Thailand Nutritional Supplements and Wellness Market Overview

- The Thailand Nutritional Supplements and Wellness Market is valued at USD 4.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in disposable incomes, and a growing aging population seeking preventive healthcare solutions. The market has seen a significant shift towards natural and organic products, reflecting changing consumer preferences towards healthier lifestyles. The functional foods and beverages segment currently leads in revenue, while sports nutrition is the fastest-growing segment, reflecting the rising interest in fitness and active lifestyles .

- Bangkok, as the capital and largest city, dominates the market due to its high population density and urban lifestyle, which fosters a greater demand for nutritional supplements. Other key regions include Chiang Mai and Phuket, where tourism and expatriate communities contribute to the market's growth. The increasing availability of wellness products in urban areas, supported by robust retail and e-commerce channels, further enhances market penetration .

- The Food Act B.E. 2522 (1979), issued by the Ministry of Public Health, regulates the production and distribution of nutritional supplements in Thailand. This legislation requires manufacturers to comply with stringent labeling, safety, and quality standards, including product registration and pre-approval of health claims. The act is designed to protect consumers and promote public health, thereby enhancing the credibility of the nutritional supplements market .

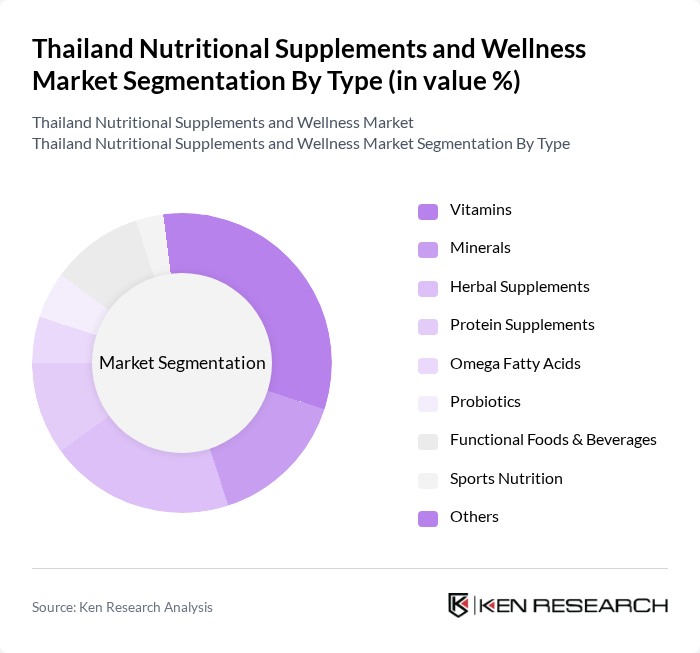

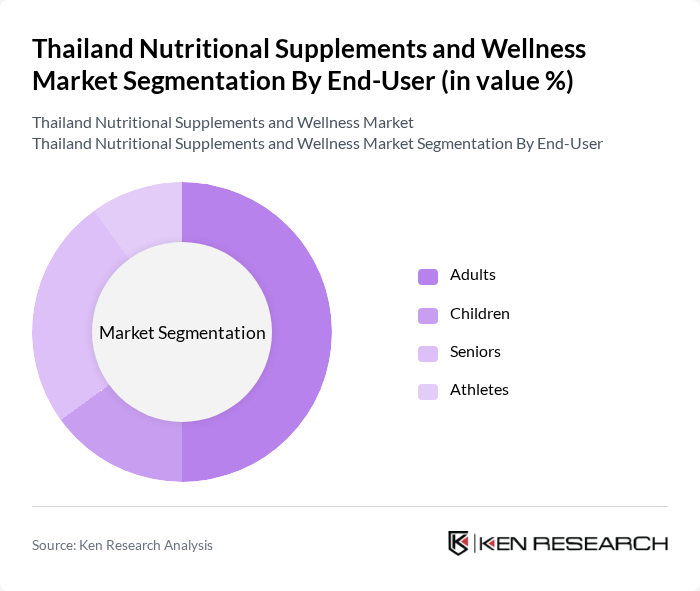

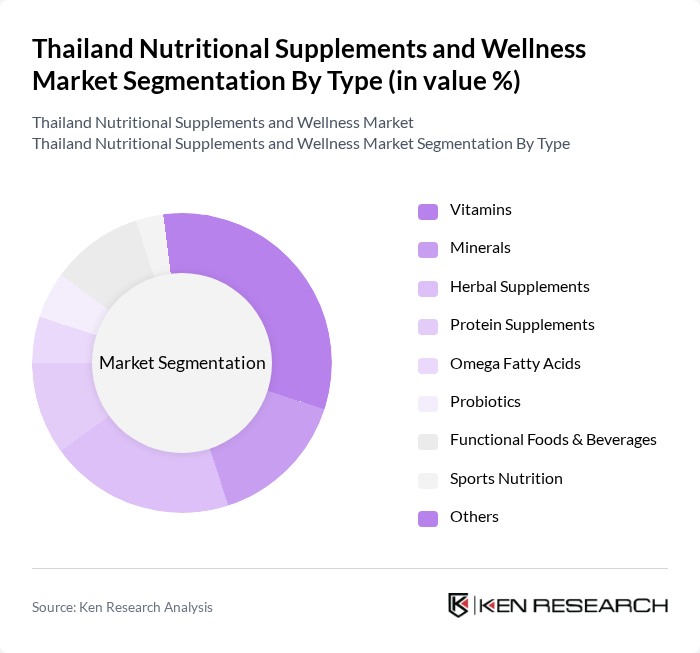

Thailand Nutritional Supplements and Wellness Market Segmentation

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, sports nutrition, and others. Among these, functional foods and beverages currently represent the largest segment by revenue, driven by consumer demand for convenient health solutions. Vitamins and herbal supplements remain particularly popular due to their perceived health benefits and natural origins. The increasing trend towards preventive healthcare has led to a surge in demand for these products, with consumers seeking to enhance their overall well-being .

By End-User:The end-user segmentation includes adults, children, seniors, and athletes. Adults represent the largest segment, driven by a growing awareness of health and wellness, as well as the popularity of dietary supplements for general well-being and beauty enhancement. The increasing focus on fitness and preventive health measures among adults has led to a higher consumption of nutritional supplements. Seniors are also a significant segment, as they seek products that support bone, joint, and immune health .

Thailand Nutritional Supplements and Wellness Market Competitive Landscape

The Thailand Nutritional Supplements and Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Blackmores Limited, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, DSM Nutritional Products, Swisse Wellness Pty Ltd., Nature's Way Products, LLC, Usana Health Sciences, Inc., Yakult (Thailand) Co., Ltd., CP-Meiji Co., Ltd., Foremost FrieslandCampina (Thailand) Ltd., Thai Otsuka Pharmaceutical Co., Ltd., Mega Lifesciences Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Nutritional Supplements and Wellness Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Thai population is becoming increasingly health-conscious, with 75% of adults actively seeking nutritional supplements to enhance their well-being. This trend is supported by a rise in health-related media coverage, with over 65% of Thais reporting that they regularly consume health information from various sources. The World Health Organization reported that health awareness campaigns have led to a 20% increase in supplement consumption among urban populations, driving market growth significantly.

