Portugal Furniture & Modular Interiors Market Overview

- The Portugal Furniture & Modular Interiors Market is valued at USD 2.2 billion, based on a five-year historical analysis of industry revenue and consumption data. This growth is primarily driven by increasing consumer demand for stylish and functional furniture, a rise in disposable income, and ongoing urbanization. The market has seen a pronounced shift towards modular and customizable furniture solutions, catering to evolving consumer preferences for versatility and space efficiency in both residential and commercial environments. Portuguese consumers increasingly seek high-quality, durable products with designs that reflect personal style and sustainability values .

- Key cities such as Lisbon and Porto remain dominant in the market due to their vibrant urban environments, higher population densities, and status as hubs for design and innovation. These cities attract both local and international furniture brands and benefit from a growing middle class and robust tourism sector, further enhancing demand for quality furniture and modular interiors. The concentration of design studios, showrooms, and retail outlets in these urban centers supports ongoing market expansion .

- In 2023, the Portuguese government enacted the “Plano de Ação para a Economia Circular 2023–2027” (Action Plan for the Circular Economy 2023–2027), issued by the Ministry of Environment and Climate Action. This regulation establishes binding guidelines for the use of eco-friendly materials and production processes in the furniture sector, requiring manufacturers to adopt sustainable practices and report compliance. The initiative aims to reduce the environmental impact of furniture production and promote the use of locally sourced materials, supporting both sustainability and the national economy .

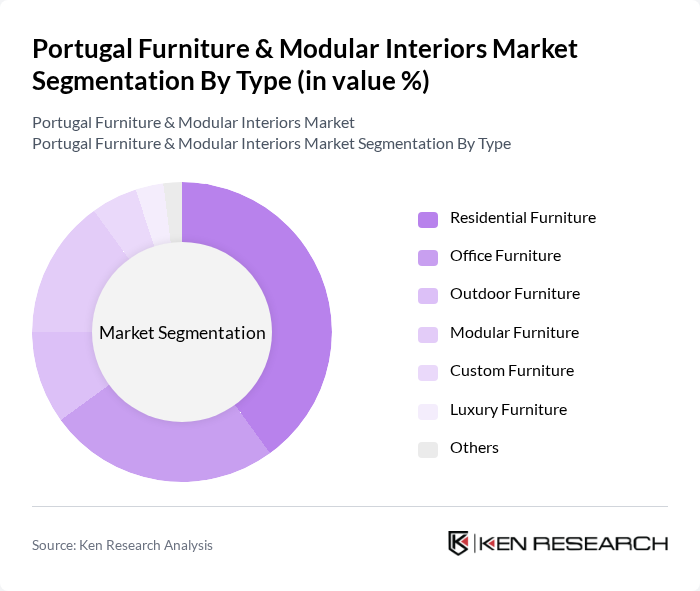

Portugal Furniture & Modular Interiors Market Segmentation

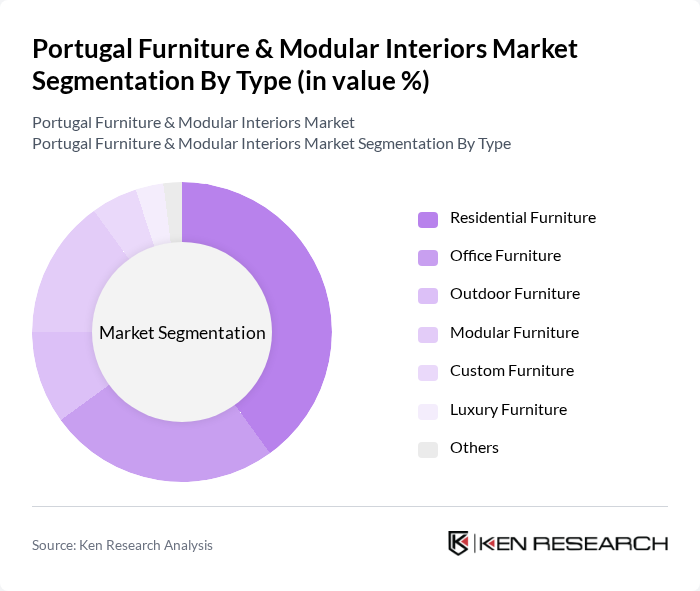

By Type:The furniture market in Portugal is segmented into Residential Furniture, Office Furniture, Outdoor Furniture, Modular Furniture, Custom Furniture, Luxury Furniture, and Others. Residential Furniture remains the most dominant segment, driven by the increasing trend of home renovations, a growing interest in interior design, and consumer investment in quality, aesthetically pleasing, and sustainable furniture for homes. Modular and custom furniture segments are experiencing notable growth as consumers seek flexible solutions to maximize space efficiency and personalize interiors .

