Region:Global

Author(s):Rebecca

Product Code:KRAA2901

Pages:84

Published On:August 2025

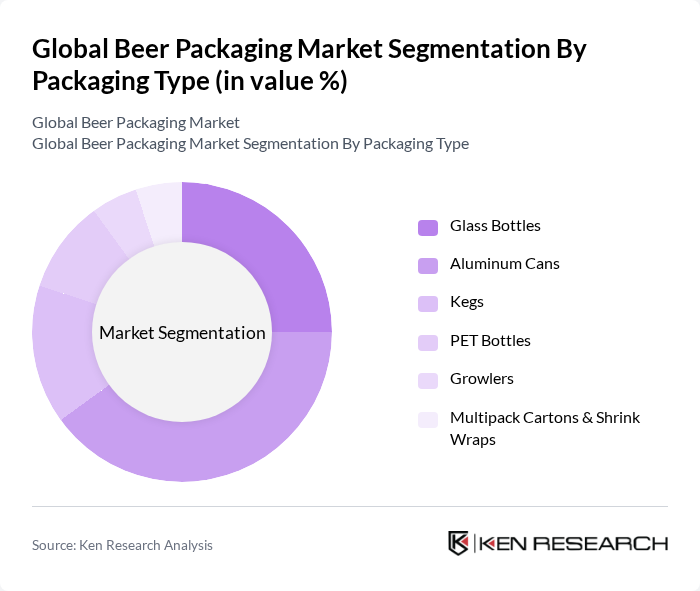

By Packaging Type:The packaging type segment includes various forms of packaging used for beer, such as glass bottles, aluminum cans, kegs, PET bottles, growlers, and multipack cartons & shrink wraps. Among these, aluminum cans have gained significant popularity due to their lightweight, high recyclability, and ability to preserve beer freshness, making them a preferred choice for both consumers and manufacturers. Glass bottles remain prominent for premium and specialty beers, while kegs are favored in the hospitality sector for bulk dispensing. PET bottles and multipack cartons are increasingly used for convenience and portability .

By Beer Type:This segment categorizes beer into various types, including lagers, ales, wheat beers, sours, specialty & hybrid beers, and non-alcoholic beers. Lagers continue to dominate the market due to their broad appeal, consistent taste profile, and widespread availability. The craft beer trend has fueled growth in ales and specialty beers, while non-alcoholic beers are gaining traction among health-conscious consumers and in regions with stricter alcohol regulations .

The Global Beer Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Ball Corporation, Crown Holdings, Inc., Ardagh Group S.A., Owens-Illinois, Inc. (O-I Glass, Inc.), Nampak Ltd., Vidrala S.A., Toyo Seikan Group Holdings, Ltd., Can-Pack S.A., Orora Limited, Krones AG, Smurfit Kappa Group plc, WestRock Company, DS Smith plc, Silgan Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the beer packaging market is poised for transformation, driven by technological advancements and evolving consumer preferences. Innovations such as smart packaging, which enhances user engagement and product tracking, are expected to gain traction. Additionally, the focus on personalized packaging solutions will cater to the growing demand for unique consumer experiences. As sustainability remains a priority, companies will increasingly adopt circular economy practices, ensuring that packaging materials are reused and recycled effectively, thereby reducing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Glass Bottles Aluminum Cans Kegs PET Bottles Growlers Multipack Cartons & Shrink Wraps |

| By Beer Type | Lagers Ales Wheat Beers Sours Specialty & Hybrid Beers Non-Alcoholic Beers |

| By Packaging Material | Glass Metal (Aluminum, Steel) Plastic (PET) Paperboard |

| By End-User | Breweries Food & Beverage Companies Retailers & Distributors Restaurants, Bars & Hotels Events & Festivals |

| By Distribution Channel | Direct-to-Customer Retail Outlets Supermarkets & Hypermarkets Convenience Stores E-Commerce |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, etc.) Asia-Pacific (China, Japan, India, South Korea, Australia, Southeast Asia) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (UAE, Saudi Arabia, South Africa, etc.) |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Brewery Packaging Strategies | 100 | Packaging Managers, Production Directors |

| Craft Brewery Packaging Innovations | 60 | Founders, R&D Managers |

| Retail Packaging Preferences | 70 | Category Managers, Merchandising Directors |

| Environmental Impact Assessments | 40 | Sustainability Officers, Compliance Managers |

| Consumer Packaging Feedback | 90 | End Consumers, Focus Group Participants |

The Global Beer Packaging Market is valued at approximately USD 25.9 billion, reflecting a significant growth trend driven by increasing beer consumption, the rise of craft breweries, and a demand for sustainable packaging solutions.