Region:Europe

Author(s):Shubham

Product Code:KRAB3216

Pages:98

Published On:October 2025

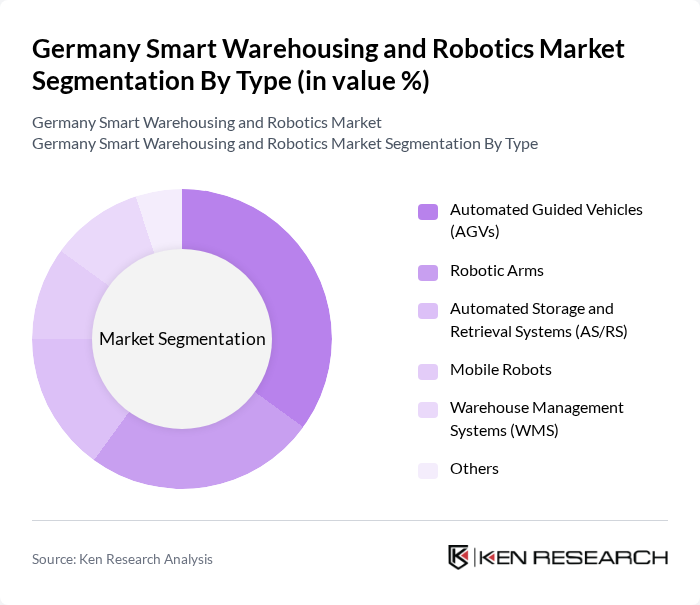

By Type:The market is segmented into various types, including Automated Guided Vehicles (AGVs), Robotic Arms, Automated Storage and Retrieval Systems (AS/RS), Mobile Robots, Warehouse Management Systems (WMS), and Others. Among these, Automated Guided Vehicles (AGVs) are leading the market due to their versatility and efficiency in transporting goods within warehouses. The increasing adoption of AGVs is driven by the need for streamlined operations and reduced labor costs, making them a preferred choice for many logistics companies.

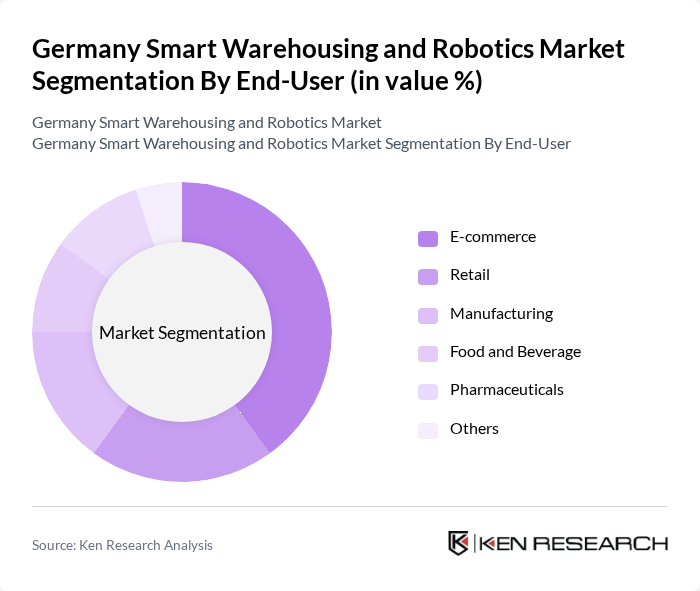

By End-User:The end-user segmentation includes E-commerce, Retail, Manufacturing, Food and Beverage, Pharmaceuticals, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment processes. As e-commerce companies expand their operations, they increasingly rely on smart warehousing solutions to manage inventory and streamline logistics, leading to a significant demand for automation technologies.

The Germany Smart Warehousing and Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, Siemens AG, Dematic GmbH, Swisslog Holding AG, Jungheinrich AG, SSI Schaefer AG, Vanderlande Industries, FANUC Corporation, ABB Ltd., Honeywell Intelligrated, Fetch Robotics, GreyOrange, Locus Robotics, Ocado Group, and 6 River Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart warehousing and robotics market in Germany appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As companies continue to embrace automation, the integration of AI and IoT technologies will enhance operational capabilities. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly solutions, positioning the market for significant growth. The collaboration between technology providers and logistics firms will be crucial in overcoming existing challenges and unlocking new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Robotic Arms Automated Storage and Retrieval Systems (AS/RS) Mobile Robots Warehouse Management Systems (WMS) Others |

| By End-User | E-commerce Retail Manufacturing Food and Beverage Pharmaceuticals Others |

| By Application | Order Fulfillment Inventory Management Packaging Shipping and Receiving Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | B2B B2C |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Smart Warehousing | 100 | Warehouse Managers, Supply Chain Executives |

| Manufacturing Automation Solutions | 80 | Operations Directors, Automation Engineers |

| E-commerce Fulfillment Centers | 90 | Logistics Coordinators, IT Managers |

| Robotics Integration in Warehousing | 70 | Technology Officers, Robotics Specialists |

| Supply Chain Optimization Strategies | 85 | Consultants, Business Analysts |

The Germany Smart Warehousing and Robotics Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing demand for automation in logistics and supply chain management, particularly due to the rise of e-commerce.