Region:Europe

Author(s):Shubham

Product Code:KRAA1753

Pages:80

Published On:August 2025

By Type:The office furniture market can be segmented into various types, including office chairs, desks and tables, workstations, storage solutions, reception and lounge furniture, partitions, and accessories. Among these, office chairs, particularly ergonomic models, are leading the market due to the growing awareness of workplace health and comfort. The demand for height-adjustable desks is also on the rise, reflecting a shift towards more flexible work environments.

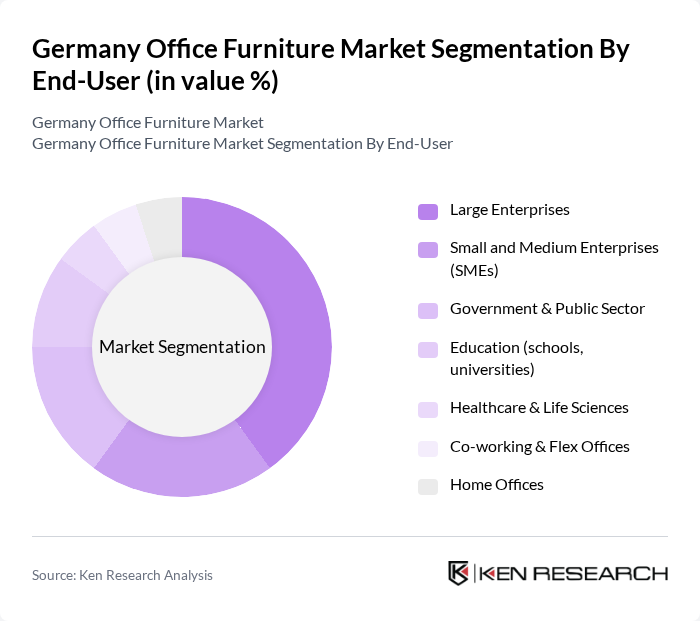

By End-User:The end-user segmentation includes large enterprises, small and medium enterprises (SMEs), government and public sector, education, healthcare, co-working spaces, and home offices. Large enterprises are the dominant segment, driven by their need for comprehensive office solutions that enhance productivity and employee satisfaction. The rise of co-working spaces has also contributed to the demand for flexible and modular furniture solutions.

The Germany Office Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steelcase Inc., MillerKnoll, Inc. (Herman Miller and Knoll), Haworth Inc., Vitra AG, Kinnarps AB, Bene AG, Wilkhahn Wilkening + Hahne GmbH & Co. KG, Interstuhl Büromöbel GmbH & Co. KG, Sedus Stoll AG, König + Neurath AG, Nowy Styl Group, Assmann Büromöbel GmbH & Co. KG, Dauphin HumanDesign Group, HNI Corporation, Teknion Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German office furniture market appears promising, driven by ongoing trends in remote work and sustainability. As companies continue to adapt to hybrid work models, the demand for flexible and multifunctional furniture solutions is expected to rise. Additionally, the integration of technology in office design will likely enhance user experience and productivity. Manufacturers that prioritize innovation and sustainability will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Chairs (task, executive, swivel, meeting chairs) Desks & Tables (work desks, height-adjustable desks, conference tables) Workstations & Benching Systems Storage (cabinets, pedestals, shelving, lockers) Reception, Lounge & Collaborative Furniture Partitions & Acoustic Solutions Accessories (monitor arms, desk dividers, power management) |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government & Public Sector Education (schools, universities) Healthcare & Life Sciences Co-working & Flex Offices Home Offices |

| By Distribution Channel | Offline (dealers, showrooms, contract furniture) Online (brand e-shops, marketplaces) Direct to Enterprise (project/contract sales) Architect & Designer Specified Facility Management & Integrators |

| By Material | Wood & Wood-based Panels Metal (steel, aluminum) Plastics & Composites Upholstery & Fabrics Sustainable/Recycled Materials |

| By Price Range | Budget Mid-Range Premium Luxury/Design Icon |

| By Design Style | Modern/Contemporary Traditional/Classic Scandinavian/Minimalist Industrial Biophilic & Sustainable Design |

| By Functionality | Ergonomic (EN 1335/DIN standards compliant) Height-adjustable & Sit-Stand Modular & Reconfigurable Fixed & Casegoods Smart/Connected (IoT, occupancy sensors) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 120 | Office Managers, Procurement Officers |

| Small Business Furniture Needs | 100 | Small Business Owners, Facility Managers |

| Ergonomic Furniture Preferences | 80 | HR Managers, Health and Safety Officers |

| Trends in Remote Work Furniture | 70 | Remote Workers, Freelancers |

| Design and Aesthetic Preferences | 90 | Interior Designers, Office Space Planners |

The Germany Office Furniture Market is valued at approximately USD 3.0 billion, reflecting a significant growth trend driven by the demand for ergonomic solutions and the rise of remote and hybrid work models.