Region:Europe

Author(s):Dev

Product Code:KRAB2283

Pages:81

Published On:October 2025

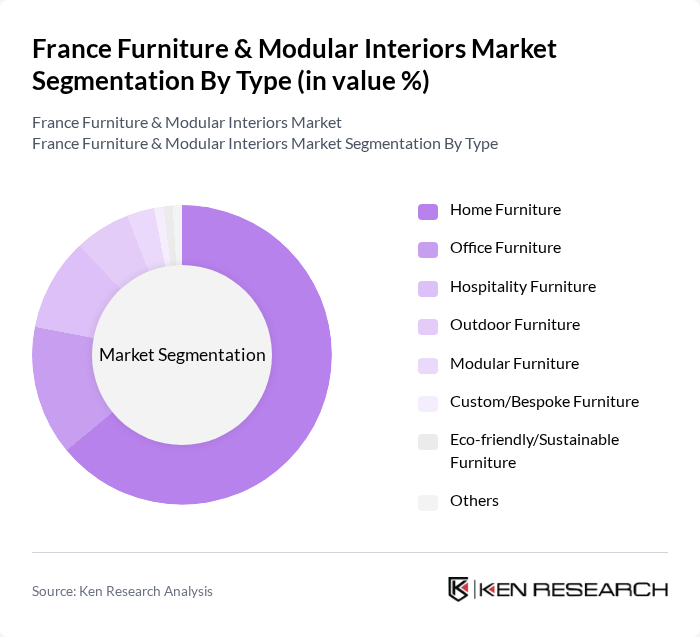

By Type:The market is segmented into various types of furniture, including Home Furniture, Office Furniture, Hospitality Furniture, Outdoor Furniture, Modular Furniture, Custom/Bespoke Furniture, Eco-friendly/Sustainable Furniture, and Others. Among these, Home Furniture is the leading segment, driven by the increasing trend of home decoration and renovation. French consumers demonstrate a high affinity for home furniture, with a strong tradition in quality furnishings and a growing interest in functional, space-saving, and sustainable solutions. The trend of creating comfortable and elegant outdoor spaces is also contributing to the growth of outdoor furniture .

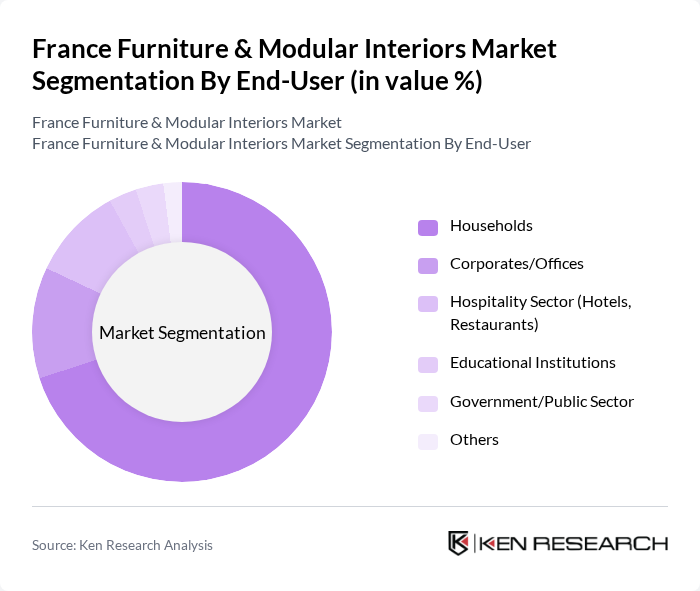

By End-User:The end-user segmentation includes Households, Corporates/Offices, Hospitality Sector (Hotels, Restaurants), Educational Institutions, Government/Public Sector, and Others. Households represent the largest segment, as the demand for furniture is primarily driven by residential consumers looking to enhance their living spaces. The trend of home improvement, interior design, and the rise in apartment living have significantly boosted this segment's growth .

The France Furniture & Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Maisons du Monde, Conforama, Roche Bobois, La Redoute, Alinéa, Habitat, Fly, Cdiscount, AM.PM, BoConcept, Ligne Roset, Gautier, Tectona, Sodezign contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France furniture and modular interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture is expected to rise. Additionally, the integration of smart technology into furniture design will likely enhance user experience, catering to the tech-savvy consumer. Companies that adapt to these trends and prioritize sustainability will be well-positioned to capture market share and drive innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Furniture Office Furniture Hospitality Furniture Outdoor Furniture Modular Furniture Custom/Bespoke Furniture Eco-friendly/Sustainable Furniture Others |

| By End-User | Households Corporates/Offices Hospitality Sector (Hotels, Restaurants) Educational Institutions Government/Public Sector Others |

| By Distribution Channel | Specialty Stores Online Retail Home Centers Department Stores/Hypermarkets Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Material | Wood Metal Plastic Fabric/Upholstery Others |

| By Design Style | Contemporary Traditional Industrial Scandinavian Others |

| By Functionality | Multi-functional Furniture Space-saving Solutions Ergonomic Designs Smart/Connected Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Modular Solutions | 100 | Office Managers, Facility Coordinators |

| Online Furniture Retail Trends | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Modular Design | 120 | Architects, Product Designers |

| Sustainability in Furniture Manufacturing | 90 | Environmental Officers, Supply Chain Managers |

The France Furniture & Modular Interiors Market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by consumer demand for stylish, functional, and customizable furniture solutions.