Region:Europe

Author(s):Geetanshi

Product Code:KRAB2703

Pages:97

Published On:October 2025

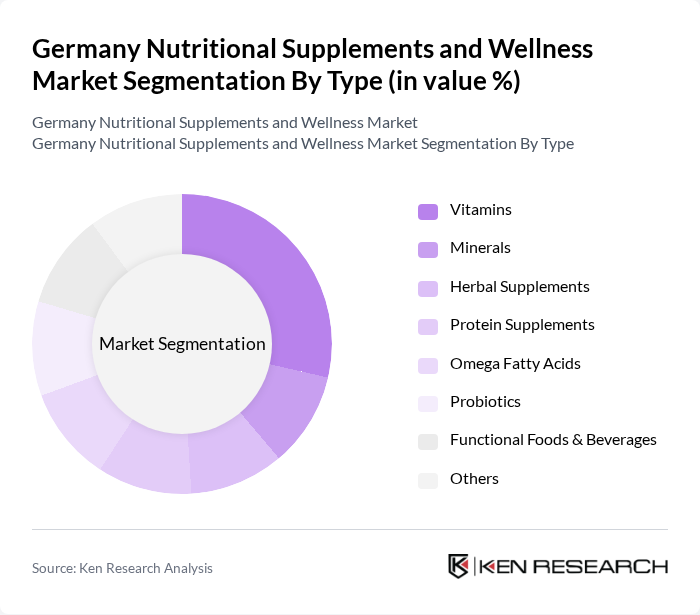

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, and others. Among these, vitamins and minerals are the most popular due to their essential role in maintaining health and preventing deficiencies. The increasing awareness of the benefits of herbal supplements is also gaining traction, particularly among health-conscious consumers. The demand for protein supplements is rising, especially among athletes and fitness enthusiasts, as they seek to enhance their performance and recovery.

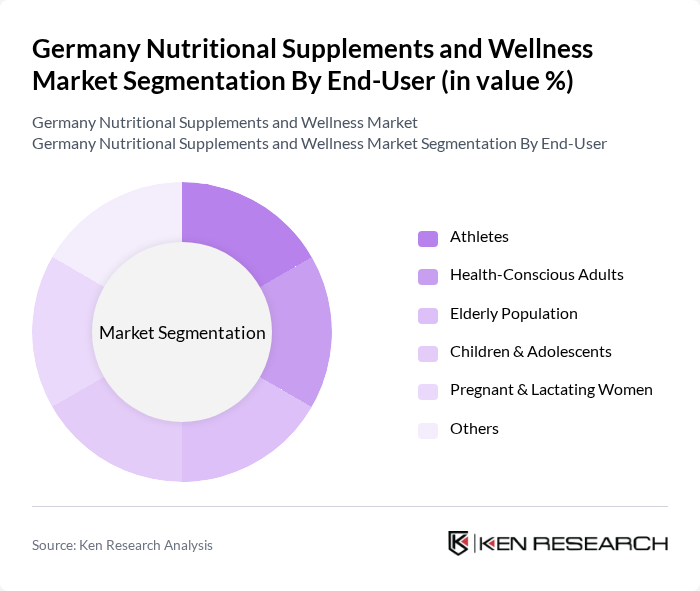

By End-User:The end-user segmentation includes athletes, health-conscious adults, the elderly population, children & adolescents, pregnant & lactating women, and others. Athletes represent a significant portion of the market, driven by their need for performance-enhancing supplements. Health-conscious adults are increasingly turning to nutritional supplements to support their wellness goals. The elderly population is also a key demographic, as they seek products that can help manage age-related health issues. The growing awareness of nutrition among children and adolescents is leading to increased demand for age-appropriate supplements.

The Germany Nutritional Supplements and Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Queisser Pharma GmbH & Co. KG, Orthomol pharmazeutische Vertriebs GmbH, Dr. B. Scheffler Nachfolger GmbH & Co. KG, ZeinPharma Germany GmbH, Denk Pharma GmbH & Co. KG, Pascoe Naturmedizin, Ayanda GmbH, Nutraceuticals Group, Pamex Pharmaceuticals GmbH, Sabinsa Europe GmbH, DMK Group, Nestlé S.A., Herbalife Nutrition Ltd., Glanbia plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany nutritional supplements market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. As consumers seek personalized and plant-based options, companies are likely to innovate and expand their product lines. Additionally, the integration of technology in health monitoring will enhance consumer engagement and product effectiveness. These trends suggest a dynamic market landscape, with opportunities for growth and collaboration among stakeholders in the health and wellness sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Functional Foods & Beverages Others |

| By End-User | Athletes Health-Conscious Adults Elderly Population Children & Adolescents Pregnant & Lactating Women Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies/Drugstores Health Food Stores Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Packaging Type | Bottles Blister Packs Pouches Jars Sachets Others |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplement Retailers | 100 | Store Managers, Product Buyers |

| Health and Wellness Consumers | 120 | Health-conscious Individuals, Fitness Enthusiasts |

| Healthcare Professionals | 80 | Nutritionists, General Practitioners |

| Online Supplement Market | 60 | E-commerce Managers, Digital Marketing Specialists |

| Fitness Centers and Gyms | 40 | Gym Owners, Personal Trainers |

The Germany Nutritional Supplements and Wellness Market is valued at approximately USD 7.8 billion, reflecting a significant growth trend driven by increasing health awareness and preventive healthcare measures among consumers.