Global Alcoholic Drinks Packaging Market Overview

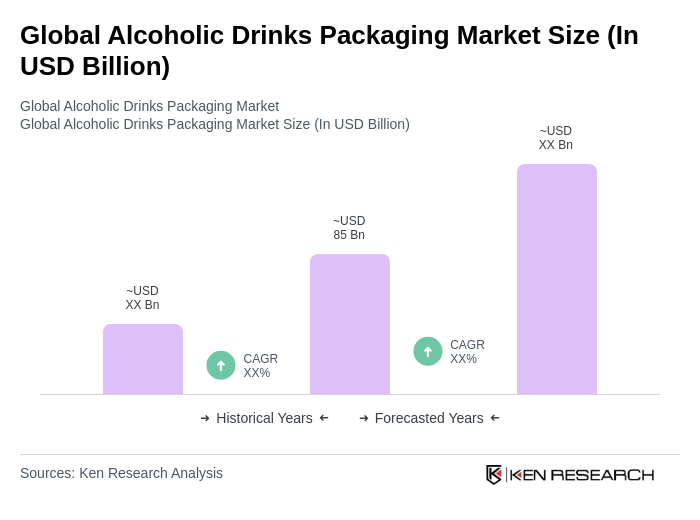

- The Global Alcoholic Drinks Packaging Market is valued at USD 85 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing consumption of premium alcoholic beverages, especially in emerging markets, and a rising demand for sustainable and eco-friendly packaging solutions. The market is further influenced by innovations in packaging technology, such as smart labeling, oxygen scavengers, and light-blocking layers, which enhance product shelf life and consumer convenience.

- Key players in this market include the United States, Germany, and China, which dominate due to their large-scale production capabilities and established distribution networks. The United States leads in innovation and premium packaging trends, Germany is recognized for its high-quality manufacturing standards, and China, with its vast consumer base, is rapidly expanding its market presence through increased production and export activities. Asia Pacific holds the largest market share, driven by rising disposable income and urbanization, while North America continues to set trends in premiumization and craft beverage packaging.

- In 2023, the European Union implemented thePackaging and Packaging Waste Directive (Directive (EU) 2018/852), issued by the European Parliament and Council, which mandates that all packaging must be recyclable or reusable by 2030. This regulation aims to reduce environmental impact and promote sustainable practices within the alcoholic drinks packaging sector, requiring manufacturers to adopt eco-friendly materials and processes, comply with extended producer responsibility, and meet specific recycling targets.

