Region:Middle East

Author(s):Rebecca

Product Code:KRAB4071

Pages:100

Published On:October 2025

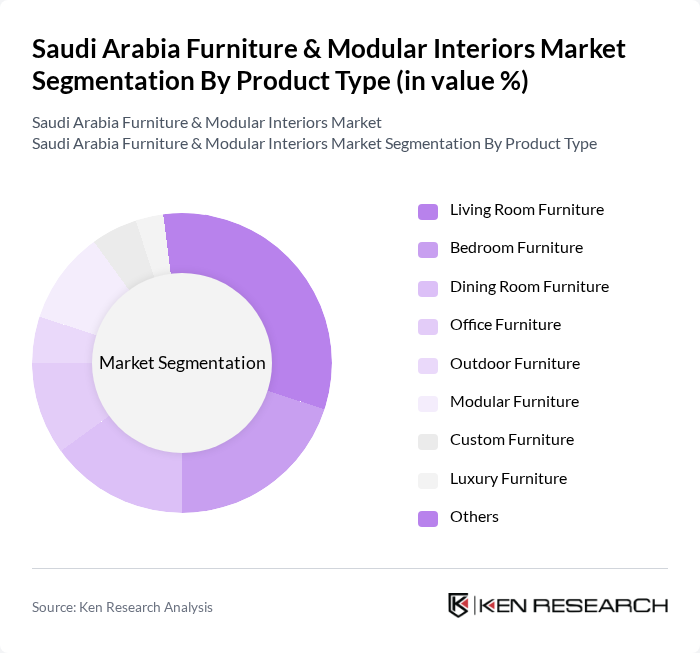

By Product Type:The product type segmentation includes various categories such as Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Office Furniture, Outdoor Furniture, Modular Furniture, Custom Furniture, Luxury Furniture, and Others. Among these, Living Room Furniture is the most dominant segment, driven by consumer preferences for stylish and functional designs that enhance home aesthetics. The increasing trend of open-concept living spaces and multifunctional furniture has also contributed to the demand for versatile living room furniture that can adapt to different layouts. The market is also witnessing a rise in demand for modular and customizable furniture, reflecting evolving consumer lifestyles and space optimization needs .

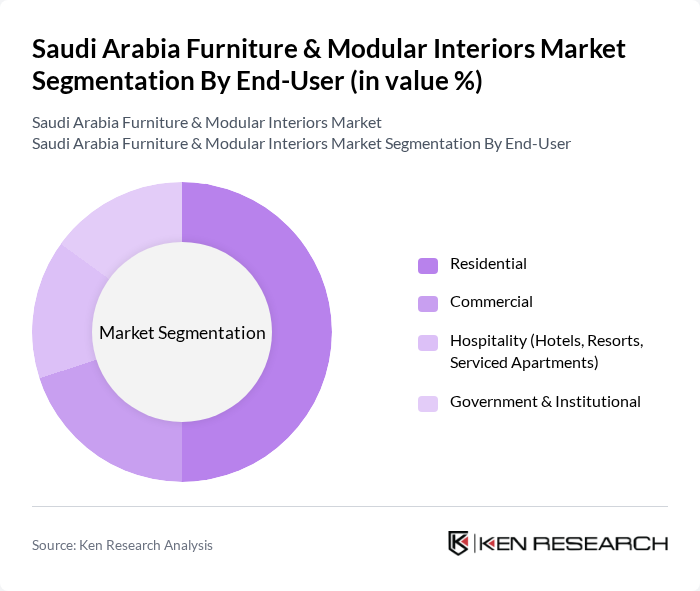

By End-User:The end-user segmentation encompasses Residential, Commercial, Hospitality (Hotels, Resorts, Serviced Apartments), and Government & Institutional sectors. The Residential segment leads the market, fueled by a growing population, increasing home ownership rates, and continuous villa and apartment deliveries. Consumers are increasingly investing in quality furniture to enhance their living spaces, which drives demand in this segment. The trend towards home improvement, interior design, and the influence of social media and digital platforms has further solidified the Residential segment's dominance. The Commercial and Hospitality segments are also expanding, driven by new office developments and hospitality giga-projects under Vision 2030 .

The Saudi Arabia Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia (Ghassan Ahmed Al Sulaiman Furniture Trading Co. Ltd.), Almutlaq Furniture, Home Centre (Landmark Group), Al Rugaib Furniture, Pan Emirates, Al-Abdulkader Furniture, Al-Hokair Group, Al-Mutlaq Co. for Furniture, United Furniture, Al-Jedaie Furniture, Al-Sorayai Group, Al-Mutlaq Holding, Al-Nahda International, Al-Jazira Furniture, and Al-Faisaliah Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture and modular interiors market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart furniture solutions is expected to gain traction, enhancing user experience and functionality. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly materials. As the market adapts to these trends, companies that prioritize innovation and sustainability will be well-positioned to capture emerging opportunities and meet consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Office Furniture Outdoor Furniture Modular Furniture Custom Furniture Luxury Furniture Others |

| By End-User | Residential Commercial Hospitality (Hotels, Resorts, Serviced Apartments) Government & Institutional |

| By Sales Channel | Online Retail Offline Retail (Showrooms, Hypermarkets) Direct Sales Distributors/Dealers |

| By Material | Wood Metal Plastic Upholstered/Fabric Glass |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Contemporary Traditional Industrial Minimalist Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 80 | Office Managers, Facility Coordinators |

| Modular Interiors for Retail Spaces | 60 | Retail Managers, Visual Merchandisers |

| Consumer Preferences in Furniture Design | 90 | General Consumers, Trend Analysts |

| Sustainability in Furniture Manufacturing | 50 | Environmental Consultants, Product Designers |

The Saudi Arabia Furniture & Modular Interiors Market is valued at approximately USD 6.5 billion, driven by factors such as urbanization, rising disposable incomes, and government housing initiatives, alongside a growing preference for modern and modular furniture solutions.