Region:Europe

Author(s):Rebecca

Product Code:KRAB0254

Pages:96

Published On:August 2025

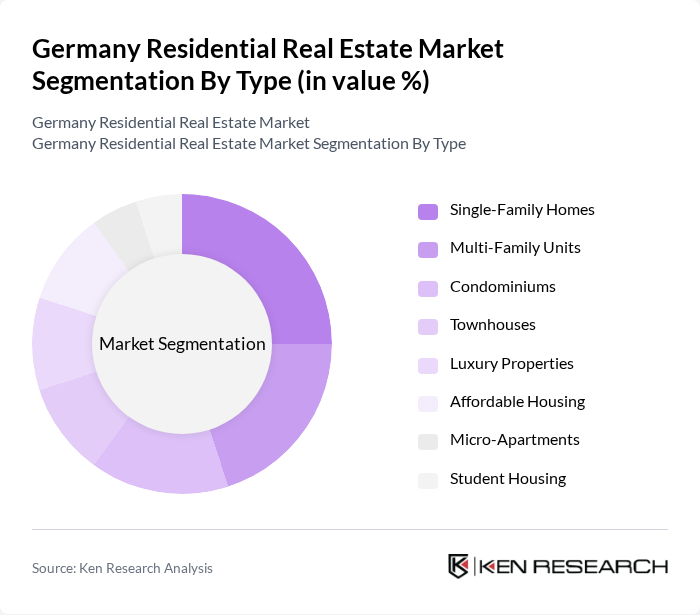

By Type:The residential real estate market can be segmented into various types, including Single-Family Homes, Multi-Family Units, Condominiums, Townhouses, Luxury Properties, Affordable Housing, Micro-Apartments, and Student Housing. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of housing options available in Germany. Demand for energy-efficient and modern properties is particularly strong in urban areas, while affordable housing and micro-apartments address the needs of younger residents and students .

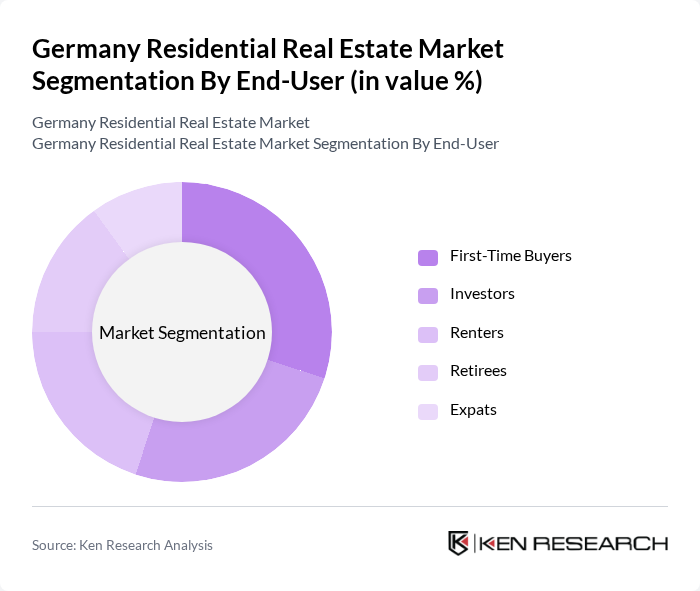

By End-User:The end-user segmentation includes First-Time Buyers, Investors, Renters, Retirees, and Expats. Each group has distinct motivations and financial capabilities, influencing their choices in the residential real estate market. Renters and first-time buyers are particularly impacted by affordability and availability, while investors focus on urban centers with high rental yields and occupancy rates .

The Germany Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vonovia SE, LEG Immobilien SE, TAG Immobilien AG, Grand City Properties S.A., Aroundtown SA, Deutsche Wohnen SE, Consus Real Estate AG, Adler Group S.A., TLG Immobilien AG, BUWOG GmbH, ImmoScout24, Engel & Völkers AG, JLL (Jones Lang LaSalle SE), CBRE Group, Inc., Savills plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany residential real estate market appears promising, driven by ongoing urbanization and government support for affordable housing. As cities continue to grow, the demand for innovative housing solutions will likely increase. Additionally, the integration of smart home technologies and sustainable building practices will shape new developments, appealing to environmentally conscious consumers. The market is expected to adapt to changing demographics and preferences, ensuring resilience amid economic fluctuations.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Condominiums Townhouses Luxury Properties Affordable Housing Micro-Apartments Student Housing |

| By End-User | First-Time Buyers Investors Renters Retirees Expats |

| By Price Range | Below €200,000 €200,000 - €500,000 €500,000 - €1,000,000 Above €1,000,000 |

| By Location | Urban Areas (e.g., Berlin, Munich, Hamburg, Frankfurt, Stuttgart, Düsseldorf, Cologne, Leipzig) Suburban Areas Rural Areas |

| By Property Condition | New Construction Resale Properties Renovated Properties |

| By Financing Type | Mortgages Cash Purchases Government Loans/Subsidies |

| By Investment Purpose | Primary Residence Rental Income Vacation Homes Buy-to-Renovate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Buyers, Investors, Relocators |

| Real Estate Agents | 60 | Residential Brokers, Market Analysts |

| Property Developers | 40 | Project Managers, Business Development Heads |

| Homeowners | 80 | Current Homeowners, Landlords |

| Financial Institutions | 50 | Mortgage Advisors, Loan Officers |

The Germany Residential Real Estate Market is valued at approximately EUR 29.6 trillion. This valuation reflects significant growth driven by urbanization, lower borrowing costs, and strong demand for housing, particularly in metropolitan areas.