Global Alcoholic Drinks Packaging Market Segmentation

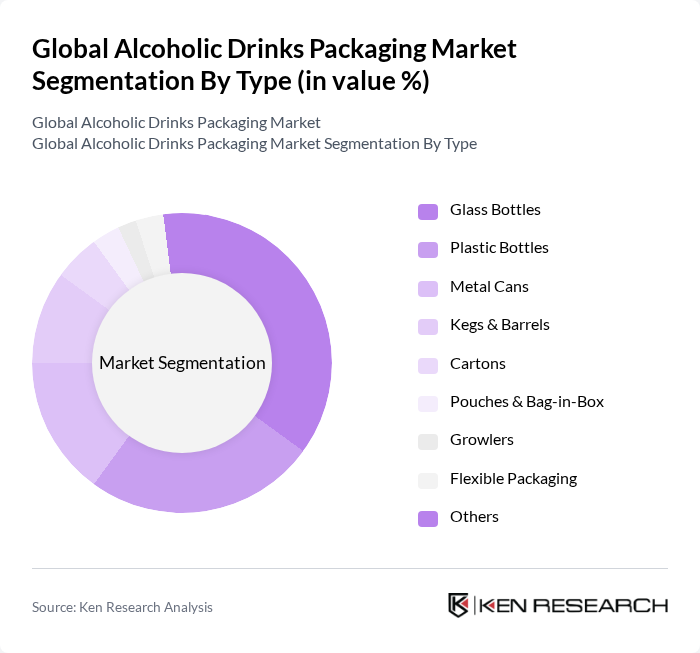

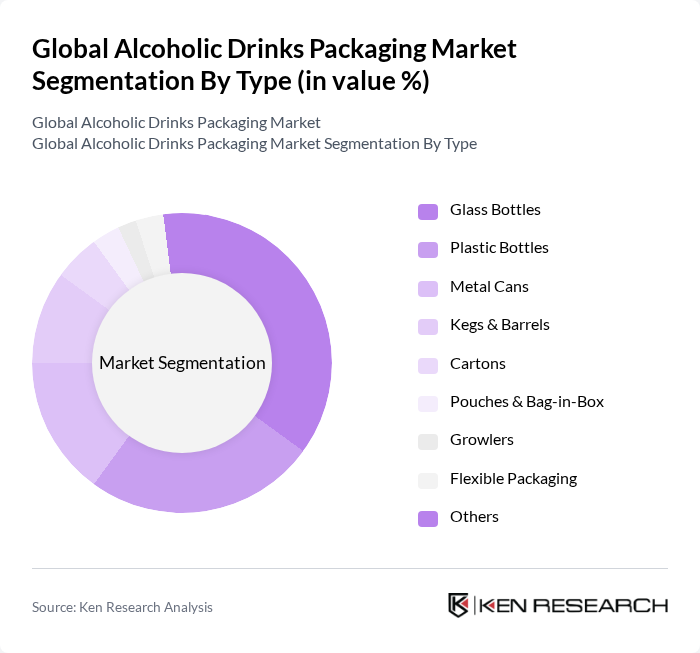

By Type:The market is segmented into various types of packaging, including Glass Bottles, Plastic Bottles, Metal Cans, Kegs & Barrels, Cartons, Pouches & Bag-in-Box, Growlers, Flexible Packaging, and Others.Glass Bottlesremain the most dominant due to their premium appeal, recyclability, and ability to preserve beverage quality.Plastic Bottlesare gaining traction owing to their lightweight, cost-effectiveness, and increasing use of recycled PET and bio-based plastics, which cater to sustainability-conscious consumers.Metal CansandFlexible Packagingformats are also growing, driven by the popularity of ready-to-drink and on-the-go alcoholic products.

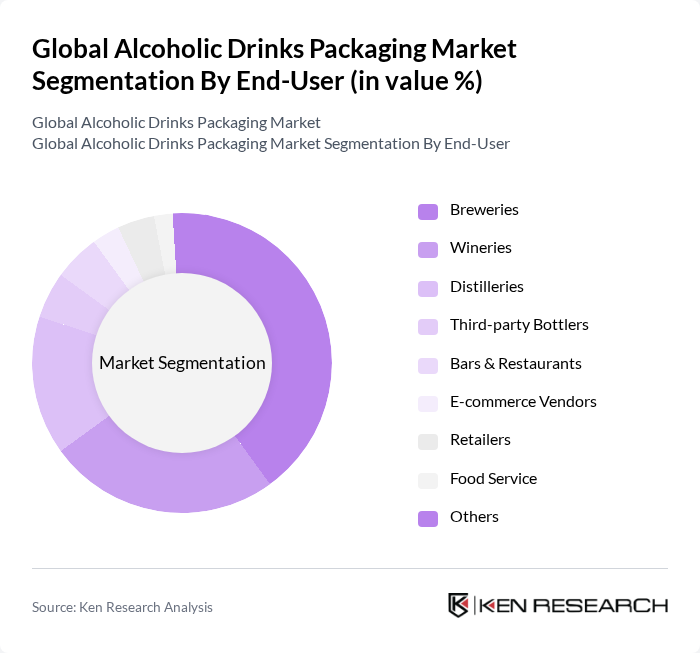

By End-User:The market is segmented by end-users, including Breweries, Wineries, Distilleries, Third-party Bottlers, Bars & Restaurants, E-commerce Vendors, Retailers, Food Service, and Others.Breweriesare the leading end-user segment, propelled by the craft beer movement and demand for unique packaging solutions that enhance brand identity.WineriesandDistilleriesalso contribute significantly, focusing on premium and sustainable packaging to attract discerning consumers. The rise ofE-commerce VendorsandThird-party Bottlersreflects the growing importance of direct-to-consumer channels and flexible packaging formats.

