Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0559

Pages:95

Published On:December 2025

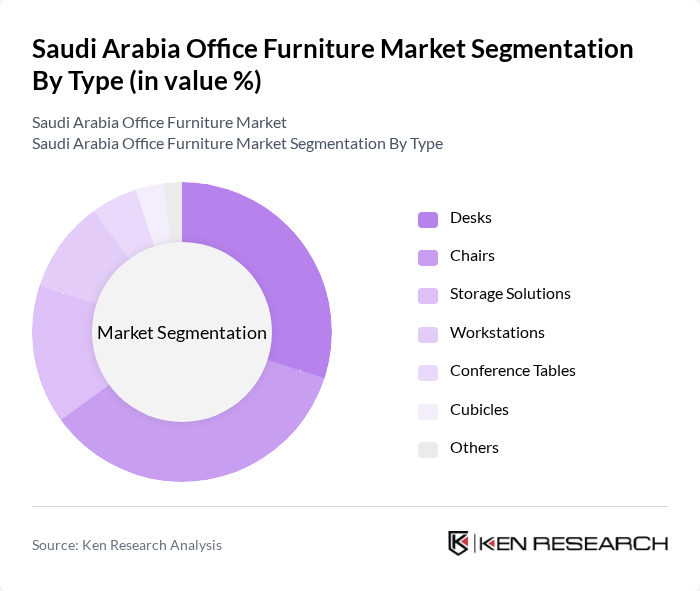

By Type:The office furniture market is segmented into various types, including desks, chairs, storage solutions, workstations, conference tables, cubicles, and others. Among these, chairs and desks are the most dominant segments due to the increasing focus on ergonomic designs and the rise of remote working trends. The demand for ergonomic chairs has surged as companies prioritize employee comfort and productivity, while desks are essential for creating functional workspaces.

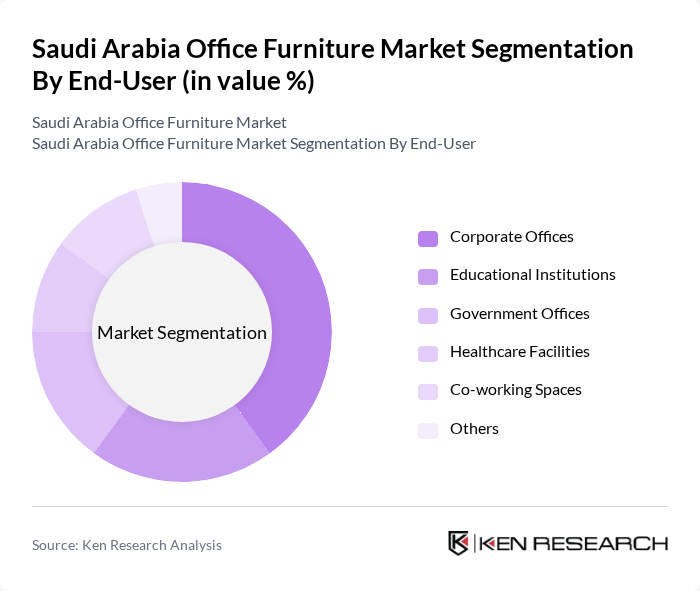

By End-User:The market is segmented by end-users, including corporate offices, educational institutions, government offices, healthcare facilities, co-working spaces, and others. Corporate offices are the leading segment, driven by the need for modern office environments that enhance productivity and collaboration. The rise of co-working spaces has also contributed significantly to the demand for flexible and adaptable office furniture solutions.

The Saudi Arabia Office Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, IKEA Saudi Arabia, Office Furniture Company, Al-Muhaidib Group, Al-Hokair Group, Al-Jazira Furniture, Al-Mansour Furniture, Al-Suwaidi Group, Al-Muhaidib Furniture, Al-Faisaliah Group, Al-Rajhi Group, Al-Saad Group, Al-Mahmal Group, Al-Babtain Group, and Al-Muhaidib & Sons contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia office furniture market appears promising, driven by the rise of e-commerce and the increasing demand for ergonomic and smart furniture solutions. As the e-commerce market is projected to generate USD 16.53 billion in future, furniture companies are likely to adapt to digital retail trends. Additionally, the focus on health and wellness in office design will propel the demand for innovative, tech-enabled furniture that enhances employee productivity and comfort.

| Segment | Sub-Segments |

|---|---|

| By Type | Desks Chairs Storage Solutions Workstations Conference Tables Cubicles Others |

| By End-User | Corporate Offices Educational Institutions Government Offices Healthcare Facilities Co-working Spaces Others |

| By Material | Wood Metal Plastic Glass Others |

| By Design Style | Modern Traditional Contemporary Industrial Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Functionality | Multi-functional Fixed Adjustable Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Furniture Purchases | 150 | Office Managers, Procurement Officers |

| Educational Institution Furniture Needs | 100 | Facility Managers, Administrative Heads |

| Healthcare Sector Furniture Requirements | 80 | Hospital Administrators, Procurement Specialists |

| Government Office Furniture Procurement | 70 | Government Procurement Officers, Facility Managers |

| Small Business Office Setup | 90 | Small Business Owners, Office Coordinators |

The Saudi Arabia Office Furniture Market is currently valued at approximately USD 780 million, reflecting significant growth driven by urbanization, digital transformation, and the expansion of tech hubs under Vision 2030.