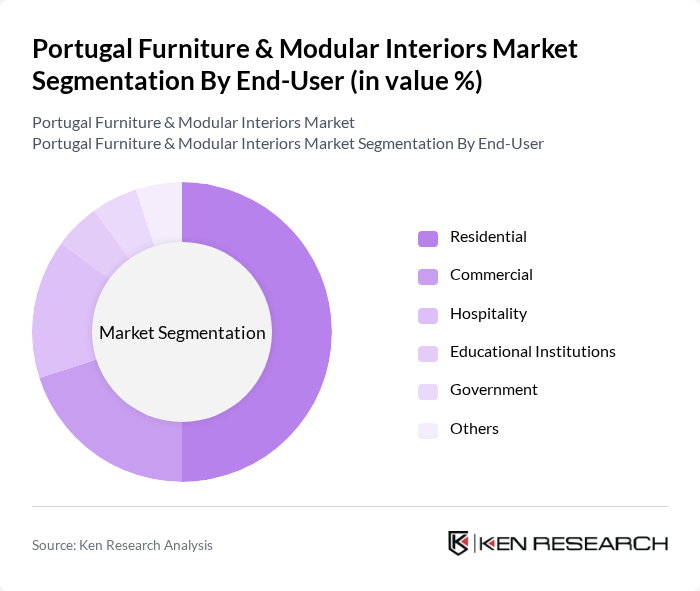

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, Educational Institutions, Government, and Others. The Residential segment leads the market, supported by a rising number of homebuyers and renters, as well as the growing trend of home improvement and remote work. Consumers increasingly seek to create comfortable, functional, and personalized living environments, fueling demand for residential furniture. The Commercial and Hospitality segments are also expanding, driven by investments in office modernization and tourism infrastructure .

Portugal Furniture & Modular Interiors Market Competitive Landscape

The Portugal Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Conforama, Moviflor, Aki, Leroy Merlin, El Corte Inglés, JYSK, Móveis do Mundo, Móveis de Portugal, Móveis e Decoração, Móveis Ferreira, Móveis de Aço, Móveis de Madeira, Móveis e Estofos, Móveis e Design contribute to innovation, geographic expansion, and service delivery in this space.

Portugal Furniture & Modular Interiors Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Portugal is projected to reach 75% in the future, according to the World Bank. This trend drives demand for furniture as more people move to cities, seeking modern living spaces. The urban population's growth leads to a higher need for stylish and functional furniture solutions, particularly in metropolitan areas like Lisbon and Porto. As urban living spaces become smaller, the demand for modular and space-saving furniture is expected to rise significantly, enhancing market growth.

- Rising Disposable Income:Portugal's GDP per capita is expected to increase to approximately €25,000 in the future, according to the IMF. This rise in disposable income allows consumers to invest more in quality furniture and home decor. As households experience improved financial conditions, they are more likely to purchase higher-end, durable, and aesthetically pleasing furniture. This trend is particularly evident among millennials and young professionals who prioritize home aesthetics and comfort, further driving market expansion.

- Demand for Sustainable Furniture:The global shift towards sustainability is reflected in Portugal, where 60% of consumers express a preference for eco-friendly furniture options, according to a recent industry report. This demand is fueled by increasing awareness of environmental issues and the desire for sustainable living. As a result, manufacturers are focusing on sourcing sustainable materials and adopting eco-friendly production processes. This trend not only meets consumer expectations but also aligns with government initiatives promoting sustainability in the furniture sector.

Market Challenges

- High Competition:The Portuguese furniture market is characterized by intense competition, with over 1,500 registered furniture companies as of the future. This saturation makes it challenging for new entrants to establish a foothold. Established brands dominate the market, leveraging brand loyalty and extensive distribution networks. As a result, smaller companies often struggle to differentiate themselves, leading to price wars and reduced profit margins, which can hinder overall market growth.

- Fluctuating Raw Material Prices:The furniture industry in Portugal faces significant challenges due to fluctuating raw material prices, particularly for wood and metals. In the future, the price of timber increased by 15% due to supply chain disruptions and increased demand. These fluctuations can lead to unpredictable production costs, making it difficult for manufacturers to maintain stable pricing. Consequently, this volatility can impact profit margins and force companies to pass costs onto consumers, potentially reducing demand.

Portugal Furniture & Modular Interiors Market Future Outlook

The future of the Portugal furniture and modular interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-efficient furniture solutions will likely grow. Additionally, the integration of smart technology into furniture design is expected to enhance user experience. Companies that prioritize sustainability and customization will be well-positioned to capture market share, catering to the increasing consumer demand for personalized and eco-friendly products.

Market Opportunities

- Expansion of Modular Furniture:The modular furniture segment is anticipated to grow significantly, with an estimated market value of €300 million in the future. This growth is driven by urban consumers seeking flexible and adaptable living solutions. Companies that innovate in modular designs can tap into this lucrative market, offering products that cater to diverse consumer needs and preferences.

- Customization Trends:The demand for customized furniture solutions is on the rise, with 40% of consumers willing to pay a premium for personalized products. This trend presents a significant opportunity for manufacturers to differentiate themselves by offering bespoke designs. By leveraging technology such as 3D printing and online configurators, companies can meet this demand, enhancing customer satisfaction and loyalty.