Region:Global

Author(s):Dev

Product Code:KRAA3072

Pages:97

Published On:August 2025

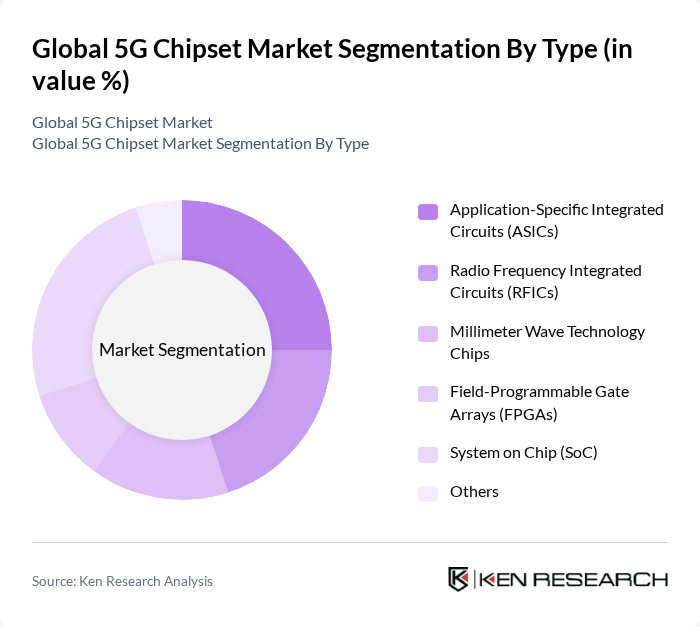

By Type:The market is segmented into various types of chipsets, including Application-Specific Integrated Circuits (ASICs), Radio Frequency Integrated Circuits (RFICs), Millimeter Wave Technology Chips, Field-Programmable Gate Arrays (FPGAs), System on Chip (SoC), and others. Each of these types serves specific functions in the 5G ecosystem, catering to different applications and performance requirements. ASICs and SoCs are particularly prominent due to their integration in consumer electronics and base stations, while RFICs and millimeter wave chips support advanced antenna systems and high-frequency applications.

The Application-Specific Integrated Circuits (ASICs) segment is currently dominating the market due to their efficiency and performance in handling specific tasks related to 5G technology. ASICs are designed to optimize power consumption and processing speed, making them ideal for applications such as base stations and mobile devices. The increasing demand for high-speed data transmission and low latency in various sectors, including telecommunications, automotive, and industrial automation, further drives the adoption of ASICs in the 5G chipset market.

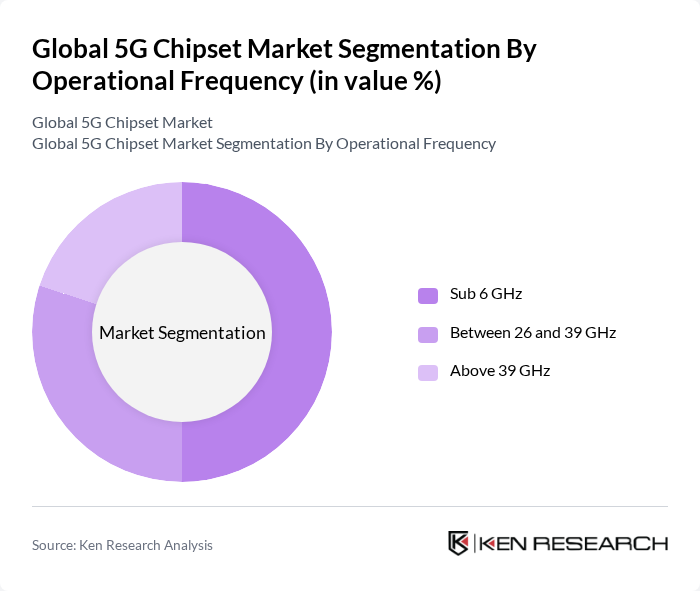

By Operational Frequency:The market is also segmented based on operational frequency, which includes Sub 6 GHz, Between 26 and 39 GHz, and Above 39 GHz. Each frequency range serves different applications and is crucial for the effective deployment of 5G networks. Sub 6 GHz is widely adopted for broad coverage and reliable connectivity, while millimeter wave bands (above 26 GHz) enable ultra-high-speed data transmission for dense urban environments and specialized industrial uses.

The Sub 6 GHz frequency range is leading the market due to its extensive coverage and ability to penetrate buildings effectively. This frequency is particularly suitable for urban environments where high data rates and reliable connectivity are essential. The growing demand for mobile broadband services and the need for enhanced connectivity in smart cities further contribute to the dominance of the Sub 6 GHz segment in the 5G chipset market.

The Global 5G Chipset Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qualcomm Technologies, Inc., Intel Corporation, MediaTek Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, Texas Instruments Incorporated, Broadcom Inc., NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics N.V., Qorvo, Inc., Marvell Technology, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 5G chipset market is poised for significant advancements, driven by technological innovations and increasing demand for connectivity. As industries adopt 5G technology, the integration of artificial intelligence and machine learning into chipsets will enhance performance and efficiency. Furthermore, the rise of private 5G networks in sectors like manufacturing and healthcare will create new opportunities for chipset manufacturers, fostering a competitive landscape that encourages continuous improvement and innovation in technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Application-Specific Integrated Circuits (ASICs) Radio Frequency Integrated Circuits (RFICs) Millimeter Wave Technology Chips Field-Programmable Gate Arrays (FPGAs) System on Chip (SoC) Others |

| By Operational Frequency | Sub 6 GHz Between 26 and 39 GHz Above 39 GHz |

| By End-User | Consumer Electronics Industrial Automation Automotive & Transportation Energy & Utilities Healthcare Retail Others |

| By Component | Antennas Processors Memory Units Power Management ICs Others |

| By Application | Mobile Broadband Fixed Wireless Access Smart Cities Remote Healthcare Autonomous Vehicles Others |

| By Sales Channel | Direct Sales Distributors Online Retail Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Procurement Managers |

| Semiconductor Manufacturers | 80 | Product Development Managers, Technical Directors |

| IoT Device Manufacturers | 60 | Product Managers, R&D Specialists |

| Automotive Industry Stakeholders | 50 | Supply Chain Managers, Technology Officers |

| Consumer Electronics Firms | 70 | Market Analysts, Product Strategy Leads |

The Global 5G Chipset Market is valued at approximately USD 33 billion, driven by the increasing demand for high-speed internet, IoT device proliferation, and advancements in telecommunications infrastructure.