Region:Global

Author(s):Dev

Product Code:KRAA3099

Pages:100

Published On:August 2025

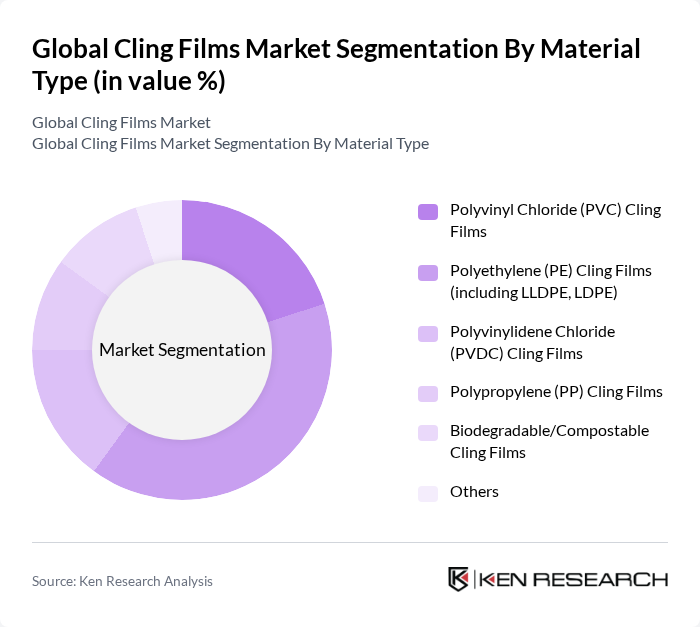

By Material Type:The material type segmentation includes various subsegments such as Polyvinyl Chloride (PVC) Cling Films, Polyethylene (PE) Cling Films (including LLDPE, LDPE), Polyvinylidene Chloride (PVDC) Cling Films, Polypropylene (PP) Cling Films, Biodegradable/Compostable Cling Films, and Others. Among these, Polyethylene (PE) Cling Films dominate the market due to their versatility, cost-effectiveness, and excellent barrier properties, making them the preferred choice for food packaging. LDPE-based cling films are especially favored for their flexibility and clarity, while biodegradable films are rapidly emerging due to regulatory and consumer sustainability demands .

By End-User:The end-user segmentation encompasses various sectors including the Food & Beverage Industry, Healthcare & Pharmaceuticals, Retail & Supermarkets, Households, Agriculture, and Others. The Food & Beverage Industry is the leading segment, driven by the increasing demand for packaged food products and the need for effective preservation methods to extend shelf life. Retail and supermarket chains, along with household use, are also significant contributors to market demand due to the widespread adoption of cling films for food storage and freshness .

The Global Cling Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global, Inc., Sealed Air Corporation, Intertape Polymer Group Inc., DuPont de Nemours, Inc., Novolex Holdings, LLC, AEP Industries Inc., Clondalkin Group Holdings B.V., Coveris Holdings S.A., Mitsubishi Chemical Group Corporation, 3M Company, Reynolds Consumer Products Inc., Winpak Ltd., Inteplast Group, Ltd., Toppan Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cling films market appears promising, driven by innovations in sustainable packaging and the increasing integration of smart technologies. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in biodegradable materials and advanced packaging solutions that enhance food safety. Additionally, the expansion of online retail channels will continue to fuel demand for cling films, as businesses seek efficient packaging methods to meet the growing needs of e-commerce and food delivery services.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyvinyl Chloride (PVC) Cling Films Polyethylene (PE) Cling Films (including LLDPE, LDPE) Polyvinylidene Chloride (PVDC) Cling Films Polypropylene (PP) Cling Films Biodegradable/Compostable Cling Films Others |

| By End-User | Food & Beverage Industry Healthcare & Pharmaceuticals Retail & Supermarkets Households Agriculture Others |

| By Application | Food Packaging (Fresh Produce, Meat, Bakery, Dairy, etc.) Medical & Pharmaceutical Packaging Industrial Packaging Consumer Goods Packaging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales (B2B) Others |

| By Thickness | Up to 8 Microns to 15 Microns to 25 Microns Above 25 Microns Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Range Mid-Range Premium Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Sector | 120 | Packaging Managers, Quality Assurance Officers |

| Healthcare Packaging Applications | 90 | Regulatory Affairs Specialists, Product Development Managers |

| Retail and Consumer Goods | 70 | Supply Chain Managers, Retail Buyers |

| Industrial Applications | 60 | Operations Managers, Procurement Specialists |

| Biodegradable Cling Film Market | 50 | Sustainability Officers, R&D Managers |

The Global Cling Films Market is valued at approximately USD 1.5 billion, driven by increasing demand for food packaging solutions and consumer awareness regarding food safety. This market has shown significant growth due to various factors, including urbanization and e-commerce expansion.