Region:Europe

Author(s):Rebecca

Product Code:KRAD0305

Pages:87

Published On:August 2025

By Type:The market is segmented into various types of office furniture, including desks, chairs, storage solutions, meeting room furniture, workstations, collaborative furniture, reception furniture, lounge seating, acoustic solutions, and others. Each of these subsegments caters to specific needs within office environments, reflecting trends in workplace design and functionality. The demand for ergonomic chairs and modular desks is particularly high, driven by the need for adaptable and health-conscious workspaces. Storage solutions and collaborative furniture are also gaining traction as offices prioritize flexibility and teamwork .

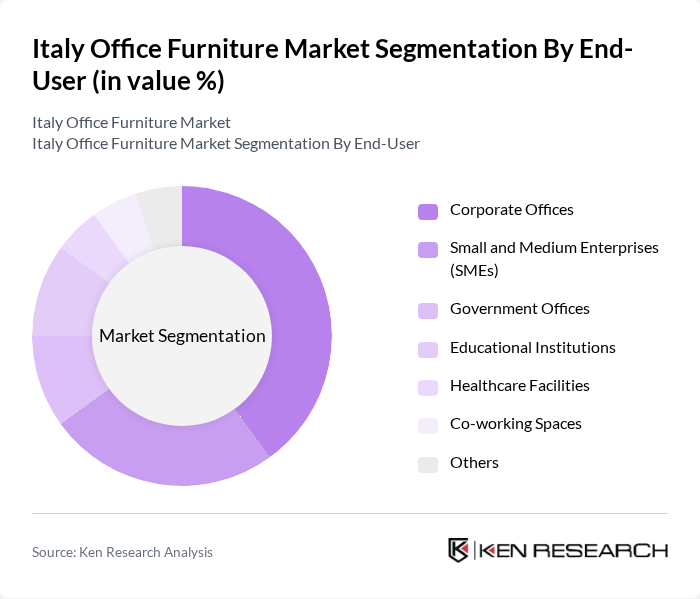

By End-User:The office furniture market is also segmented by end-user categories, which include corporate offices, small and medium enterprises (SMEs), government offices, educational institutions, healthcare facilities, co-working spaces, and others. Each segment has unique requirements and preferences that influence purchasing decisions and trends in office furniture design. Corporate offices and SMEs are the largest consumers, driven by ongoing modernization and expansion of workspaces. Co-working spaces and educational institutions are also emerging as important segments due to changing work and learning patterns .

The Italy Office Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fantoni S.p.A., Estel Group S.r.l., IVM S.p.A., Mascagni S.p.A., Martex S.p.A., UniFor S.p.A. (Molteni Group), Frezza S.p.A., DVO S.p.A., Las Mobili S.r.l., Manerba S.p.A., Sinetica Industries S.r.l., Tecno S.p.A., Arper S.p.A., Haworth Italy S.r.l., Vitra Italia S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian office furniture market appears promising, driven by evolving workplace dynamics and consumer preferences. The integration of technology in furniture design is expected to enhance functionality, while the emphasis on wellness will continue to shape product offerings. Additionally, the rise of hybrid work environments will necessitate adaptable furniture solutions, creating opportunities for innovation. Companies that prioritize sustainability and customization will likely gain a competitive edge, aligning with consumer demand for responsible and personalized products.

| Segment | Sub-Segments |

|---|---|

| By Type | Desks Chairs Storage Solutions Meeting Room Furniture Workstations Collaborative Furniture Reception Furniture Lounge Seating Acoustic Solutions Others |

| By End-User | Corporate Offices Small and Medium Enterprises (SMEs) Government Offices Educational Institutions Healthcare Facilities Co-working Spaces Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Flagship Stores, Home Centers) Direct Sales B2B Sales Others |

| By Material | Wood Metal Plastic Glass Other Materials |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Functionality | Fixed Furniture Modular Furniture Adjustable Furniture Multi-purpose Furniture Others |

| By Design Style | Modern Traditional Contemporary Industrial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 100 | Office Managers, Procurement Specialists |

| Small Business Office Setup | 60 | Small Business Owners, Facility Managers |

| Co-working Space Furniture Solutions | 50 | Co-working Space Operators, Interior Designers |

| Educational Institution Furniture Needs | 40 | Administrative Staff, Facility Coordinators |

| Government Office Furniture Procurement | 40 | Government Procurement Officers, Facility Managers |

The Italy Office Furniture Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by the demand for ergonomic and modular office environments, as well as the rise of remote and hybrid work models.