Global Alcoholic Drinks Packaging Market Competitive Landscape

The Global Alcoholic Drinks Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Ball Corporation, Crown Holdings, Inc., O-I Glass, Inc., Ardagh Group S.A., Smurfit Kappa Group plc, Silgan Holdings Inc., Berry Global, Inc., Mondi Group, DS Smith plc, WestRock Company, Orora Limited, CCL Industries Inc., Tetra Pak International S.A., International Paper Company, United Bottles & Packaging, Vetreria Etrusca S.p.A., Encore Glass, Creative Glass, Brick Packaging, LLC contribute to innovation, geographic expansion, and service delivery in this space.

Global Alcoholic Drinks Packaging Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging Solutions:The global shift towards sustainability is driving the demand for eco-friendly packaging in the alcoholic drinks sector. In future, the sustainable packaging market is projected to reach $500 billion, with a significant portion attributed to alcoholic beverages. This trend is fueled by consumer preferences for brands that prioritize environmental responsibility, as evidenced by a 70% increase in sales for products using recyclable materials, according to the World Packaging Organization.

- Growth in the Global Alcoholic Beverage Market:The alcoholic beverage market is expected to surpass $1.5 trillion in future, driven by rising disposable incomes and changing consumer lifestyles. This growth is particularly evident in emerging markets, where alcohol consumption is increasing by 5% annually. The demand for diverse alcoholic products, including craft beers and premium spirits, is further propelling the need for innovative packaging solutions that enhance product appeal and shelf life, as reported by the International Wine and Spirits Record.

- Innovations in Packaging Technology:Technological advancements in packaging are revolutionizing the alcoholic drinks market. In future, investments in smart packaging technologies are expected to reach $2 billion, enhancing consumer engagement through features like QR codes and temperature indicators. These innovations not only improve user experience but also provide brands with valuable data on consumer preferences and behaviors, as highlighted by a report from Smithers Pira, indicating a 30% increase in consumer interaction with smart packaging.

Market Challenges

- Stringent Regulations on Packaging Materials:The alcoholic drinks packaging industry faces significant challenges due to stringent regulations regarding packaging materials. In future, compliance costs are projected to rise by 15% as governments enforce stricter guidelines on materials used, particularly concerning safety and environmental impact. This regulatory landscape complicates the supply chain and increases operational costs for manufacturers, as noted by the European Commission's recent directives on packaging waste.

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a substantial challenge to the alcoholic drinks packaging market. In future, the cost of key materials such as glass and aluminum is expected to increase by 10-20% due to supply chain disruptions and geopolitical tensions. This fluctuation can significantly impact profit margins for packaging manufacturers, as highlighted by the World Bank's commodity price index, which indicates ongoing instability in raw material markets.

Global Alcoholic Drinks Packaging Market Future Outlook

The future of the alcoholic drinks packaging market is poised for transformation, driven by sustainability and technological advancements. As consumer preferences shift towards eco-friendly options, brands are increasingly adopting biodegradable materials and lightweight packaging solutions. Additionally, the rise of e-commerce is reshaping distribution channels, necessitating innovative packaging that ensures product integrity during transit. These trends indicate a dynamic market landscape where adaptability and innovation will be crucial for success in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for alcoholic drinks packaging. With a projected increase in alcohol consumption by 5% annually in regions like Asia-Pacific, companies can capitalize on this trend by developing tailored packaging solutions that cater to local preferences and regulatory requirements, potentially increasing market share and profitability.

- Development of Smart Packaging Technologies:The rise of smart packaging technologies offers a lucrative opportunity for innovation in the alcoholic drinks sector. By integrating features such as NFC tags and augmented reality, brands can enhance consumer engagement and provide interactive experiences. This trend is expected to attract tech-savvy consumers, driving sales and brand loyalty in a competitive market landscape.