Region:Asia

Author(s):Dev

Product Code:KRAB0417

Pages:82

Published On:August 2025

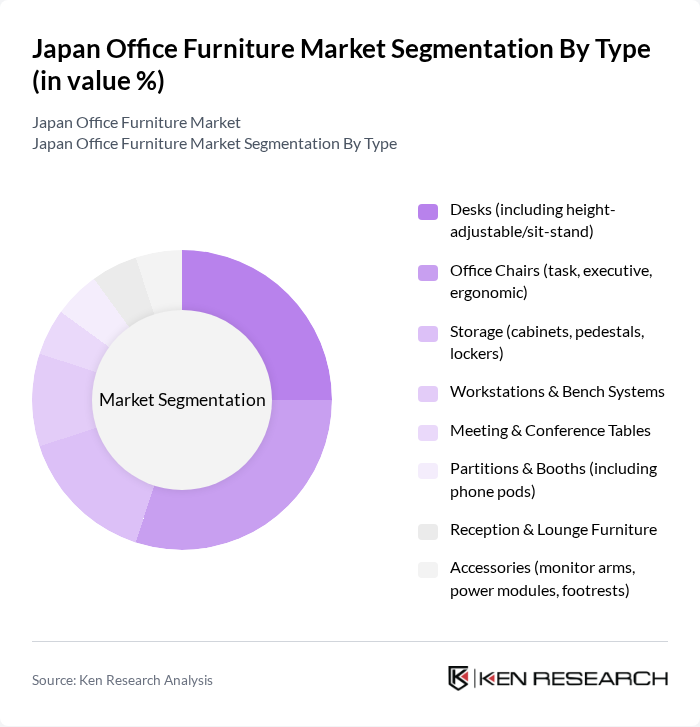

By Type:The office furniture market can be segmented into various types, including desks, office chairs, storage solutions, workstations, meeting tables, partitions, reception furniture, and accessories. Each of these subsegments caters to specific needs within the office environment, with varying levels of demand based on trends in workplace design and functionality.

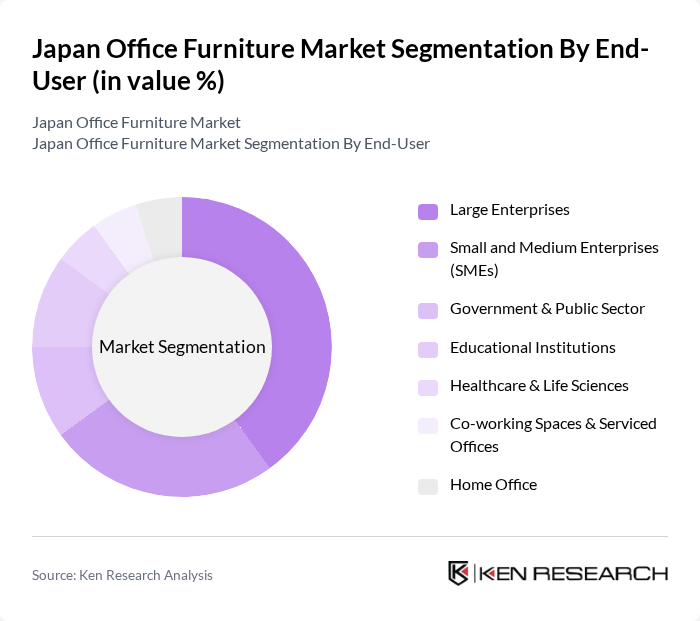

By End-User:The end-user segmentation includes large enterprises, small and medium enterprises (SMEs), government and public sector, educational institutions, healthcare and life sciences, co-working spaces, and home offices. Each segment has unique requirements and preferences, influencing the types of office furniture purchased.

The Japan Office Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Okamura Corporation, Kokuyo Co., Ltd., Itoki Corporation, Uchida Yoko Co., Ltd., Askul Corporation (Solo and Private Brand Office Furniture), Nitori Holdings Co., Ltd., Ryohin Keikaku Co., Ltd. (MUJI), Karimoku Furniture Inc., Maruni Wood Industry Inc., Hida Sangyo Co., Ltd., CondeHouse Co., Ltd., Koizumi Seiki Corporation, Tendo Mokko Co., Ltd., Aichi Corporation (seating and public space solutions), Steelcase Inc. (Japan) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan office furniture market appears promising, driven by ongoing trends in sustainability and technology integration. As companies increasingly prioritize eco-friendly materials, the demand for sustainable office furniture solutions is expected to rise. Additionally, the integration of smart technology into office furniture will enhance functionality and user experience. These trends, combined with the growth of flexible workspaces and co-working environments, will shape the market landscape, fostering innovation and new business opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Desks (including height-adjustable/sit-stand) Office Chairs (task, executive, ergonomic) Storage (cabinets, pedestals, lockers) Workstations & Bench Systems Meeting & Conference Tables Partitions & Booths (including phone pods) Reception & Lounge Furniture Accessories (monitor arms, power modules, footrests) |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government & Public Sector Educational Institutions Healthcare & Life Sciences Co-working Spaces & Serviced Offices Home Office |

| By Distribution Channel | Specialty Office Furniture Dealers Multi-brand Retail & Showrooms Online (brand e-stores and marketplaces) Direct-to-Enterprise (tenders, project sales) Interior Design/Architect Channels |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Wood & Wood-based Panels Metal Plastics & Composites Fabrics & Mesh Others (glass, bamboo, recycled materials) |

| By Design Style | Modern Traditional Contemporary Minimalist Japanese Aesthetic (e.g., wabi-sabi, natural materials) |

| By Functionality | Multi-functional & Modular Fixed Adjustable & Ergonomic Acoustic & Privacy Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 140 | Office Managers, Procurement Officers |

| Educational Institution Furniture Needs | 100 | Facility Managers, Administrative Heads |

| Healthcare Facility Furniture Requirements | 80 | Operations Managers, Healthcare Administrators |

| Small Business Office Setup | 70 | Business Owners, Office Coordinators |

| Co-working Space Furniture Trends | 90 | Co-working Space Managers, Interior Designers |

The Japan Office Furniture Market is valued at approximately USD 3.4 billion, reflecting steady demand driven by ergonomic adoption, hybrid work needs, and the expansion of co-working spaces. This valuation aligns with industry trackers that estimate the market between USD 3.4 and 3.6 billion.