Region:Global

Author(s):Dev

Product Code:KRAD1694

Pages:85

Published On:November 2025

By Type:The bags and containers market is segmented into various types, including plastic bags, paper bags, fabric bags, biodegradable bags, reusable bags, specialty bags, bag-in-box containers, tote bags, backpacks, and others. Among these, plastic bags continue to hold the largest market share due to their versatility, low cost, and widespread use in retail and food packaging. However, there is a pronounced shift towards biodegradable and reusable bags, driven by increasing environmental awareness and regulatory pressures. Bag-in-box containers are also gaining traction in the food and beverage sector for their efficiency and sustainability .

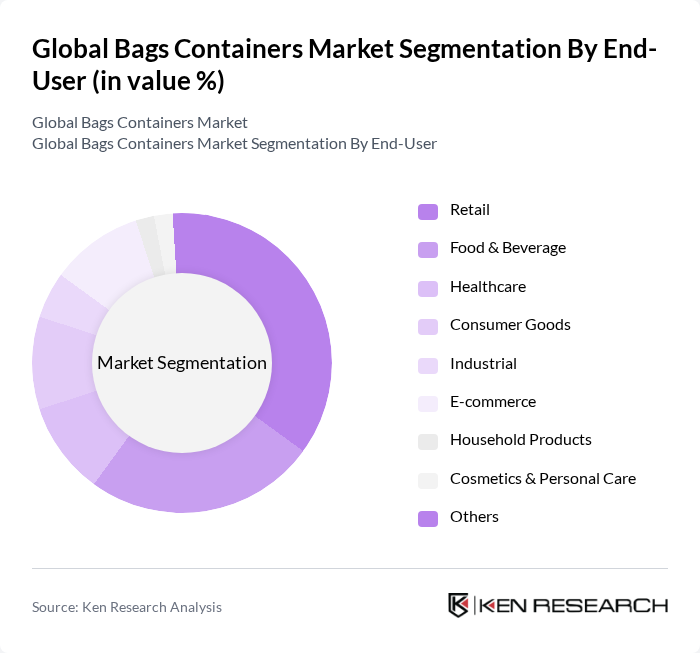

By End-User:The market is segmented by end-user into retail, food & beverage, healthcare, consumer goods, industrial, e-commerce, household products, cosmetics & personal care, and others. The retail sector remains the largest end-user, propelled by the need for efficient packaging solutions in supermarkets and convenience stores. The food and beverage industry is a significant contributor, particularly with the adoption of bag-in-box and specialty packaging. E-commerce is rapidly expanding, driven by the surge in online shopping and the demand for secure, sustainable packaging .

The Global Bags Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Smurfit Kappa Group, International Paper Company, Novolex Holdings, Inc., DS Smith Plc, Huhtamaki Oyj, WestRock Company, ProAmpac LLC, Sonoco Products Company, Graphic Packaging Holding Company, Clondalkin Group Holdings B.V., Schur Flexibles Group, Uflex Ltd., Constantia Flexibles Group GmbH, Coveris Holdings S.A., Linpac Packaging Limited, Winpak Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the bags and containers market is poised for transformation, driven by sustainability and technological advancements. As consumer preferences shift towards eco-friendly options, companies are likely to invest heavily in biodegradable materials and innovative designs. Additionally, the integration of smart technology in packaging is expected to enhance user experience and operational efficiency. The focus on circular economy practices will further shape the market, encouraging businesses to adopt sustainable practices that align with consumer values and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Plastic Bags Paper Bags Fabric Bags Biodegradable Bags Reusable Bags Specialty Bags Bag-in-Box Containers Tote Bags Backpacks Others |

| By End-User | Retail Food & Beverage Healthcare Consumer Goods Industrial E-commerce Household Products Cosmetics & Personal Care Others |

| By Material | Polyethylene (PE) Polypropylene (PP) Paper & Paperboard Cotton Jute Canvas Metal Others |

| By Application | Packaging Transportation Storage Promotional Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | North America (U.S., Canada) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Consumer Type | Individual Consumers Businesses Government Agencies NGOs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Flexible Packaging Market | 100 | Product Managers, R&D Directors |

| Rigid Containers Segment | 80 | Operations Managers, Supply Chain Analysts |

| Eco-friendly Packaging Solutions | 60 | Sustainability Managers, Marketing Executives |

| Food & Beverage Packaging | 90 | Quality Assurance Managers, Procurement Officers |

| Consumer Goods Packaging | 70 | Brand Managers, Logistics Coordinators |

The Global Bags Containers Market is valued at approximately USD 48 billion, driven by the increasing demand for sustainable packaging solutions, rising e-commerce activities, and consumer preferences for convenience in shopping.