- Rising Disposable Income:Thailand's GDP per capita is approximately $7,233, reflecting a moderate increase from previous periods. This economic growth has resulted in higher disposable incomes, allowing consumers to allocate more funds towards health and wellness products. As a result, the nutritional supplements market is expected to benefit from this increased purchasing power, with a notable 25% rise in sales of premium health products reported in urban areas.

- Aging Population:Thailand's demographic shift is evident, with the proportion of individuals aged 60 and above expected to reach 18% of the total population. This aging population is increasingly focused on preventive healthcare, leading to a surge in demand for nutritional supplements tailored to their needs. The Thai Ministry of Public Health has indicated that older adults are responsible for 35% of total supplement sales, highlighting the significant market potential driven by this demographic trend.

Market Challenges

- Regulatory Compliance Issues:The Thai nutritional supplements market faces stringent regulatory compliance challenges, with over 1,200 new products requiring approval from the Food and Drug Administration (FDA) annually. Companies often struggle to navigate these regulations, leading to delays in product launches and increased operational costs. Approximately 30% of new product applications are rejected due to non-compliance, highlighting the need for better understanding and adherence to regulatory standards.

- Consumer Misinformation:The prevalence of misinformation regarding nutritional supplements poses a significant challenge in Thailand. A survey conducted by the Ministry of Health revealed that 45% of consumers are confused about the benefits and risks associated with various supplements. This misinformation can lead to poor purchasing decisions and decreased trust in legitimate products, ultimately hindering market growth and creating barriers for reputable brands trying to establish themselves.

Thailand Nutritional Supplements and Wellness Market Future Outlook

The Thailand nutritional supplements market is poised for continued growth, driven by increasing health awareness and a focus on preventive healthcare. As consumers become more educated about health benefits, the demand for personalized and plant-based supplements is expected to rise. Additionally, the integration of digital health technologies will facilitate better consumer engagement and product accessibility. Companies that adapt to these trends will likely capture a larger market share, positioning themselves favorably in this evolving landscape.

Market Opportunities

- Expansion of Product Lines:Companies have the opportunity to diversify their product offerings by introducing specialized supplements targeting specific health concerns, such as immunity and digestive health. With the Thai market showing a 35% increase in demand for targeted health solutions, brands that innovate and expand their product lines can significantly enhance their market presence and consumer loyalty.

- Increasing Demand for Organic Products:The organic supplement segment is witnessing rapid growth, with sales projected to increase by 30% in future. As consumers become more environmentally conscious, the demand for organic and sustainably sourced products is expected to rise. Companies that prioritize organic certifications and transparent sourcing practices will likely attract a dedicated customer base, capitalizing on this growing trend.