Region:Global

Author(s):Shubham

Product Code:KRAA2675

Pages:82

Published On:August 2025

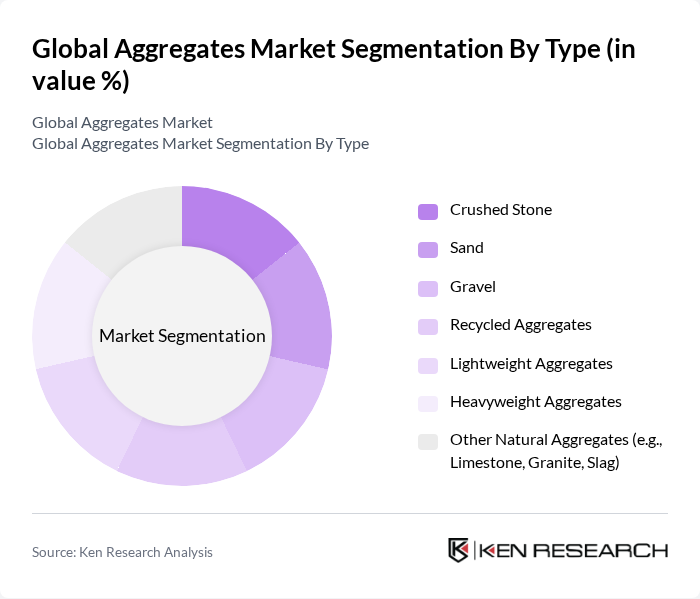

By Type:The market is segmented into various types of aggregates, including crushed stone, sand, gravel, recycled aggregates, lightweight aggregates, heavyweight aggregates, and other natural aggregates. Among these, crushed stone and sand are the most widely used due to their versatility and essential role in construction and infrastructure projects. The demand for recycled aggregates is also increasing as sustainability becomes a priority in the construction industry, with regulatory incentives and green building certifications accelerating adoption .

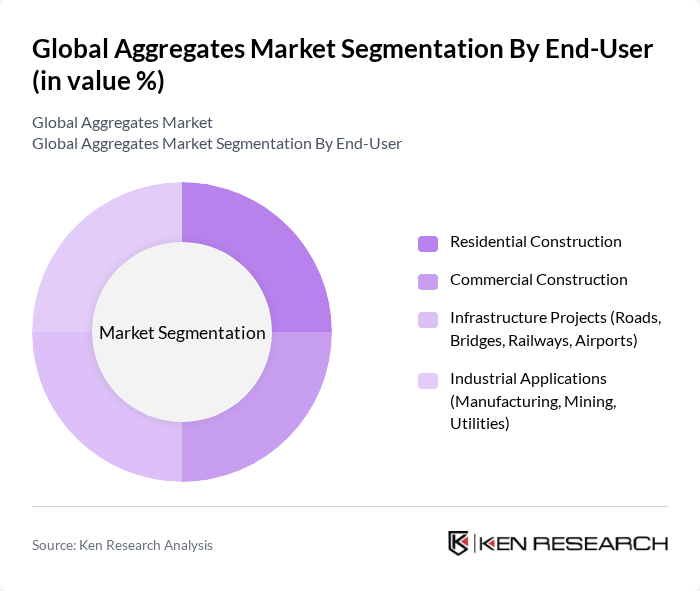

By End-User:The aggregates market serves various end-users, including residential construction, commercial construction, infrastructure projects, and industrial applications. Infrastructure projects, particularly roads, bridges, and railways, are the largest consumers of aggregates due to the extensive material requirements for these developments. The residential and commercial construction sectors are also significant contributors, driven by urbanization and population growth. The growing emphasis on sustainable infrastructure and green building standards is further shaping demand patterns across all end-user segments .

The Global Aggregates Market is characterized by a dynamic mix of regional and international players. Leading participants such as CRH plc, Heidelberg Materials AG, Martin Marietta Materials, Inc., Vulcan Materials Company, Holcim Ltd., Boral Limited, CEMEX S.A.B. de C.V., Aggregate Industries Limited, Eurovia (VINCI Group), Tarmac (CRH plc), Hanson UK (Heidelberg Materials), Breedon Group plc, U.S. Concrete, Inc. (now part of Vulcan Materials), Summit Materials, Inc., Taiheiyo Cement Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aggregates market appears promising, driven by ongoing infrastructure projects and urbanization trends. As governments worldwide prioritize infrastructure development, the demand for aggregates is expected to remain robust. Additionally, the integration of sustainable practices and digital technologies in production processes will likely enhance operational efficiency. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capitalize on emerging opportunities in the aggregates sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Crushed Stone Sand Gravel Recycled Aggregates Lightweight Aggregates Heavyweight Aggregates Other Natural Aggregates (e.g., Limestone, Granite, Slag) |

| By End-User | Residential Construction Commercial Construction Infrastructure Projects (Roads, Bridges, Railways, Airports) Industrial Applications (Manufacturing, Mining, Utilities) |

| By Application | Road Construction Concrete Production Asphalt Production Railway Ballast Drainage & Erosion Control Landfill Covering |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Platforms |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Nordics, Benelux, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Sustainability Practices | Eco-Friendly Materials (Recycled, Low-Carbon Aggregates) Energy-Efficient Production Waste Reduction & Circular Economy Techniques |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Aggregates | 100 | Project Managers, Site Supervisors |

| Commercial Infrastructure Projects | 80 | Construction Managers, Procurement Managers |

| Road and Highway Development | 60 | Civil Engineers, Urban Planners |

| Recycling and Sustainable Aggregates | 50 | Sustainability Managers, Environmental Consultants |

| Aggregates Supply Chain Management | 40 | Logistics Coordinators, Supply Chain Analysts |

The Global Aggregates Market is valued at approximately USD 590 billion, driven by increasing demand for construction materials due to urbanization, infrastructure development, and the expansion of the real estate sector.