Region:Asia

Author(s):Dev

Product Code:KRAB6059

Pages:96

Published On:October 2025

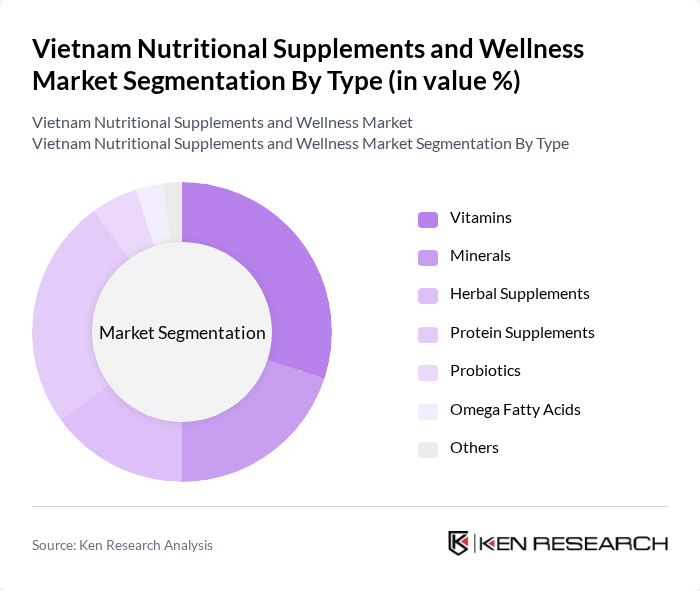

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein supplements, probiotics, omega fatty acids, and others. Among these, vitamins and protein supplements are particularly popular due to their perceived health benefits and widespread consumer awareness. The demand for herbal supplements is also on the rise as consumers seek natural alternatives for health management.

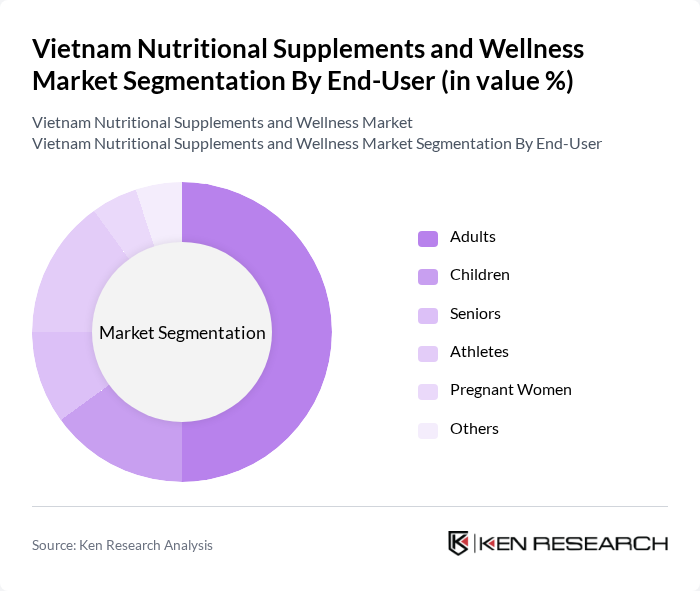

By End-User:The end-user segmentation includes adults, children, seniors, athletes, pregnant women, and others. Adults represent the largest segment, driven by increasing health consciousness and the desire for preventive health measures. Athletes also contribute significantly to the market, seeking protein and energy supplements to enhance performance and recovery.

The Vietnam Nutritional Supplements and Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutifood, Herbalife Vietnam, Amway Vietnam, Abbott Laboratories, GNC Vietnam, Blackmores, Mega Lifesciences, Nature's Way, Unicity Vietnam, NutraBlast, Herbalife Nutrition, USANA Health Sciences, Swisse Wellness, Youtheory, Nature's Bounty contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Nutritional Supplements and Wellness Market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, companies are expected to leverage data analytics to tailor products to individual health needs. Additionally, the integration of digital health solutions will enhance consumer engagement, fostering a more informed customer base. This dynamic environment presents opportunities for innovation and growth, particularly in the organic and preventive healthcare segments, which are gaining traction among health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Probiotics Omega Fatty Acids Others |

| By End-User | Adults Children Seniors Athletes Pregnant Women Others |

| By Distribution Channel | Online Retail Supermarkets Pharmacies Health Stores Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Target Health Benefit | Immune Support Digestive Health Weight Management Energy Boost Bone Health Others |

| By Brand Positioning | Established Brands Emerging Brands Private Labels Niche Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Nutritional Supplement Usage | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retailer Insights on Wellness Products | 100 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 80 | Nutritionists, General Practitioners |

| Market Trends from E-commerce Platforms | 70 | E-commerce Managers, Digital Marketing Specialists |

| Influencer Opinions on Nutritional Products | 60 | Health Bloggers, Social Media Influencers |

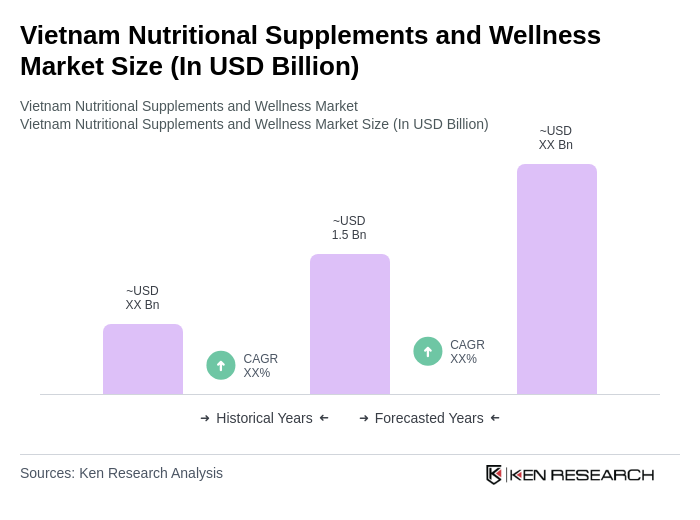

The Vietnam Nutritional Supplements and Wellness Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing health awareness and a rising middle class focused on preventive healthcare.