Region:Global

Author(s):Dev

Product Code:KRAD5207

Pages:94

Published On:December 2025

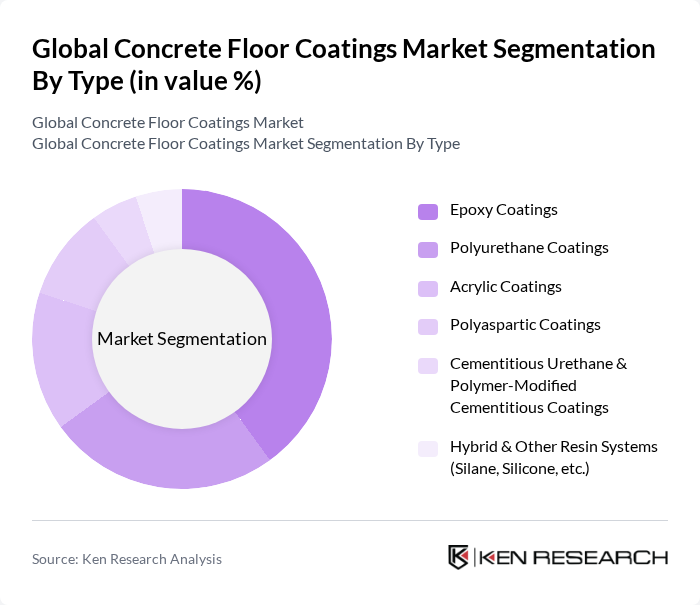

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Polyaspartic Coatings, Cementitious Urethane & Polymer-Modified Cementitious Coatings, and Hybrid & Other Resin Systems (Silane, Silicone, etc.). Each type serves different applications and consumer preferences, with specific characteristics that cater to various flooring needs.

The Epoxy Coatings segment is the dominant player in the market due to its excellent adhesion, chemical resistance, and durability, making it ideal for industrial and commercial applications. The growing trend towards high-performance flooring solutions has led to increased adoption of epoxy coatings, particularly in warehouses and manufacturing facilities. Polyurethane Coatings follow closely, favored for their flexibility and UV resistance, making them suitable for both indoor and outdoor applications.

By End-User:The market is segmented by end-user into Residential (Garages, Basements, Decorative Interiors), Commercial (Retail, Offices, Hospitality), Industrial (Warehouses, Manufacturing, Logistics), Institutional (Healthcare, Education, Public Buildings), and Infrastructure & Utilities (Parking Structures, Transit, Others). Each segment has unique requirements and preferences that influence the choice of coatings.

The Commercial segment leads the market, driven by the increasing demand for aesthetically pleasing and durable flooring solutions in retail and hospitality sectors. The Industrial segment also holds a significant share, as businesses prioritize safety and durability in their flooring choices. The Residential segment is growing steadily, with homeowners increasingly opting for decorative and functional flooring solutions.

The Global Concrete Floor Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, RPM International Inc. (including Rust-Oleum, Tremco, Flowcrete), Sika AG, Akzo Nobel N.V., The Valspar Corporation (a Sherwin-Williams brand), Behr Process Corporation, Benjamin Moore & Co., Tnemec Company, Inc., Mapei S.p.A., Ardex GmbH, Duraamen Engineered Products Inc., CPC Floor Coatings (Concrete Polishing & Coating Contractors), Elite Crete Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the concrete floor coatings market appears promising, driven by ongoing trends towards sustainability and technological innovation. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to invest in low-VOC and sustainable coating solutions. Additionally, the integration of smart technologies in flooring systems is expected to enhance functionality and appeal, creating new avenues for growth. The rise of e-commerce platforms will also facilitate broader market access, enabling consumers to explore diverse product offerings conveniently.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Acrylic Coatings Polyaspartic Coatings Cementitious Urethane & Polymer-Modified Cementitious Coatings Hybrid & Other Resin Systems (Silane, Silicone, etc.) |

| By End-User | Residential (Garages, Basements, Decorative Interiors) Commercial (Retail, Offices, Hospitality) Industrial (Warehouses, Manufacturing, Logistics) Institutional (Healthcare, Education, Public Buildings) Infrastructure & Utilities (Parking Structures, Transit, Others) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Decorative & Aesthetic Flooring Protective & Industrial Flooring High-Performance & Heavy-Duty Flooring Hygienic & Cleanroom Flooring Outdoor & Parking Decks |

| By Performance Characteristics | Chemical & Stain Resistance Abrasion & Impact Resistance Slip Resistance UV & Weathering Resistance Aesthetic & Decorative Effect (Colors, Flakes, Metallics) |

| By Distribution Channel | Direct Sales to Contractors & Specifiers Specialty Coatings & Construction Supply Stores Home Improvement & DIY Retail Chains Online & E-commerce Platforms Distributors & Value-Added Resellers |

| By Pricing Strategy | Premium, High-Performance Systems Mid-Range, Project-Based Systems Economy & DIY-Oriented Systems Performance-Based / Lifecycle Cost Pricing Contractor & Volume-Based Discount Structures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Flooring Applications | 120 | Facility Managers, Project Managers |

| Residential Coating Solutions | 90 | Homeowners, Interior Designers |

| Industrial Coating Solutions | 70 | Plant Managers, Safety Officers |

| Retail Space Flooring | 60 | Store Managers, Visual Merchandisers |

| Public Infrastructure Projects | 50 | Urban Planners, Government Officials |

The Global Concrete Floor Coatings Market is valued at approximately USD 4.7 billion, driven by the increasing demand for durable and aesthetically pleasing flooring solutions across residential, commercial, and industrial sectors.