Region:Global

Author(s):Geetanshi

Product Code:KRAA2351

Pages:81

Published On:August 2025

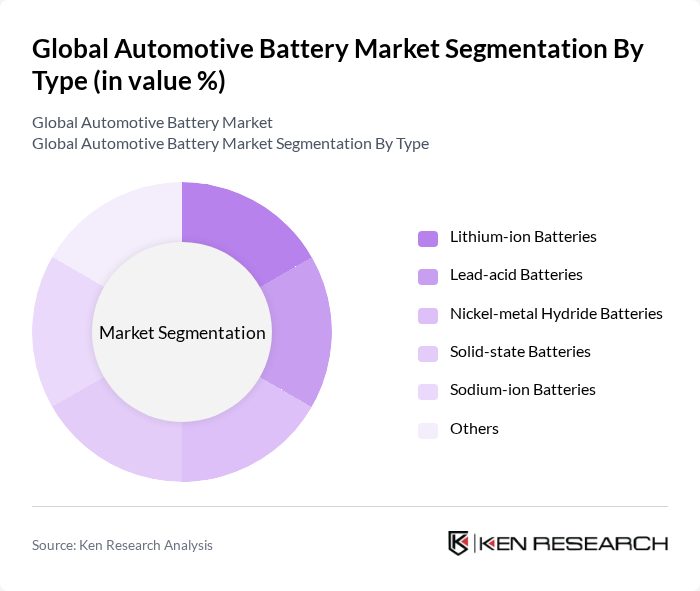

By Type:The market is segmented into Lithium-ion Batteries, Lead-acid Batteries, Nickel-metal Hydride Batteries, Solid-state Batteries, Sodium-ion Batteries, and Others. Lithium-ion Batteries hold the largest share due to their high energy density, lightweight construction, and superior efficiency, making them the preferred choice for electric vehicles and advanced automotive electronics. The surge in EV production and adoption continues to reinforce the dominance of Lithium-ion Batteries in the market.

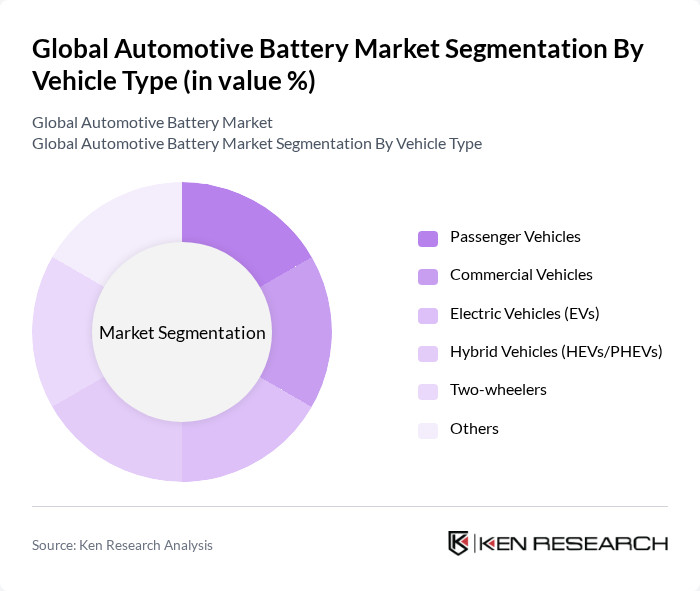

By Vehicle Type:The market is categorized into Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Hybrid Vehicles (HEVs/PHEVs), Two-wheelers, and Others. Electric Vehicles (EVs) are the fastest-growing subsegment, propelled by the global transition to sustainable mobility and supportive government policies. The increasing consumer preference for eco-friendly vehicles and the expansion of EV charging infrastructure are significantly boosting demand for automotive batteries tailored to electric vehicles.

The Global Automotive Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Holdings Corporation, LG Energy Solution Ltd., Samsung SDI Co., Ltd., BYD Company Limited, A123 Systems LLC, Contemporary Amperex Technology Co., Limited (CATL), Clarios (formerly Johnson Controls Power Solutions), Tesla, Inc., Exide Industries Limited, Saft Groupe S.A., Toshiba Corporation, VARTA AG, Envision AESC Group Ltd., Farasis Energy, Inc., Northvolt AB, GS Yuasa International Ltd., East Penn Manufacturing Company, Hitachi, Ltd., EnerSys, and Robert Bosch GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The automotive battery market is poised for significant transformation, driven by technological advancements and increasing regulatory support for electric vehicles. As battery technologies evolve, particularly with the development of solid-state batteries, performance and safety are expected to improve. Additionally, the expansion of charging infrastructure will facilitate greater EV adoption, while government incentives will continue to play a crucial role in shaping market dynamics, ensuring a robust growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Batteries Lead-acid Batteries Nickel-metal Hydride Batteries Solid-state Batteries Sodium-ion Batteries Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) Hybrid Vehicles (HEVs/PHEVs) Two-wheelers Others |

| By Application | Starting, Lighting, and Ignition (SLI) Electric Propulsion Start-stop Systems Auxiliary Power Others |

| By Sales Channel | OEMs Aftermarket Online Sales Others |

| By Distribution Mode | Direct Sales Distributors Retailers Others |

| By Price Range | Economy Mid-range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 100 | Production Managers, R&D Directors |

| Automotive OEMs | 80 | Procurement Managers, Product Development Engineers |

| EV Charging Infrastructure Providers | 60 | Operations Managers, Business Development Executives |

| Battery Recycling Companies | 50 | Sustainability Managers, Operations Directors |

| Industry Analysts and Consultants | 40 | Market Analysts, Research Directors |

The Global Automotive Battery Market is valued at approximately USD 69 billion, driven by the increasing demand for electric vehicles (EVs) and advancements in battery technology, particularly lithium-ion batteries.