Region:Asia

Author(s):Shubham

Product Code:KRAB1124

Pages:92

Published On:October 2025

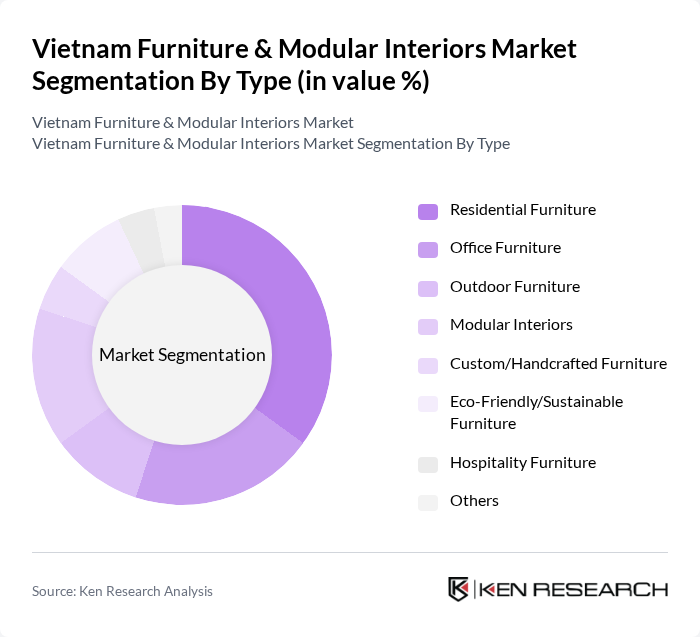

By Type:The furniture market is segmented into various types, including Residential Furniture, Office Furniture, Outdoor Furniture, Modular Interiors, Custom/Handcrafted Furniture, Eco-Friendly/Sustainable Furniture, Hospitality Furniture, and Others. Among these, Residential Furniture remains the most dominant segment, driven by the increasing trend of home decoration, renovation, and the rise in new housing units. Consumers are investing in stylish and functional furniture that enhances their living spaces, with a growing preference for modular and space-saving designs. The demand for Eco-Friendly/Sustainable Furniture is also on the rise, reflecting heightened awareness of environmental issues and a willingness to pay more for certified sustainable products .

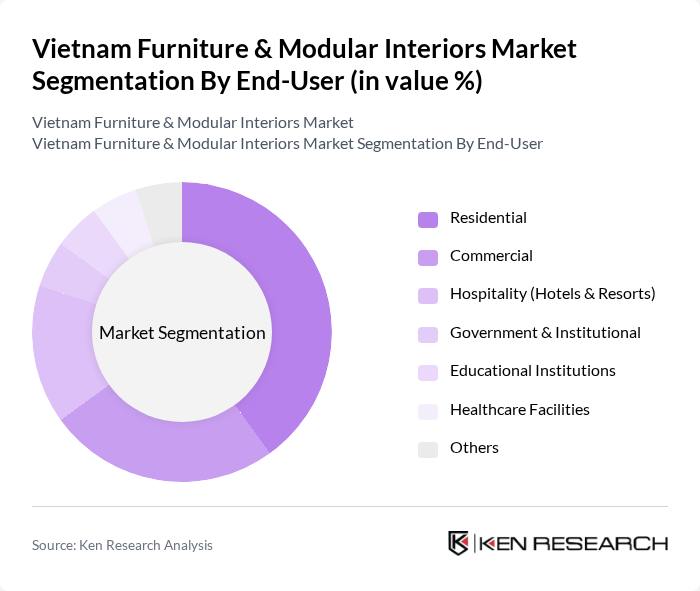

By End-User:The market is segmented by end-users, including Residential, Commercial, Hospitality (Hotels & Resorts), Government & Institutional, Educational Institutions, Healthcare Facilities, and Others. The Residential segment leads the market, driven by the increasing number of households, urbanization, and the trend of home improvement. The Commercial segment is also significant, as businesses invest in quality office furniture to enhance employee productivity and comfort. The hospitality sector is experiencing robust demand due to Vietnam’s expanding tourism industry and new hotel developments .

The Vietnam Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as AA Corporation, The One Furniture, Hòa Phát Furniture, Xuân Hòa Furniture, An C??ng Wood Working JSC, Minh Duong Furniture Corp., ??c Thành Wood Processing JSC, Duy Tân Plastic, Furaka JSC, Kinh B?c Furniture, N?i Th?t Hòa Bình, Thái Bình Furniture, Vixfurniture Company Co. Ltd., Bristol Technologies Sdn Bhd (Vietnam), Ashley Furniture Industries, LLC (Vietnam Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam furniture and modular interiors market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are expected to adopt eco-friendly practices and materials. Additionally, the integration of smart technology into furniture design will cater to the growing demand for multifunctional living spaces. With a focus on customization and personalization, companies that innovate and adapt to these trends will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Modular Interiors Custom/Handcrafted Furniture Eco-Friendly/Sustainable Furniture Hospitality Furniture Others |

| By End-User | Residential Commercial Hospitality (Hotels & Resorts) Government & Institutional Educational Institutions Healthcare Facilities Others |

| By Distribution Channel | Online Retail (E-commerce) Offline Retail (Furniture Stores, Supermarkets) Direct Sales (B2B/Project Sales) Wholesale/Distributors Showrooms Others |

| By Material | Wood (Solid, Engineered, Certified) Metal Plastic & Polymers Fabric/Upholstery Glass Others (Bamboo, Rattan, Composite) |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Modern Traditional Contemporary Minimalist Rustic Others |

| By Functionality | Multi-Functional Space-Saving Ergonomic Modular Smart Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 120 | Homeowners, Interior Designers |

| Commercial Modular Interiors | 90 | Office Managers, Facility Coordinators |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Consumer Preferences in Furniture Design | 100 | End Consumers, Design Students |

| Sustainability Trends in Furniture Manufacturing | 70 | Sustainability Officers, Product Development Managers |

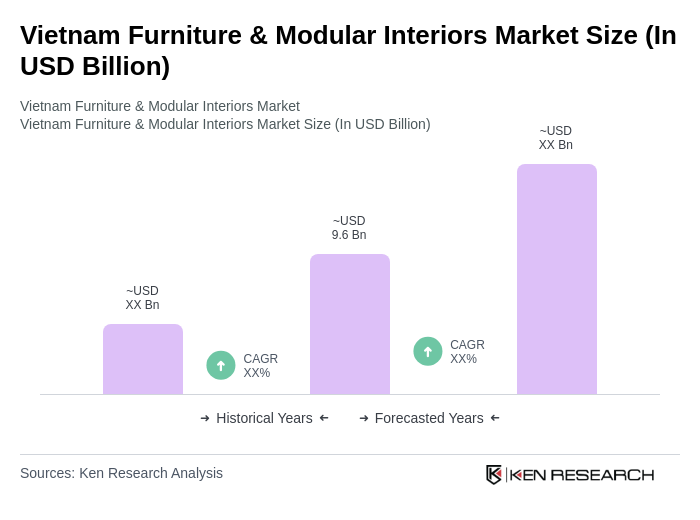

The Vietnam Furniture & Modular Interiors Market is valued at approximately USD 9.6 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a demand for modern living spaces.