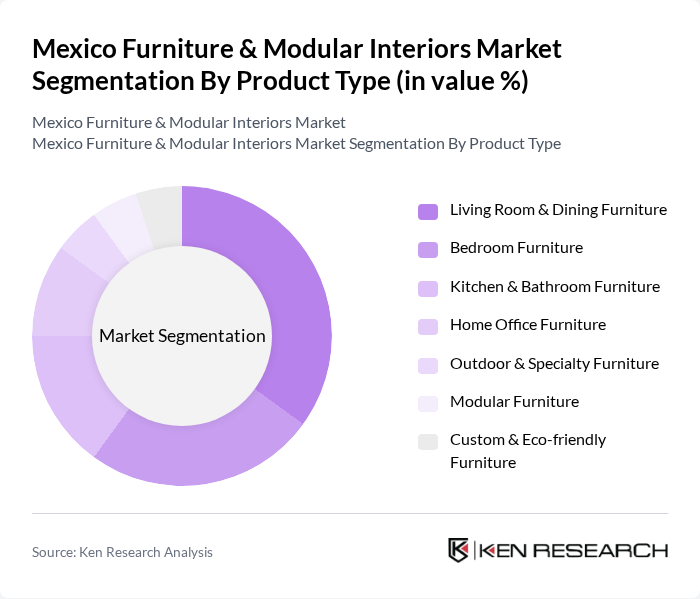

By Product Type:The product type segmentation includes Living Room & Dining Furniture, Bedroom Furniture, Kitchen & Bathroom Furniture, Home Office Furniture, Outdoor & Specialty Furniture, Modular Furniture, and Custom & Eco-friendly Furniture. Living Room & Dining Furniture remains the most dominant segment, driven by consumer demand for stylish, functional designs that enhance home aesthetics. The increasing adoption of open-concept living spaces and the rise of compact urban housing have further fueled demand for versatile and attractive living room furniture. Space optimization and multifunctionality are key purchasing criteria for Mexican consumers, with modular and eco-friendly options gaining traction.

By End-User:The end-user segmentation covers Residential, Commercial (Offices, Retail, Institutions), Hospitality (Hotels, Restaurants), and Government & Public Sector. The Residential segment leads the market, supported by a surge in home renovations, increased interest in interior design, and the expansion of remote work, which has boosted demand for home office furniture. Commercial and hospitality segments are also growing, driven by the expansion of corporate offices, retail outlets, and hotels, as well as the proliferation of co-working spaces and technology parks in major cities.

The Mexico Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muebles Dico S.A. de C.V., Grupo Famsa S.A.B. de C.V., IKEA México S.A. de C.V., Grupo Coppel S.A. de C.V., Muebles América S.A. de C.V., Muebles Troncoso S.A. de C.V., Muebles Placencia S.A. de C.V., Muebles Liz S.A. de C.V., Muebles y Mudanzas Express S.A. de C.V., Casa Palacio, Liverpool (El Puerto de Liverpool, S.A.B. de C.V.), Sears México (Grupo Sanborns S.A.B. de C.V.), Flexi S.A. de C.V., Crate & Barrel México, GAIA Design S.A.P.I. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico Furniture & Modular Interiors Market is poised for dynamic growth, driven by urbanization and rising disposable incomes. As consumers increasingly seek sustainable and technologically integrated furniture solutions, manufacturers must adapt to these evolving preferences. The expansion of e-commerce platforms will further facilitate market access, allowing businesses to reach a broader audience. Companies that embrace innovation and sustainability will likely lead the market, capitalizing on emerging trends and consumer demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Living Room & Dining Furniture Bedroom Furniture Kitchen & Bathroom Furniture Home Office Furniture Outdoor & Specialty Furniture Modular Furniture Custom & Eco-friendly Furniture |

| By End-User | Residential Commercial (Offices, Retail, Institutions) Hospitality (Hotels, Restaurants) Government & Public Sector |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets) Direct Sales Wholesale/Distributors |

| By Material | Wood Metal Plastic & Synthetics Fabric & Upholstery |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Modern/Contemporary Traditional Rustic Minimalist |

| By Functionality | Multi-functional Furniture Space-saving Solutions Ergonomic Furniture Smart/Connected Furniture |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 80 | Office Managers, Facility Coordinators |

| Modular Interiors Market | 60 | Architects, Project Managers |

| Online Furniture Retail Trends | 90 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Furniture Design | 70 | Design Students, Trend Analysts |

The Mexico Furniture & Modular Interiors Market is valued at approximately USD 9.8 billion, reflecting a combination of home furniture and contract furniture segments. This valuation is based on a five-year historical analysis and indicates significant growth potential in the sector.