Region:Europe

Author(s):Shubham

Product Code:KRAB5563

Pages:89

Published On:October 2025

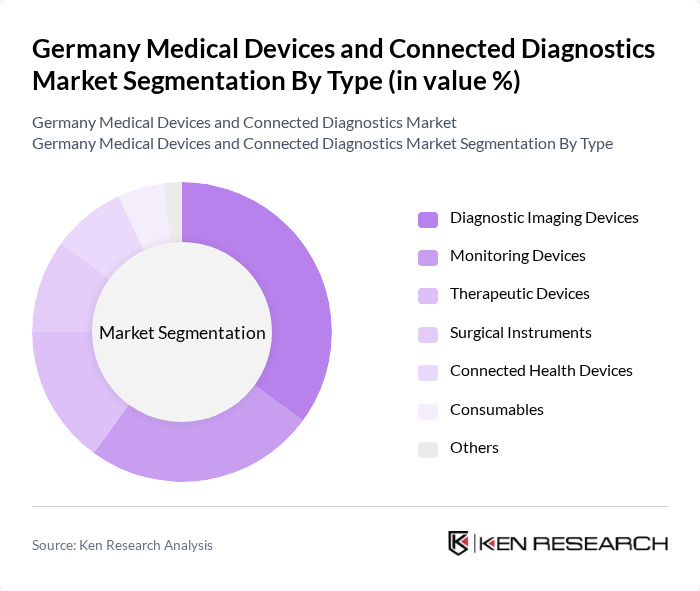

By Type:The market is segmented into various types of medical devices, each catering to specific healthcare needs. The dominant sub-segment is Diagnostic Imaging Devices, which includes technologies such as MRI and CT scans. These devices are essential for accurate diagnosis and treatment planning, driving their widespread adoption in hospitals and clinics. Monitoring Devices also hold significant market share, reflecting the growing trend towards remote patient monitoring and chronic disease management. The increasing integration of connected health devices further enhances patient engagement and data collection, making them crucial in modern healthcare.

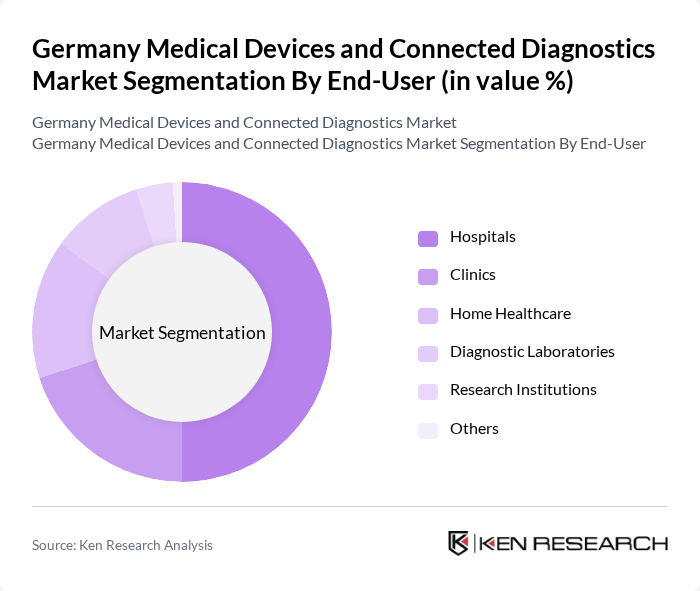

By End-User:The end-user segmentation reveals that hospitals are the largest consumers of medical devices, driven by the need for advanced diagnostic and therapeutic solutions. Clinics and home healthcare services are also significant contributors, reflecting the shift towards outpatient care and patient-centric models. Diagnostic laboratories play a crucial role in the market, as they require sophisticated devices for accurate testing and analysis. Research institutions are increasingly investing in innovative technologies, further propelling market growth.

The Germany Medical Devices and Connected Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Roche Diagnostics, B. Braun Melsungen AG, Drägerwerk AG, Philips Healthcare, GE Healthcare, Medtronic, Abbott Laboratories, Stryker Corporation, Olympus Corporation, Johnson & Johnson, Boston Scientific, Terumo Corporation, Canon Medical Systems, Mindray Medical International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany medical devices and connected diagnostics market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centric care. As the healthcare landscape evolves, the integration of artificial intelligence and telemedicine is expected to reshape diagnostics and treatment methodologies. Additionally, the increasing focus on preventive healthcare will likely lead to the development of innovative solutions that cater to the specific needs of patients, enhancing overall healthcare delivery and outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices Monitoring Devices Therapeutic Devices Surgical Instruments Connected Health Devices Consumables Others |

| By End-User | Hospitals Clinics Home Healthcare Diagnostic Laboratories Research Institutions Others |

| By Application | Cardiovascular Neurology Orthopedics Diabetes Management Oncology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North Germany South Germany East Germany West Germany Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Digital Health Technologies Traditional Medical Devices Hybrid Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Connected Diagnostic Devices | 150 | Healthcare IT Managers, Medical Device Engineers |

| Wearable Health Monitoring Devices | 100 | Product Managers, Clinical Researchers |

| In-Vitro Diagnostic Equipment | 80 | Laboratory Managers, Quality Assurance Officers |

| Telehealth Solutions | 120 | Telemedicine Coordinators, Health Policy Analysts |

| Regulatory Compliance in Medical Devices | 90 | Regulatory Affairs Specialists, Compliance Managers |

The Germany Medical Devices and Connected Diagnostics Market is valued at approximately USD 45 billion, reflecting significant growth driven by technological advancements, an aging population, and increased healthcare expenditure.