Region:Global

Author(s):Rebecca

Product Code:KRAB0950

Pages:97

Published On:December 2025

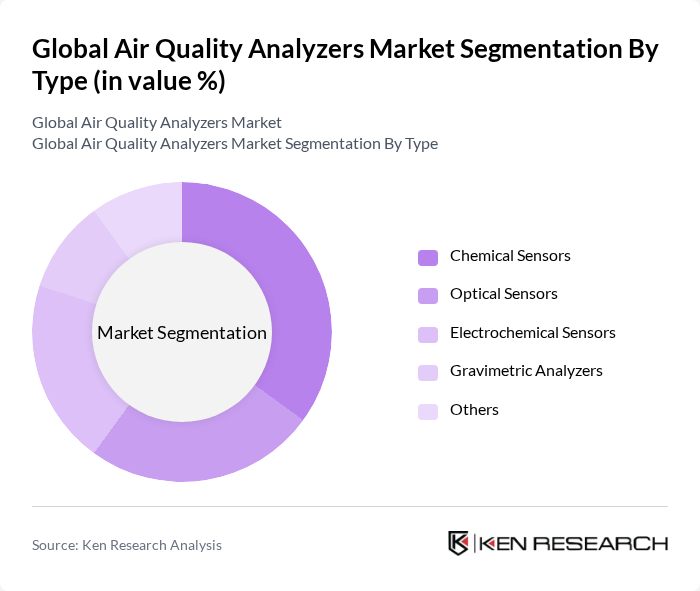

By Type:The market is segmented into various types of air quality analyzers, including Chemical Sensors, Optical Sensors, Electrochemical Sensors, Gravimetric Analyzers, and Others. Among these, Chemical Sensors are leading the market due to their high sensitivity and specificity in detecting various pollutants. The increasing focus on environmental monitoring and regulatory compliance has further propelled the demand for these sensors, making them a preferred choice for both industrial and residential applications.

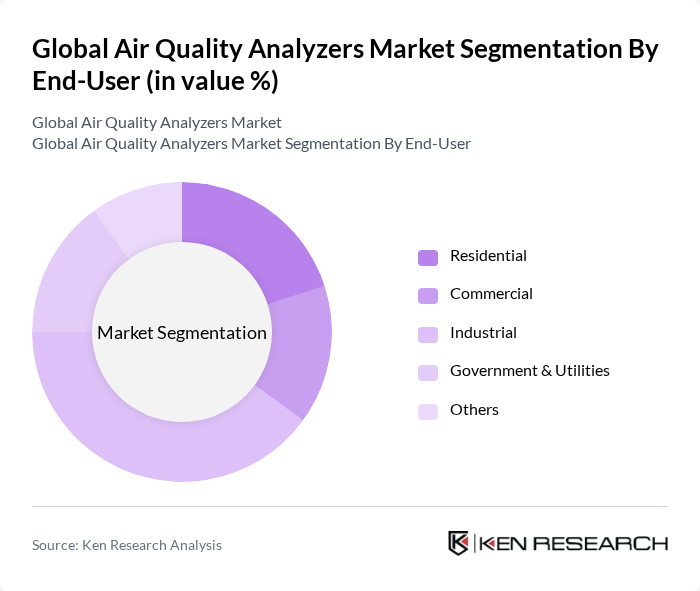

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Industrial segment dominates the market, driven by stringent regulations on emissions and the need for continuous monitoring of air quality in manufacturing processes. Industries are increasingly investing in advanced air quality analyzers to comply with environmental standards and ensure worker safety, leading to a significant market share in this category.

The Global Air Quality Analyzers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aeroqual, Thermo Fisher Scientific, Horiba, Teledyne Technologies, Siemens, Agilent Technologies, 3M, PerkinElmer, Beckman Coulter, Emerson Electric, Environnement S.A, Aeroqual, RKI Instruments, YSI (Xylem), Acoem contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air quality analyzers market appears promising, driven by increasing investments in smart monitoring technologies and public-private partnerships. For instance, Vietnam plans to install 113 new monitoring stations by future, reflecting a commitment to enhancing air quality infrastructure. Additionally, collaborations like the EPA's extended CRADA with Aeroqual aim to improve sensor technologies, ensuring that the market remains responsive to evolving environmental challenges and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Sensors Optical Sensors Electrochemical Sensors Gravimetric Analyzers Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Continuous Monitoring Systems Portable Monitoring Systems Stationary Monitoring Systems Others |

| By Application | Indoor Air Quality Monitoring Outdoor Air Quality Monitoring Industrial Emission Monitoring Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| By Policy Support | Environmental Protection Policies Air Quality Improvement Programs Research and Development Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Air Quality Monitoring | 100 | Environmental Managers, Compliance Officers |

| Residential Air Quality Solutions | 80 | Homeowners, HVAC Technicians |

| Government Regulatory Frameworks | 60 | Policy Makers, Environmental Analysts |

| Research and Development in Air Quality Technologies | 70 | R&D Managers, Product Development Engineers |

| Market Trends in Air Quality Monitoring | 90 | Market Analysts, Industry Consultants |

The Global Air Quality Analyzers Market is valued at approximately USD 5 billion, driven by increasing environmental regulations, public health awareness regarding air pollution, and the adoption of smart technologies like IoT-enabled sensors.